Between January and November 2024, residents of Kazakhstan sent KZT223.5 bn ($421.5 mn) at the exchange rate on January 15, 2025) to Uzbekistan. This made Uzbekistan the leading destination for remittances from Kazakhstan. Russia ranked second with KZT210.2 bn ($396.4 mn), and Turkey followed with KZT145.3 bn ($274 mn), according to Finprom.kz, citing data from Kazakhstan’s National Bank.

Decline in Total Transfers

The total volume of money transfers from Kazakhstan during this period amounted to KZT731.8 billion ($1.38 bn), which is a 17.6% decrease compared to the same period in 2023.

-RCdgyuH6.webp)

Conversely, transfers into Kazakhstan totaled KZT217.2 bn ($409.6 mn), marking the lowest figure since 2015.

Key countries sending remittances to Kazakhstan included:

- Russia: $108.6 mn

- USA: $54.9 mn

- South Korea: $43.2 mn

- Uzbekistan: $40.9 mn

- Turkey: $34.7 mn

- Germany: $29.8 mn

-p4xLDTCT.webp)

Factors Behind Uzbekistan’s Leading Position

Uzbekistan’s leadership in remittance volume can largely be attributed to its high rate of labor migration to Kazakhstan. In November 2024, reports indicated that Uzbek citizens were the second-largest group of labor migrants in Kazakhstan.

