As Uzbekistan continues its economic transformation, it has become a focal point for investors seeking new opportunities in emerging markets. Yueh Cho, Treasurer of the Chamber of Commerce Swiss-EurAsia, offers a unique perspective on the country’s investment climate, drawing comparisons to his native China’s early reform era while highlighting the distinct challenges and opportunities that make Uzbekistan stand out.

A Frontier Market with Untapped Potential

Speaking candidly, Cho describes Uzbekistan as a country in transition, reminiscent of China 30 years ago. “It’s a land full of labor force but short on capital,” he notes, emphasizing the government’s enlightened push for foreign trade and investment through economic reforms.

However, he also acknowledges the collision at times between old and new systems, especially outside the capital. “The president wants the country to open up for business and this is increasing being the case in Tashkent, but at lower levels down the chain of command, you might still encounter old ways of operating,” Cho explains.

Currency controls, a still mostly closed banking system, and bureaucratic hurdles persist, but progress is visible. “In just two years, I’ve observed significant developments—from new projects to a growing international presence at the airport,” he adds, citing the influx of Indian, Chinese, and European visitors.

Learning from the Chinese SEZ Model

When Cho reflects on Uzbekistan’s potential, he often draws comparisons with his native China’s economic reforms in the late 20th century. One pivotal strategies behind China’s economic rise was the establishment of Special Economic Zones (SEZs), designed to attract foreign investment, foster innovation, and spur development through market-oriented reforms.

“The Chinese model could offer a playbook for Uzbekistan,” Cho explains.

“China’s approach was to carve out small, geographically defined spaces where rules were different—more flexible and business-friendly. These zones became experimental hubs for economic liberalization, serving as gateways for foreign investors and global markets. Cities like Shenzhen where President Mirziyoyev paid a visit earlier this year transformed from sleepy fishing villages into global economic powerhouses in a matter of decades.”

