Uzbekistan’s banking sector may face declining financial popularity and lower household incomes over the next two years, according to a recent report by Standard & Poor’s (S&P). The international rating agency’s analysis, titled “2025 Prospects of Banks in Central Asia and the Caucasus”, highlights concerns over rising unsecured consumer loans and evolving risk management practices.

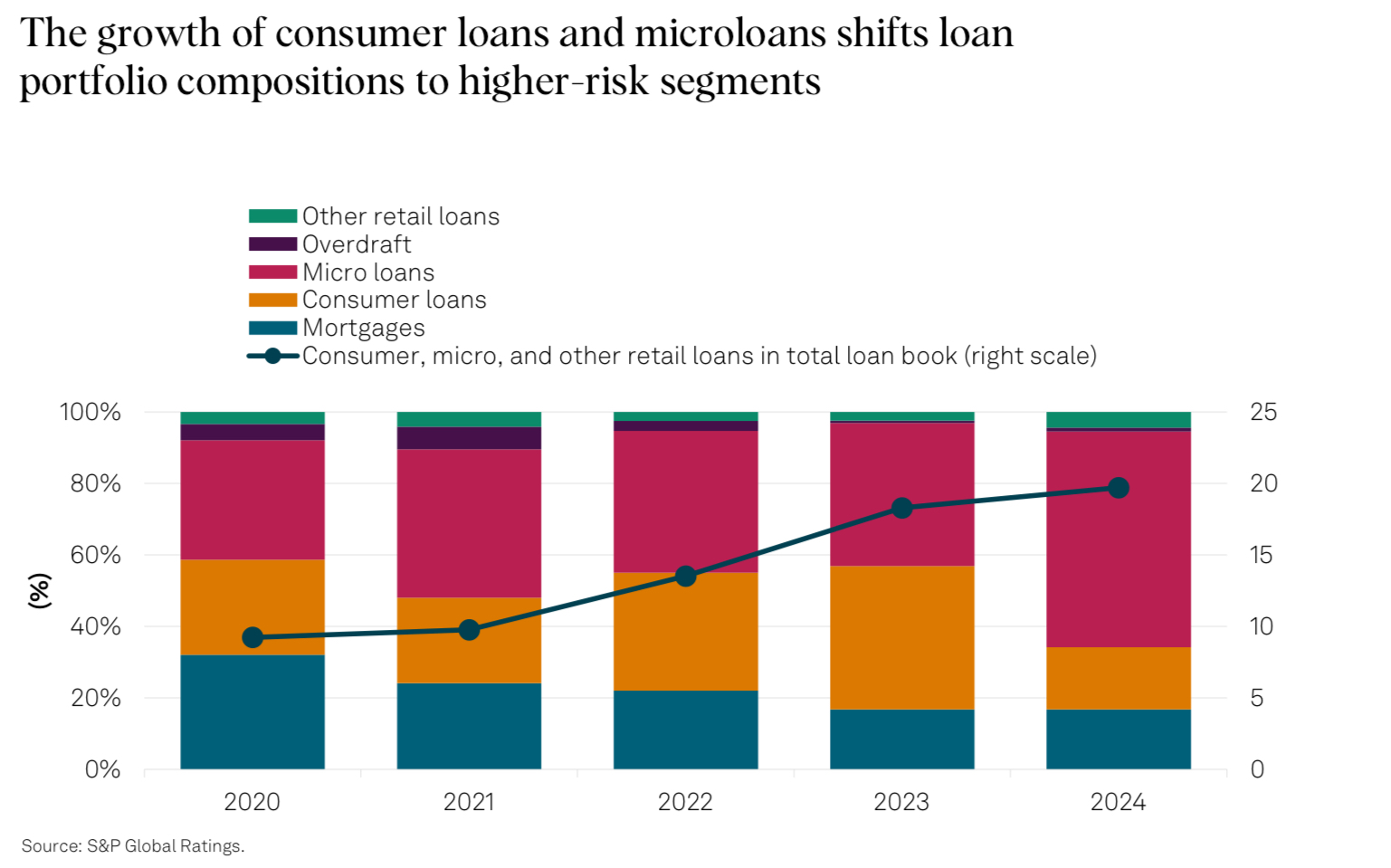

S&P notes that the share of consumption and microcredits in Uzbekistan’s loan portfolio is increasing, signaling higher risks. To sustain profitability, banks are expanding unsecured consumer loans and financing for small and medium-sized enterprises (SMEs). However, aggressive lending growth, intensified competition—including the entry of foreign players—and an underdeveloped risk management culture could impact asset quality.

Regulatory measures implemented in 2023 have slowed the rapid growth of retail lending, reducing its pace from nearly 50% in previous years to around 20% in 2024. While this has helped stabilize the sector, concerns persist regarding unsecured consumer loans due to their higher risk exposure.

Despite ongoing reforms, Uzbekistan’s banking sector remains dominated by state-owned banks, which control approximately 70% of total assets. S&P points out that government influence continues to affect banking supervision and investor confidence. The agency suggests that meaningful privatization and increased foreign investment could improve governance, regulation, and financial oversight.

