Uzbekistan has embarked on a transformative journey, prioritizing innovation as a significant driving force for economic growth, societal development, and global competitiveness. This analytical work aims to explore the evolution of the innovative processes in Uzbekistan from 2013 to 2023, shedding light on the progress achieved, the challenges encountered, and the road ahead for fostering an innovation-driven economy.

Uzbekistan’s innovation landscape has undergone significant changes since 2013, shaped by dynamic global trends, domestic reforms, and evolving economic priorities. In the early 2010s, the country faced structural challenges, including limited access to advanced technology, insufficient research and development (R&D) investments, and weak linkages between academia and industry. In 2017, recognizing innovation's vital role in sustainable development, the government initiated broad reforms to strengthen institutions, boost R&D and technological capacity, and foster entrepreneurship, laying the foundation for long-term growth and competitiveness.

The period under review has seen several notable milestones, such as the establishment of the Ministry of Innovative Development in 2017 (which later was transformed into an Agency of Innovative Development under the Ministry of Higher Education, Science, and Innovation in 2022), reflecting a strong commitment to fostering innovation at the national level. Moreover, numerous policy reforms promoting start-up ecosystems, incentivizing R&D activities, and strengthening intellectual property rights have further enhanced the enabling environment for innovation.

Nevertheless, despite these strides, challenges still remain. Uzbekistan’s innovation ecosystem continues to grapple with a lack of skilled professionals and limited funding for R&D, which hinders the full realization of its innovation potential. The ongoing transition from a resource-based to a knowledge-based economy necessitates a more inclusive approach to innovation. This ensures that small and medium enterprises (SMEs), regional hubs, and marginalized communities can also contribute to and benefit from the innovation agenda.

This analytical work adopts a multidimensional approach to evaluate the state of innovation in Uzbekistan and examines quantitative indicators such as the implementation of innovation, innovative volume and costs, R&D expenditure, researchers in R&D, and patent filings while also analyzing qualitative aspects like policy effectiveness, institutional collaboration, and societal perceptions of innovation. Further, comparative insights from regional and global benchmark countries, such as the Philippines, Vietnam, Indonesia, Kazakhstan, and Georgia, will provide a contextual understanding of Uzbekistan’s innovation performance.

The findings of this study aim to inform policymakers, academia, and industry stakeholders about the key achievements and persistent gaps in Uzbekistan’s innovation ecosystem. By reflecting on the lessons learned over the past decade, this analytical work seeks to shape a forward-looking innovation strategy that aligns with Uzbekistan’s aspirations for economic diversification, global integration, and sustainable development.

National Level Analysis

In 2023, Uzbekistan's innovation landscape saw 5,026 organizations introducing 8,294 innovations, a striking rise from the 761 organizations and 1,334 innovations implemented in 2013. However, the number of innovations per organization—a measure of innovation intensity—declined slightly from 1.8 in 2013 to 1.7 in 2023. The highest level of innovation intensity occurred between 2020 and 2022, possibly reflecting the adaptive responses of firms navigating the disruptions of the COVID-19 pandemic. Despite the restrictive measures straining business operations and reducing the number of innovative firms during the pandemic. Firms that remained active intensified their innovation efforts to mitigate economic challenges. This led to a sharp rebound in innovation output and organizational participation between 2022 and 2023 with a delayed effect, highlighting the resilience and evolving capacity of Uzbekistan's innovation ecosystem.

