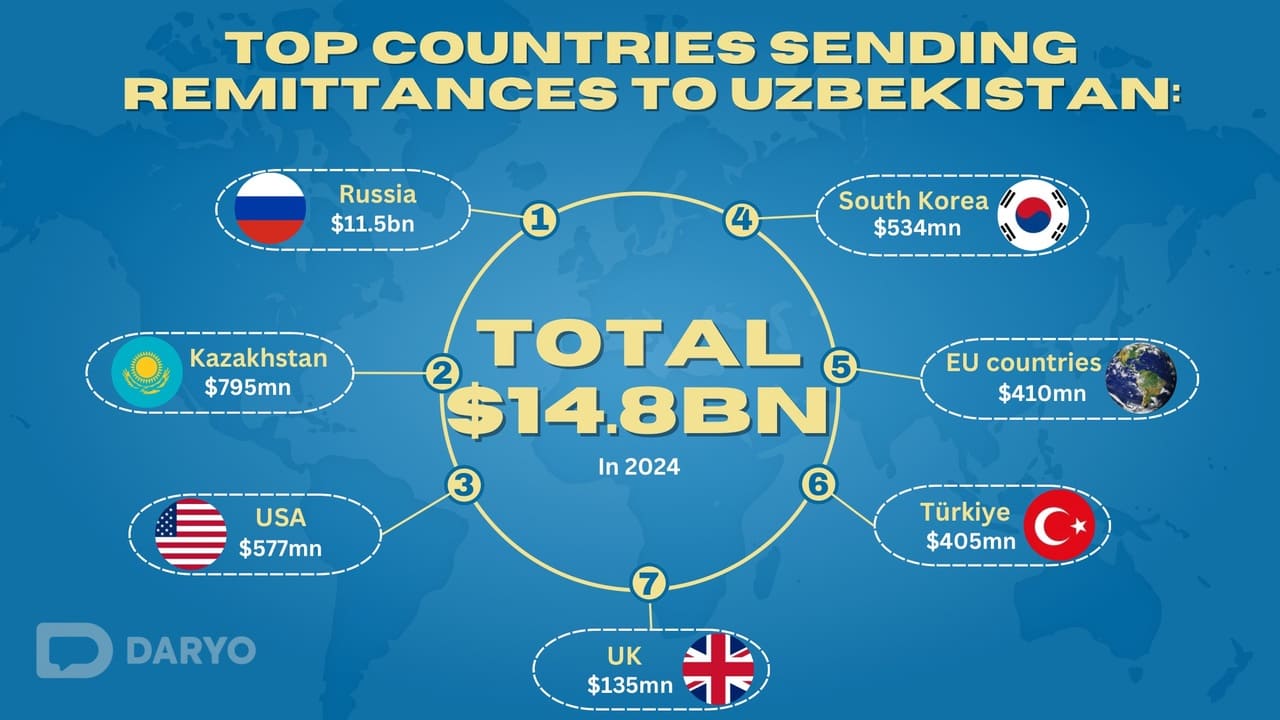

Uzbekistan saw a rise in the volume of cross-border money transfers in 2024, reaching a total of $14.8bn, a 30% increase compared to the previous year, according to the Central Bank.

The largest influx of funds occurred in July, with $1.78bn in transfers, marking a 66% y/y increase. However, the volume gradually declined in the following months, and in December, the total reached $1.07bn, which still represented an 11% rise over last year’s figures.

As in previous years, Russia remained the top source of remittances, contributing 77% of the total, or $11.5bn. Kazakhstan and the United States followed, with $795mn and $577mn.

Notably, transfers from non-CIS countries saw considerable growth. The volume of remittances from the UK surged by 83%, totaling $135mn, while payments from South Korea reached $534mn, marking a 56% increase. Transfers from EU countries also rose by 32%, reaching $410mn.

The Central Bank attributed the rise in remittances to economic growth in the countries sending the funds, which created greater demand for labor and led to higher wages. The increase also reflects a shift in the migration structure, with more migrants coming from countries with higher per capita incomes.

Currency exchange rate dynamics in countries traditionally popular with Uzbek migrants also played a role in the higher remittance volumes.

Over half of the funds received were through traditional transfer systems, totaling $8.16bn, an increase of 14.4% compared to 2023. Additionally, migrants sent $5.91bn via peer-to-peer (p2p) services to individual cards, marking a 50.8% rise.

The share of p2p services in the total remittance volume grew to 40%, up from 34% a year earlier. Bank SWIFT transfers also saw a notable surge, more than doubling to $774mn.

The volume of remittances sent from Uzbekistan to other countries also increased by 19%, amounting to $2.8bn.

Follow Daryo's official Instagram and Twitter pages to keep current on world news.

Comments (0)