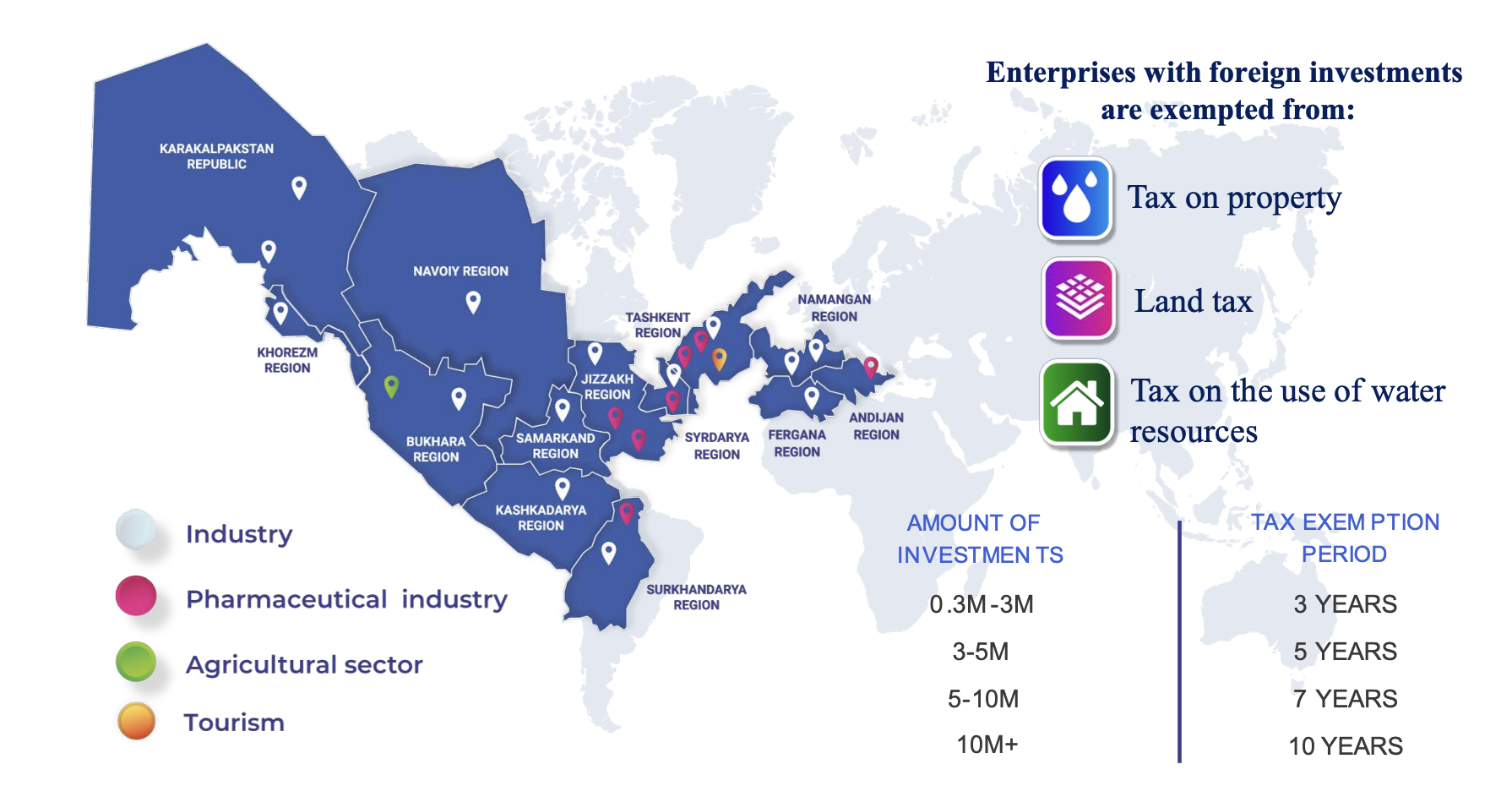

Uzbekistan, with its strong labor force and a burgeoning desire to attract foreign capital, could benefit from adopting a similar strategy. SEZs allow for targeted policy changes without disrupting the broader economic system, offering a controlled environment to test reforms. Cho suggests that these zones could provide the “free room” needed to streamline processes such as currency control and investor protections while offering incentives like tax breaks and simplified regulations.

Opportunities for SEZ Development

Uzbekistan already boasts several Free Economic Zones (FEZs), such as Navoi, Angren, and Jizzakh, which focus on industries ranging from manufacturing to logistics. However, Cho notes that for these zones to achieve their full potential, Uzbekistan must ensure seamless connectivity—both logistical and bureaucratic—and actively market them to foreign investors.

“China’s SEZs thrived because of comprehensive planning and accessibility,” Cho says. “Uzbekistan could enhance its zones by focusing on infrastructure, improving transparency, and creating a centralized one-stop-shop for investors to navigate regulations.”

Moreover, Cho highlights transit trade as an immediate opportunity, pointing to how Kyrgyzstan, with fewer resources than Uzbekistan, has benefited significantly from its position as a trade corridor under the WTO framework.

“Uzbekistan can go a step further by building specialized SEZs that target high-growth sectors like renewable energy, agribusiness, and digital services,” he suggests.

The Chamber’s Role in Facilitating Trade and Investment

As Treasurer of the Chamber of Commerce Swiss-EurAsia, Cho sees his role as more than just symbolic. “We aim to act as a bridge, not only for Swiss members but also for Uzbek businesses,” he explains. By offering discounted membership fees to Uzbek entrepreneurs, the Chamber hopes to attract local members and partners and provide tailored support for their needs to expand in Switzerland and Europe.

The Chamber’s Swiss membership base includes bothindustrial and financial sector as well as individuals who have a keen interest in and often are expert on the region. But Cho emphasizes the importance of diversifying these connections to include sectors where Uzbekistan has untapped potential.

“For example, agriculture—Uzbekistan has world-class dried fruits and nuts. The challenge is helping small producers navigate Western Europe’s concentrated procurement systems,” Cho explains. He envisions e-commerce platforms as a way to aggregate Uzbek production capacity and connect with European buyers.

On the investment side, Cho highlights the recent success of a Geneva-based financial institution in raising $30mn for frontier market investments in Uzbekistan. “It’s promising to see capital flowing into the country. But more outreach is needed to tap into Switzerland’s robust financial ecosystem,” he says, pointing out the additional challenge of not having a dedicated Uzbek ambassador for Switzerland who is based in Switzerland.

Building Human Capital

A key takeaway from Cho’s observations is Uzbekistan’s strong human capital base. “A significant advantage is the younger generation’s proficiency in English, unlike in some neighboring countries,” he says. This linguistic capability enhances the country’s appeal to foreign businesses looking to hire local talent for global operations.

Yet, challenges persist, particularly in job creation for university graduates. “Many end up in roles below their qualifications or struggle to sustain startups,” Cho notes, emphasizing the importance of foreign investment in creating skilled jobs.

Opportunities and Challenges for Swiss Investors

Cho identifies logistics, agriculture, and financial services as the most promising sectors for Swiss investors in Uzbekistan. “The country is geographically positioned as a transit hub for Central Asia, making logistics a particularly attractive area,” he notes.

However, the financial sector remains underdeveloped. “There’s a critical need to build Uzbekistan’s capital markets,” Cho says. He sees opportunities for Swiss expertise to shape this emerging sector by organizing investor roadshows and fostering public-private partnerships.

The Chamber also seeks to play a pivotal role in these developments. “We’re a neutral body that can connect Uzbek institutions with Swiss family offices, asset managers, and other potential investors,” Cho explains.

A Vision for the Future

While Cho acknowledges the road ahead is challenging, his optimism is palpable. “Uzbekistan is like a startup,” he says. “The foundation is there, but scaling requires more structured efforts in policy, investment, and trade facilitation.”

By fostering partnerships between Swiss and Uzbek businesses, the Chamber of Commerce Swiss-EurAsia aims to bridge the gap between ambition and execution. For investors, this could be the start of a mutually beneficial journey in a country poised for transformation.

Comments (0)