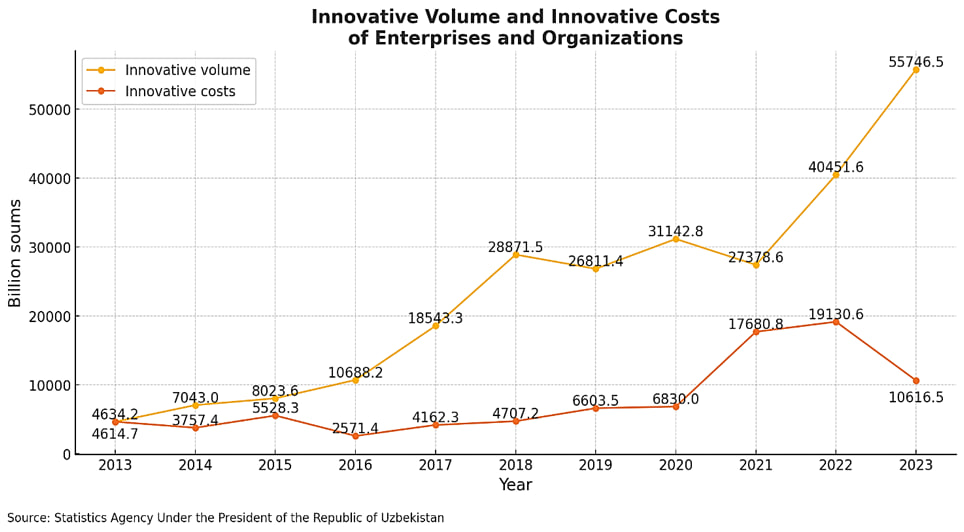

An analysis of innovation expenditures in Uzbekistan reveals a stable upward trend, with total costs rising 2.3 times from UZS4.6 trillion (soum) in 2013 to UZS10.6 trillion in 2023. Despite this growth, spending decreased slightly in 2016 and contracted more significantly in 2023, signifying changing investment dynamics.

Innovation output, however, has surged at a far faster pace. The total volume of innovations expanded 12.1 times over the decade, from UZS4.6 trillion in 2013 to UZS55.7 trillion in 2023. Notably, innovative volume increased significantly between 2016 and 2018 and from 2021 to 2023, given the accelerated technological adoption and production enhancements. Likewise, the return on innovation investment has also improved during this period. In 2013, every soum spent on innovation generated just 1 soum of output. By 2023, that return had multiplied to 5.3 soums, demonstrating a significant boost in efficiency and the growing impact of innovation on economic performance.

The relationship between innovation spending and output reflects both lagged and cumulative effects. While innovation costs often take time to translate into measurable gains, the compounding nature of investment explains the stronger growth in output relative to expenditure. However, this effect tends to weaken after two years, suggesting that sustained investment is necessary to maintain momentum.