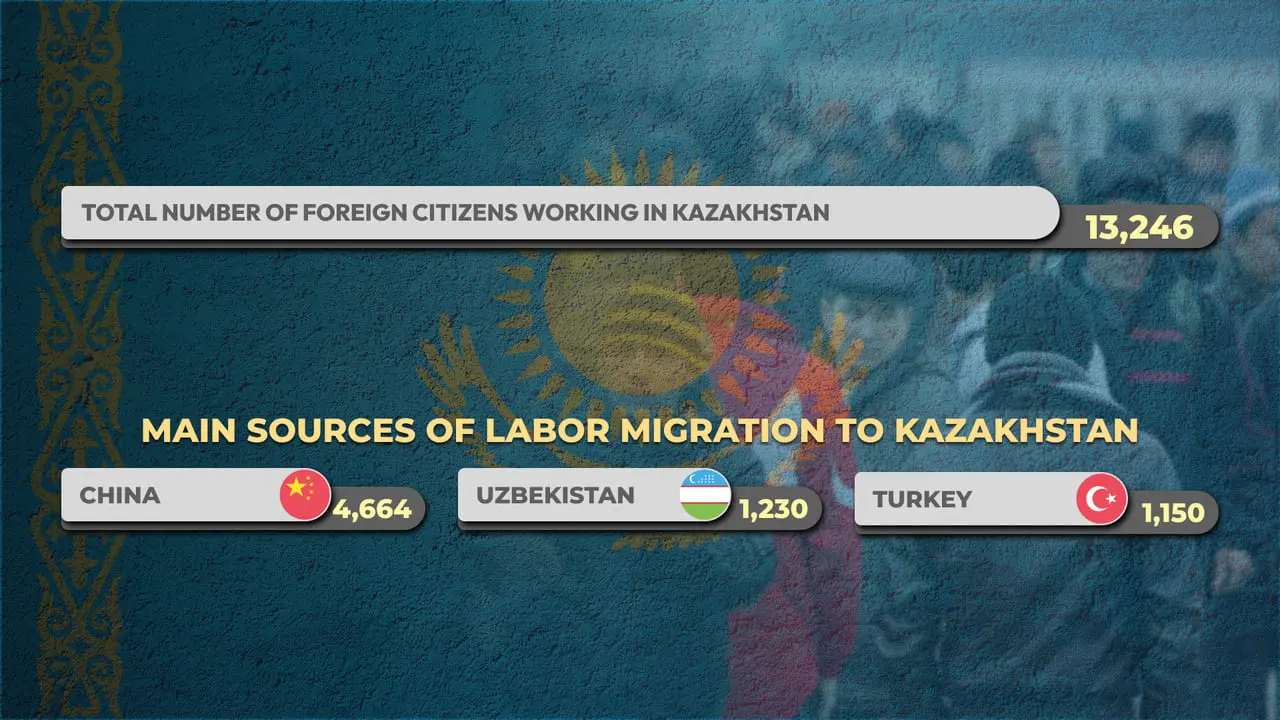

As of November 1, 2024, 13,246 foreign workers had received official employment permits in Kazakhstan, of which 1,230 were from Uzbekistan.

Labor migration by nationality:

- China: 4,664 workers

- Uzbekistan: 1,230 workers

- Turkey: 1,150 workers

- India: 1,108 workers

Labor Market Overview

Kazakhstan has 1,789 registered employers hiring foreign workers. These employers collectively employ more than 389,800 Kazakh citizens, who make up 96.8% of their workforce.

Foreign worker employment by sector:

- Construction: 5,155 workers

- Manufacturing: 1,387 workers

- Administrative support: 1,363 workers

- Mining: 1,359 workers

- Agriculture: 1,168 workers

Kazakhstan’s Ministry of Labor sets annual quotas for foreign labor. In 2024, the limit was set at 0.23% of the workforce, equivalent to 17,200 permits.

Migration Trends

Migration trends also highlight significant movement from Uzbekistan. In the first half of 2024, over 5,000 Uzbek citizens emigrated permanently, with 81.5% (4,128 individuals) relocating to Kazakhstan. Russia was the second-most popular destination, attracting 760 migrants, followed by Kyrgyzstan with 34 migrants.

International Money Transfer Systems

The money transfer market in Kazakhstan is dominated by two major systems, but the overall volume of transfers, both outbound and inbound, continues to decline.

Between January and November 2024, international money transfer systems processed outbound remittances totaling KZT731.8 bn ($1.38 bn), a 17.6% decrease from the same period in 2023. This marks the second consecutive year of decline.

Inbound transfers to Kazakhstan during the same period amounted to KZT217.2 bn ($409.6 mn), a 23.1% year-on-year decrease and the lowest figure in nine years.

Top Destinations for Outbound Transfers

- Uzbekistan: KZT223.5 bn ($421.5 mn)

- Russia: KZT210.2 bn ($396.4 mn)

- Turkey: KZT145.3 bn ($274 mn)

- Georgia: KZT50.3 bn ($94.86 mn)

- Kyrgyzstan: KZT26.9 bn ($50.73 mn)

- China: KZT24.2 bn ($45.64 mn)

Sources of Inbound Transfers

- Russia: KZT57.6 bn ($108.6 mn)

- USA: KZT29.1 bn ($54.9 mn)

- South Korea: KZT22.9 bn ($43.2 mn)

- Uzbekistan: KZT21.7 bn ($40.9 mn)

- Turkey: KZT18.4 bn ($34.7 mn)

- Germany: KZT15.8 bn ($29.8 mn)

Dominance of “Zolotaya Korona”

The “Zolotaya Korona” system remains the leading money transfer system in Kazakhstan. Between January and November 2024, it facilitated KZT613.4 bn ($1.16 bn) in outbound transfers, accounting for 83.8% of the total. This marks an increase from 79.8% the previous year.

In terms of inbound transfers, “Zolotaya Korona” leads with a 51.1% share, processing KZT111.1 bn ($209.5 mn). Western Union holds 30.1%, up from 22.4% in 2023. Other systems saw their share decline from 26.8% to 18.8%.

Conclusion

Uzbekistan’s status as the top recipient of remittances from Kazakhstan underscores its strong labor and economic ties with its neighbor. However, the decline in overall transfer volumes reflects broader economic challenges and currency fluctuations, impacting financial flows across the region.

Comments (0)