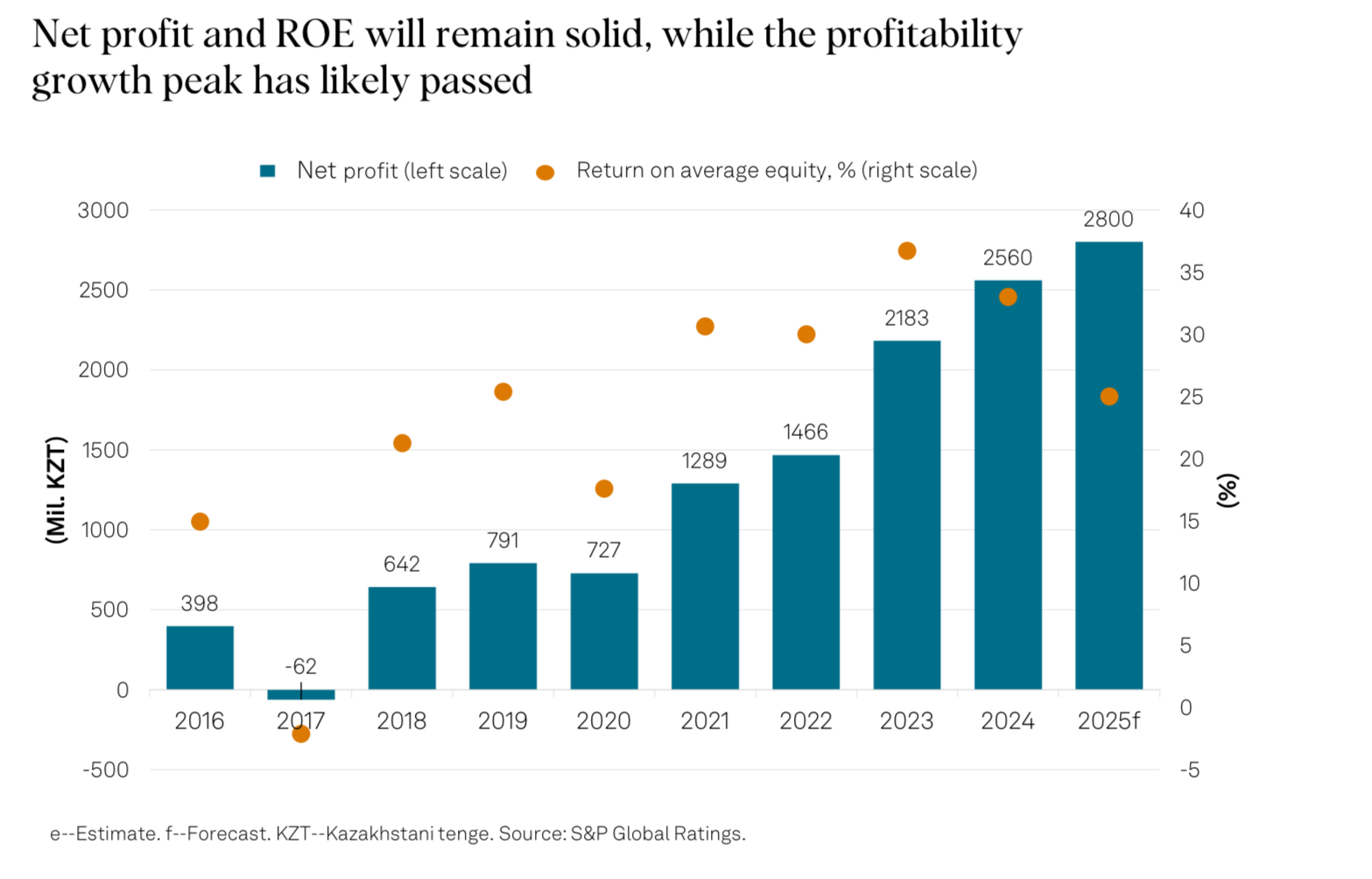

In contrast, Kazakhstani banks are expected to maintain solid margins that support earnings generation, helping them build buffers against potential risks in a volatile economic environment. Over the past three years, banks have shifted their focus toward retail banking, with retail loans comprising 60% of total loans by the end of 2024.

Net interest margins have expanded by approximately 150 basis points since 2021, reaching an average of 6.4% in 2024. While S&P considers banks’ credit risk to be under control, the agency expects retail lending growth to slow to 18%-20% in 2025. Retail loans will remain the primary driver of lending growth, but less aggressive expansion should help stabilize banks’ risk profiles.

However, S&P warns that the rapid increase in household indebtedness—particularly among lower-income segments—could lead to higher credit costs if a downturn occurs in the credit cycle.

Standard & Poor’s (S&P) is a subsidiary of the U.S.-based S&P Global and one of the world’s top three credit rating agencies, alongside Moody’s and Fitch Ratings. Established in 1941, it is known for its financial market analysis and for creating the S&P 500 stock index.

Follow Daryo's official Instagram and Twitter pages to keep current on world news.

Comments (0)