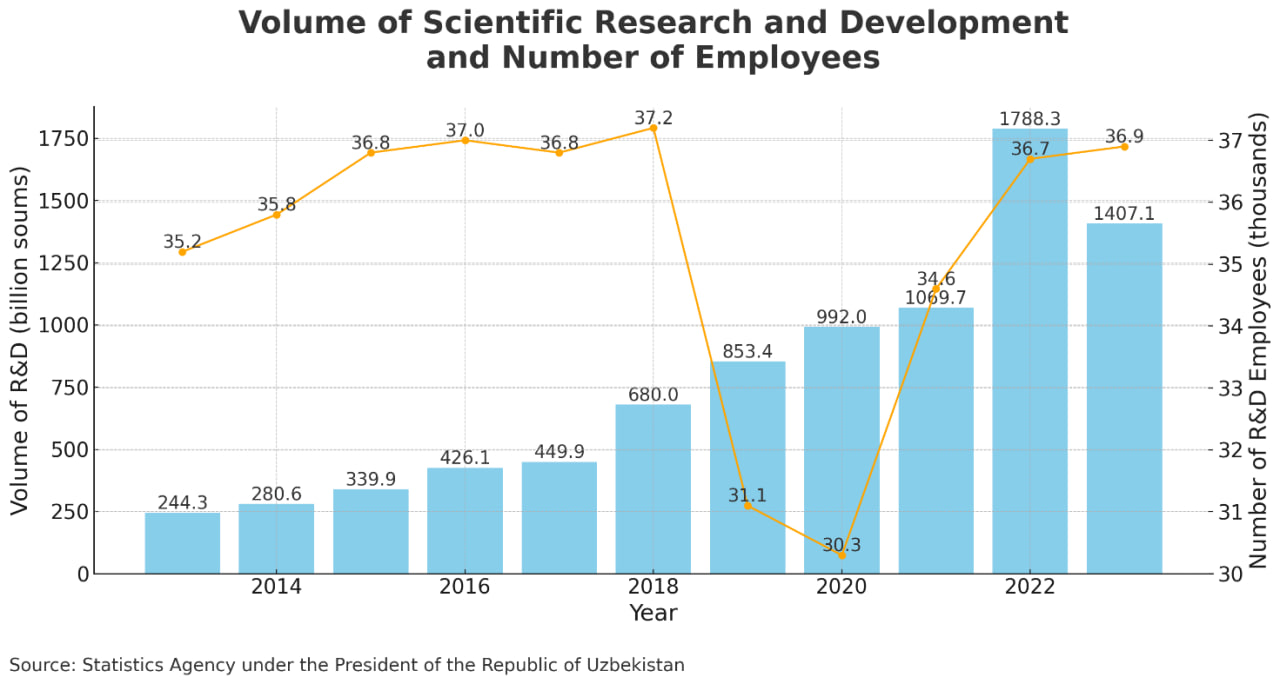

As for R&D investment, Uzbekistan has seen a significant rise over the past decade, with the volume growing from UZS244.3 bn in 2013 to UZS1788.3 bn in 2022. This substantial increase reflects a commitment to strengthening the country's innovation capabilities. However, the research volume declined in 2023, falling to UZS1407.1 bn, indicating a potential slowdown. Despite this dip, the long-term trend remains positive, suggesting that Uzbekistan’s R&D sector has expanded, likely due to increased government funding and international collaborations. The rapid growth between 2018 and 2022 highlights the country’s efforts to modernize its research infrastructure and boost technological advancements.

In contrast, the number of employees engaged in R&D has remained relatively stable, fluctuating between 35.2 thousand in 2013 and 36.9 thousand in 2023. The most significant drop occurred between 2019 and 2020, when employment fell by approximately 5%, possibly due to the effects of policy reforms, the COVID-19 pandemic, and/or shifts in industry dynamics. While the workforce size has since rebounded, it has not kept pace with the rapid increase in research output, suggesting that Uzbekistan’s R&D growth may be driven more by efficiency gains, technological progress, or a shift toward more specialized workers. This discrepancy points to a changing landscape where research output is increasingly fueled by technology and innovation rather than an expanding labor force. However, sustaining this level of R&D growth requires continuous investment in specialized skills and human capital.

Comparative Analysis with Benchmark Countries (Philippines, Vietnam, Indonesia, Kazakhstan, Georgia)

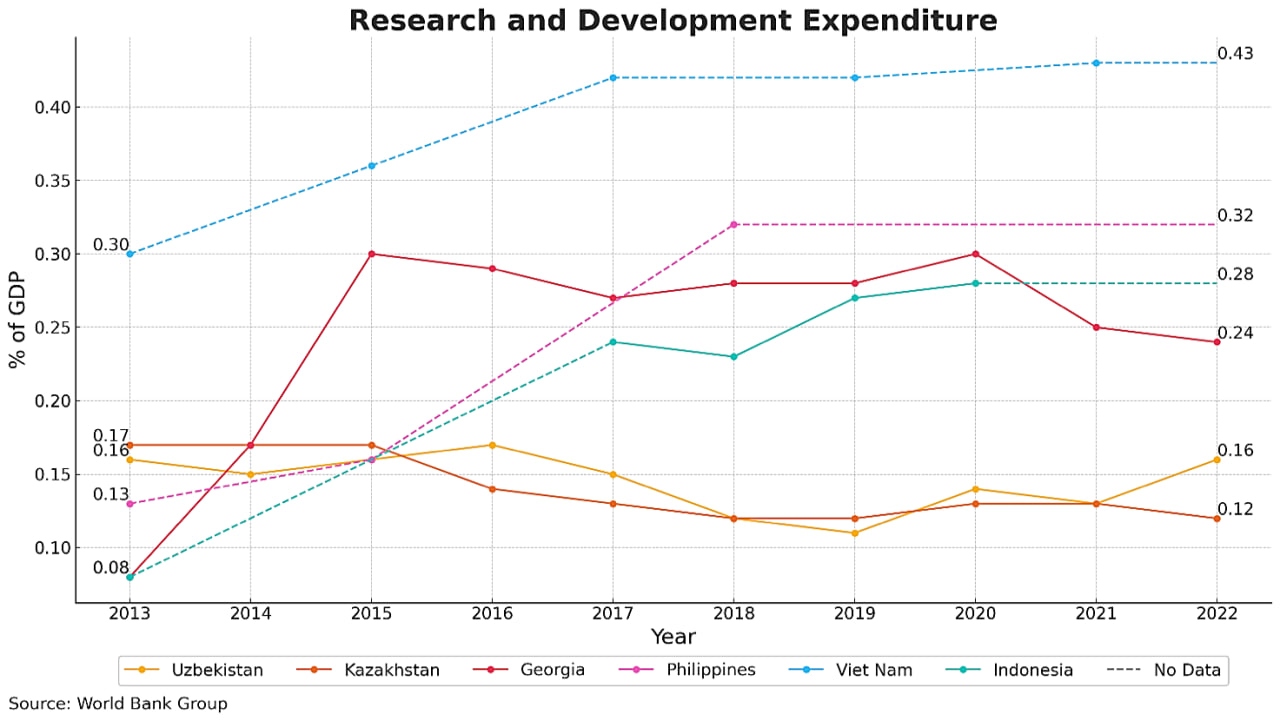

Over the past decade, R&D expenditure as a percentage of GDP in Uzbekistan and its benchmark countries reveals contrasting trends in investment. As for the data from the World Bank, Uzbekistan's R&D expenditure as a percentage of GDP has experienced fluctuations during 2013-2022, signaling a less consistent investment pattern compared to some of the benchmark countries. From 0.16% in 2013, Uzbekistan’s spending fell to 0.11% by 2019, before partially recovering to 0.16% in 2022. This decline and subsequent stabilization contrast with the steady rise observed in countries like Vietnam, where R&D spending grew from 0.30% of GDP in 2013 to 0.43% in 2021, the highest among the countries in this comparison. Similarly, Georgia saw rapid growth from 0.08% in 2013 to 0.30% in 2015, maintaining a relatively stable range thereafter. These countries demonstrate a more predictable and upward trajectory in their R&D investments, highlighting a clear commitment to expanding research capacities.

Further, in contrast, Kazakhstan’s R&D expenditure has trended downward, dropping from 0.17% in 2013 to 0.12% in 2022, signaling reduced investment over time. Indonesia and the Philippines also present mixed trends, with Indonesia’s R&D spending increasing from 0.08% in 2013 to 0.28% in 2020, though recent data is unavailable. The Philippines reached 0.32% in 2018, but data gaps make it difficult to evaluate the long-term trajectory. While these countries show some growth potential, inconsistent or fragmented data hinder a full understanding of their R&D trends. Overall, Uzbekistan’s R&D trajectory places it in the middle of the pack, reflecting a period of uncertainty and underperformance compared to the sustained growth of Vietnam and Georgia. Despite these fluctuations, Uzbekistan’s recent rebound in 2022 suggests efforts to stabilize and potentially boost future investments in research and development.

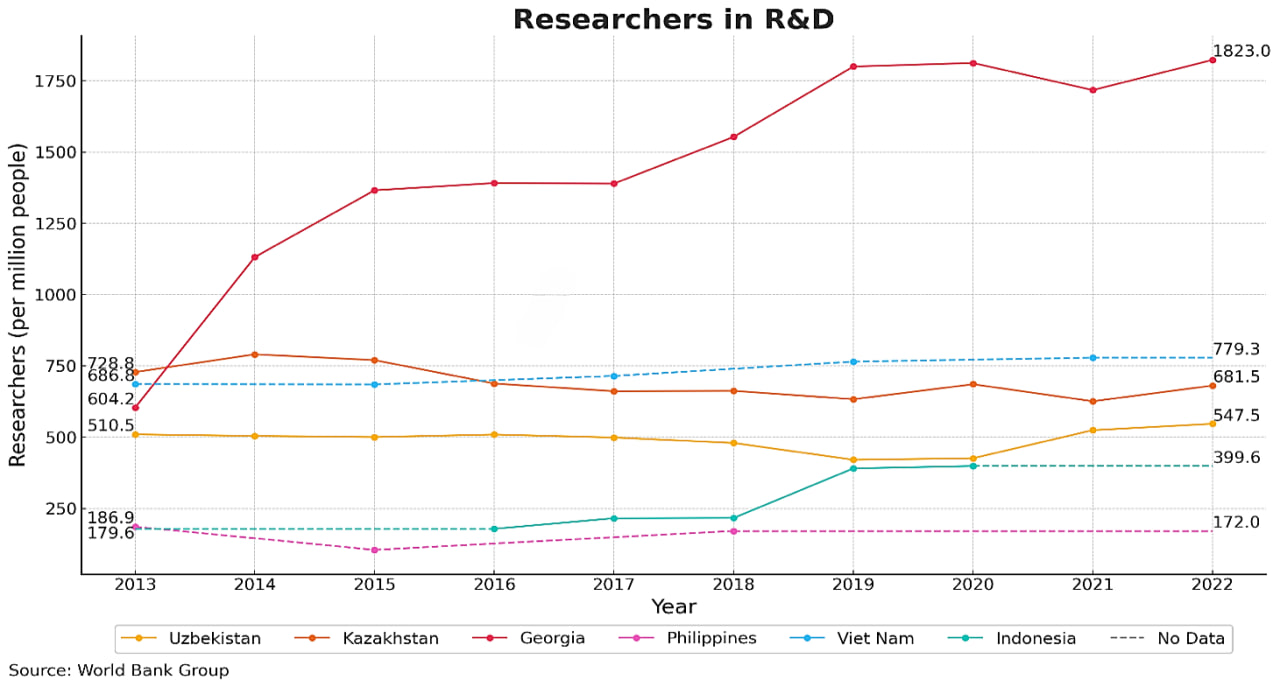

The number of researchers in R&D per million people across Uzbekistan and its benchmark countries shows varied trends, reflecting differing national approaches to fostering research capacity. Georgia stands out for its remarkable and sustained growth, with the number of researchers increasing from 604.2 per million in 2013 to 1823.0 in 2022, a 201.4% surge. This consistent upward trajectory underscores Georgia's ongoing commitment to expanding its research infrastructure. Vietnam also shows growth, though at a slower pace, surging by 13.5%, from 686.8 in 2013 to 779.3 in 2021, suggesting steady investment in research compared to Georgia. This highlights Georgia’s sustained growth, positioning it as a leader in terms of the number of R&D personnel.

In contrast, Uzbekistan and Kazakhstan demonstrate more volatile trends. For instance, Uzbekistan’s researcher count declined by 17.5%, from 510.5 per million in 2013 to 421.5 in 2019 before rebounding to 547.5 in 2022, indicating potential signs of recovery with around 30% growth. Likewise, Kazakhstan also experienced a decline, dropping from 791.1 researchers per million in 2014 to 626.5 in 2021, with a slight recovery to 681.5 in 2022. While both countries show recent improvements, they lag behind Georgia and Vietnam regarding researcher engagement. Indonesia and the Philippines exhibit fragmented trends, remaining well below those of the leading countries with inconsistent improvements.

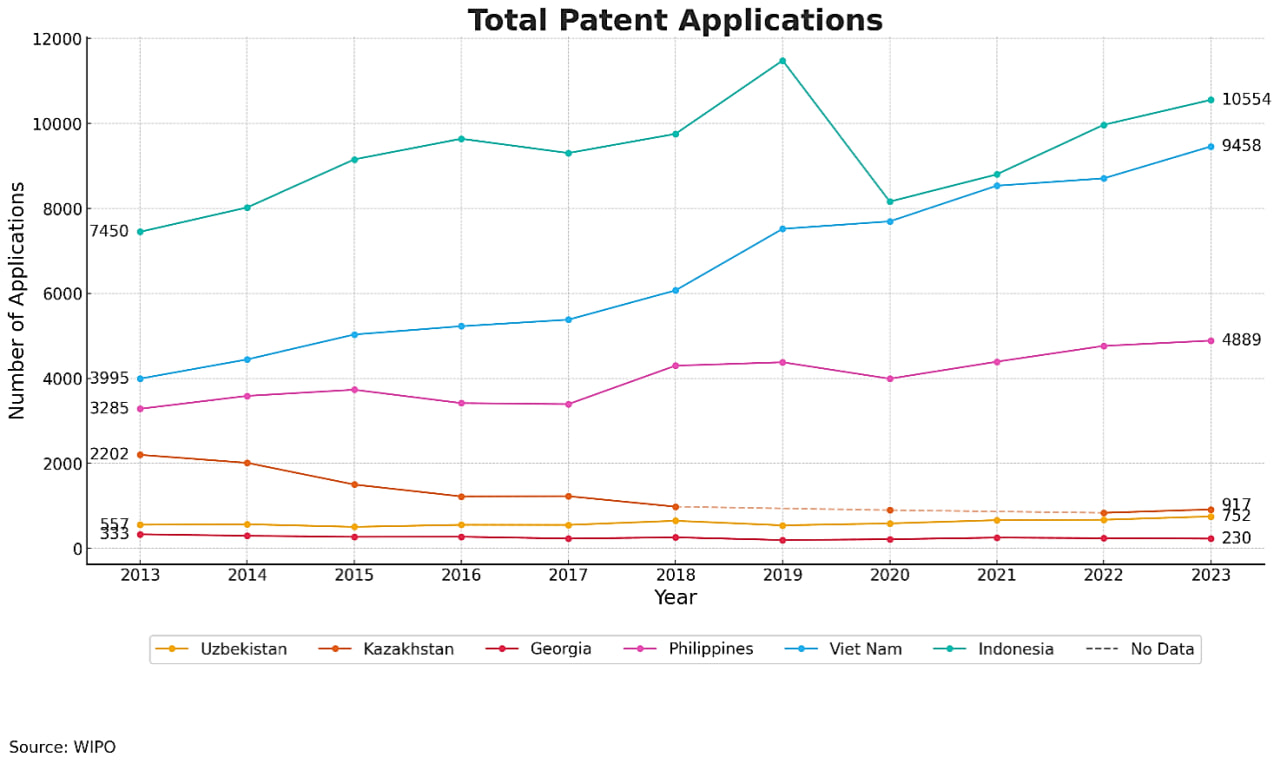

Further, total patent applications across Uzbekistan and its benchmark countries highlight contrasting trends, with notable differences in both volume and growth patterns. For instance, Indonesia leads the group, with applications rising by 41.4%, from 7450 in 2013 to 10554 in 2023, despite a brief dip in 2020. Vietnam follows closely, increasing from 3995 in 2013 to 9458 in 2023, reflecting a dynamic and expanding patent landscape with almost three times surge. The Philippines also shows consistent growth, with applications climbing by 48.9%, from 3285 to 4889 during the same period. These countries’ strong upward trajectories suggest a thriving environment for innovative and scientific activities.

In contrast, Uzbekistan and Kazakhstan exhibit more modest trends in patent filings. Uzbekistan’s numbers remain relatively stable, fluctuating between 557 in 2013 and 752 in 2023, signaling a slow but steady increase with 35.1% growth. Conversely, Kazakhstan’s patent filings significantly declined by 58.3%, from 2202 in 2013 to 917 in 2023. Nevertheless, Kazakhstan’s numbers highlight a more developed but now fading patenting infrastructure in contrast to Uzbekistan. With its consistent but low numbers, Georgia records the least patent activity, oscillating between 197 and 333 applications, signifying its limited engagement in patenting compared to other benchmark nations. Overall, while Vietnam, Indonesia, and the Philippines lead with substantial growth, Uzbekistan seems to be an emerging hub with more moderate but stable trends in patent activity.

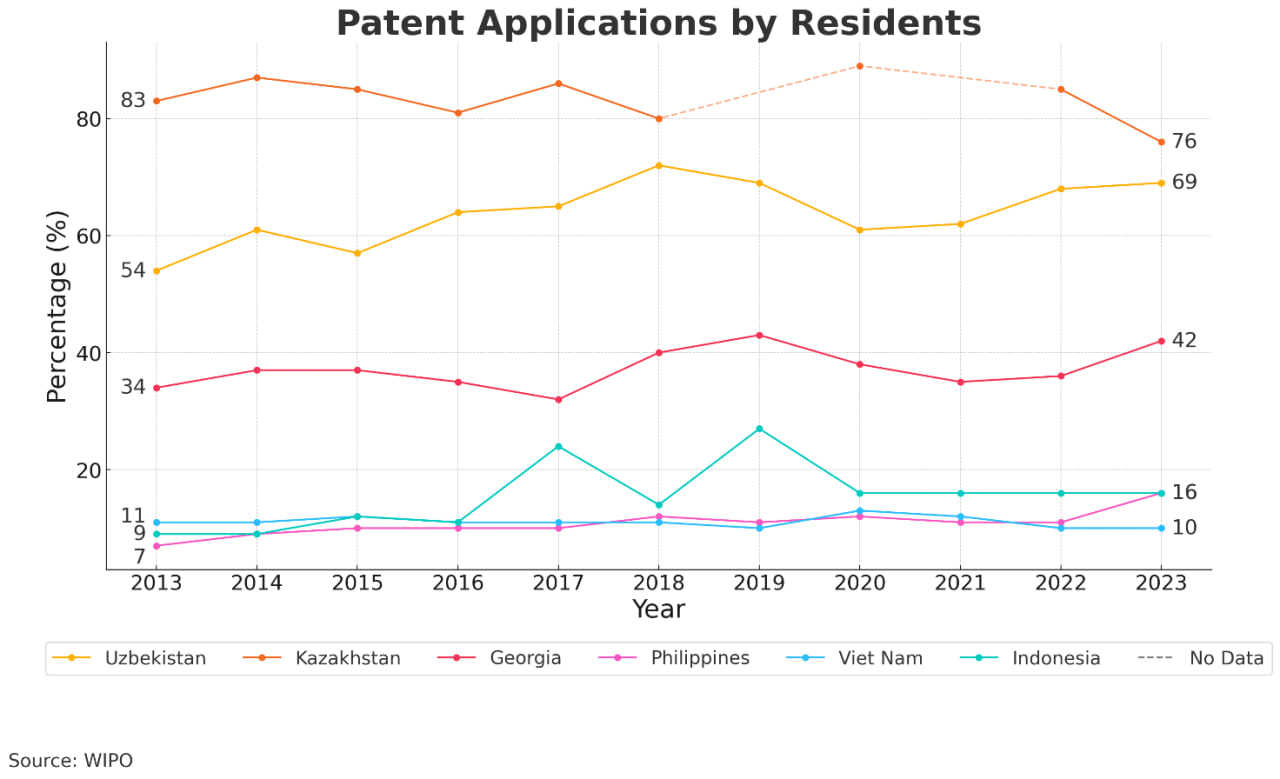

Further, a closer look at the composition of total applications reveals that resident patent applications dominate Kazakhstan and Uzbekistan with 76% and 69% ratios, respectively. This balance suggests a stronger reliance on local innovation. On the contrary, nonresident patents make up a significant proportion of the total patent applications in countries such as Vietnam, Indonesia, and the Philippines, often accounting for over 85%. This trend highlights the strong appeal of these markets to foreign innovators, driving overall patent growth and differentiating them from their Central Asian counterparts. Georgia’s patent environment mirrors the patterns seen in Vietnam and Indonesia, where foreign applicants dominate with over 58%, underscoring a limited pool of domestic inventors.

Overall, Indonesia, Vietnam, and the Philippines lead in total patent applications, driven largely by foreign interest and investment in innovation. Uzbekistan and Kazakhstan, while maintaining lower volumes, show more active domestic participation, reflecting efforts to strengthen local R&D. Georgia’s small and fluctuating patent output further emphasizes its reliance on foreign filings, suggesting a patent environment still in the early stages of development.

Conclusion and policy recommendations

Over the past decade, the innovative landscape in Uzbekistan reflects notable achievements with some significant challenges. The country has expanded its innovation output substantially, with innovation volumes growing more than twelvefold between 2013 and 2023. However, innovation intensity - innovations per organization - declined slightly, indicating that broader participation has driven growth more than deeper innovation within firms. R&D investment surged significantly from 2013 to 2022, but a contraction in 2023 signals the need for sustained and consistent funding. Despite showing signs of recovery, researcher density remains volatile compared to regional leaders like Georgia, which has more than tripled its researcher base. Patent filings in Uzbekistan show moderate growth but are dominated by resident applications, contrasting with the foreign-driven patent landscapes of Vietnam, Indonesia, the Philippines, and Georgia.

While Uzbekistan’s policy reforms, including the establishment of the Agency of Innovative Development, have laid a strong foundation, gaps in R&D funding, skilled human capital, and technology commercialization seem to persist. Hence, addressing these structural issues is essential for transitioning from incremental innovation to breakthrough improvements that drive long-term economic growth.

The review of the present innovation landscape has the following policy recommendations that can solidify Uzbekistan’s position as an emerging innovation hub and achieve sustainable, knowledge-based economic growth:

- Increase R&D investment

- To sustain innovation growth, Uzbekistan should target a steady increase in R&D spending to exceed 0.2% of GDP by 2030, focusing on priority sectors like ICT, green technology, and high-tech startups. In addition, promoting public-private partnerships and venture funding mechanisms can further complement state investments.

- Develop a robust human capital strategy

- Uzbekistan should also expand research training and retention programs by providing scholarships, competitive salaries, and research grants. Besides, partnerships with leading international universities can help improve domestic capacity in cutting-edge fields.

- Enhance technology commercialization

- The government should strengthen the linkages between academia and industry by reinforcing the existing mechanisms of technology commercialization through existing technology transfer offices and innovation hubs. This can be guided by the best practices of Vietnam, where a similar innovation-driven industrial strategy has been successfully implemented.

- Modernize intellectual property (IP) systems

- Uzbekistan should prioritize attracting more nonresident patent applications by modernizing its intellectual property systems. This effort should include simplifying patent processes, adopting online filing platforms, and providing clear, multilingual guidelines to reduce barriers for foreign applicants. Besides, incentivizing joint patent filings between domestic and foreign entities can also help promote technology transfer and fast-track patent examinations for priority sectors such as ICT and green technologies can boost Uzbekistan’s appeal.

- Promote regional innovation hubs

- Uzbekistan should also encourage regional collaboration in establishing innovation centers that focus on local strengths, ensuring inclusive growth that benefits SMEs and young innovators. This can help foster innovation across the Central Asian region.

References

- Statistics Agency under the President of the Republic of Uzbekistan. URL: https://stat.uz/en/

- World Bank Open Data. URL: https://data.worldbank.org/

- World Intellectual Property Organization (WIPO). URL: https://www.wipo.int/portal/en/index.html

- Agency of Innovative Development under the Ministry of Higher Education, Science and Innovation of the Republic of Uzbekistan. URL: https://innovation.gov.uz/en

- Ministry of Higher Education, Science and Innovation of the Republic of Uzbekistan. URL: https://edu.uz/en

Written by: Dr. Ikboljon Kasimov – Head of Research and Grants Department at the Graduate School of Business and Entrepreneurship under the Cabinet of Ministers of the Republic of Uzbekistan.

Anton Kostyuchenko, Chief Specialist of the Project Office for the Promotion and Implementation of Green Economy Graduate School of Business and Entrepreneurship.

Comments (0)