In Uzbekistan, US dollars are often the go-to choice for saving and making significant purchases, from homes to cars. While the soum (UZS) has gained more traction over the past decade, many still hesitate to trust the national currency's stability. This article delves into the underlying factors driving this ongoing preference for dollars.

Why is the soum not fully trusted?

The US dollar holds a dominant position in the global financial system, serving as the primary currency for trade, investment, and reserves in many countries, including Uzbekistan. This widespread use of the dollar, not just by the state but also by the population, highlights its importance.

Although the soum has been Uzbekistan's national currency since 1994, it still struggles to gain widespread trust. In many regions, high-value goods and services continue to be priced in dollars.

For example, purchasing property, land, or a car on the secondary market often means dealing in dollars. Many people keep their savings, make rent payments, or conduct other transactions in US currency. While the soum has seen increasing use over the past 7-8 years, economists argue that it still hasn't earned the level of confidence needed for it to fully replace the dollar in everyday life.

Economist Bekhzod Khoshimov attributes the low level of trust in the soum to the long-standing restrictions on currency conversion. From 1996 to 2017, Uzbekistan had strict controls, making it difficult for people to exchange foreign currencies freely. It wasn’t until 20 years later that currency policy was liberalized.

“Just a decade ago, confidence in the national currency was extremely low. Back then, anything of considerable value was priced in dollars. Even a tailor would quote a price like, ‘I’ll sew a dress for $50.’ People stored their savings in dollars, quickly converting them to soums only when making a purchase. The liberalization of the currency exchange rate, however, has played a significant role in reducing the dollarization of the economy. At the same time, the government began requiring prices to be set in soums. Even airline tickets and cars were previously sold in dollars. However, now UzaAvto is announcing car prices in soums. All payments and values in the country should be determined in the national currency. For instance, in Russia, if you ask, "How much does an apartment cost?" you'll be given the price in rubles, not dollars. In Uzbekistan, however, prices for apartments, yard sales, rent payments, and other transactions are still often quoted in dollars,” the economist noted.

According to the analysis, in developing countries, a significant portion of income is spent on consumption, creating a strong link between the rise in the dollar exchange rate and inflation.

This leads to high dollarization, where the national currency often fails to serve as a proper measure for goods and assets. As a result, not only the prices of goods but also long-term assets, such as real estate and cars, increase in the national currency.

Economically, the law of demand suggests that when the price of a good rises, demand for it falls. However, in the foreign exchange market, this dynamic works in the opposite direction. Expectations of a higher dollar exchange rate actually fuel further demand for the dollar, exacerbating the cycle.

"We created this situation ourselves. If we had always had normal currency conversion, we would be speaking in tenge, like Kazakhstan does with its own currency. We made the mistake of closing the conversion process, but now we're glad that things are improving," said economist Bekhzod Khoshimov.

He argued that the closure of currency conversion was an artificial, not natural, process driven by the state. Now, to stabilize the economy, natural processes should not be interfered with.

"All transactions in the country should be in soums, and the soum must gain trust," he emphasized.

Khoshimov pointed out the difference in interest rates between dollar and soum deposits:

"You can earn a maximum of 8 percent on a dollar deposit, but up to 27% on a soum deposit. The reason is simple: the soum is so undervalued in the market that banks have to offer a large premium to encourage people to hold it." He added, "The soum is depreciating against the dollar by less than 18% per year—banks are not foolish."

Currency stability is the key factor in building confidence in any currency, and for the soum, its stability is significantly influenced by external factors. Specifically, the stability of the currencies of Russia, China, and Kazakhstan—Uzbekistan’s main trading partners—plays a crucial role.

Another major factor contributing to the depreciation of the soum is the high deficit in the country’s foreign trade balance. From January to November 2024, Uzbekistan’s exports amounted to $24.2bn, while imports reached $35.1bn, resulting in a negative difference of approximately $10.9bn.

This trade imbalance puts downward pressure on the national currency, affecting not only its value but also production, currency policy, and the overall economic situation in the country.

Deposits in soums have increased

Eldor Zakirov, head of the Central Bank Department, shared with journalists that the population's trust in the soum is on the rise. Notably, inflation has dropped from 20% in 2018 to 10% today, while the annual average exchange rate fluctuation has decreased from 15% to around 5-6%. These improvements have made the long-term dynamics of the exchange rate far more stable than in previous years.

“Today over 80% of population (individuals) deposits are now held in soums. This shift is largely due to lower inflation, a relatively stable exchange rate, and high interest rates on soum deposits, making it increasingly profitable to save in the national currency. As a result, deposits in the banking system have been growing rapidly. In the past 4-5 years, term deposits in soums have increased by 1.5 to 1.6 times annually, and from January to November 2024, deposits in soums surged by 57%. In 2018, total deposits in Uzbek banks were under $3bn. Today, that figure has risen to $9bn, marking a three-fold increase in just five years,” the expert voiced.

The depreciation of the soum against the dollar has also slowed in 2024, with the soum weakening by just 4.5%. In comparison, the national currency depreciated by 9.7% in 2023 and 3.94% in 2022.

What increases the value of the soum?

The value of a national currency, including the soum, is determined by the overall health of the economy, both domestically and in the context of global economic trends. Stable economic growth, inclusive development, and active foreign economic activity are key factors influencing a currency's strength.

Mamarizo Nurmuratov, former Chairman of the Central Bank, highlighted that since the liberalization of Uzbekistan's foreign exchange market in 2017, the soum has depreciated much less compared to many other countries.

"Over the past four years, the soum has been depreciating by an average of 6-7% annually. This suggests that despite inflation above 10%, there is no real cause to claim that the currency is weakening. In fact, economic growth is a result of this exchange rate stability," Nurmuratov stated.

He further emphasized that the soum should not be considered weak simply because the exchange rate is around UZS 11,500 to $1. The overall economic fundamentals, he argued, are what truly determine the value of the currency.

In general, a wide range of factors influence the appreciation of a national currency. A key element is the effective implementation of economic policies. Additionally, socio-political stability—both internally and externally—is essential for fostering confidence in the currency.

Economies are vulnerable to various "shocks," such as wars, conflicts, and international sanctions, which can significantly impact currency values. Given the interconnected nature of the global economy, financial issues in other countries inevitably affect Uzbekistan’s economic situation.

Another crucial factor in strengthening a currency is reducing inflation. When inflation is under control, the currency tends to retain its value. Furthermore, the normalization of the export-import balance, alongside an increase in foreign investments, also plays a critical role in bolstering the national currency. Together, these factors contribute to a stable and appreciating currency.

Deputy Chairman of the Central Bank, Behzod Hamraev, disagrees with claims that the soum is undervalued. He explained that comparing currencies purely based on how many goods one can buy with a dollar in different countries is overly simplistic.

"For example, you might get 10 items for $1 in country 'A' and 20 in country 'B.' This doesn't necessarily mean that the currency of 'A' is stronger," he stated.

He also pointed out a recent magazine ranking that placed the soum among the top ten weakest currencies. Hamrayev argued that even currencies that are not typically considered weak can be denominated—split into smaller units. He referenced the Turkish lira, which was devalued by 39% this year. In 2006, Turkey redenominated the lira at 100,000 units, and if that had not occurred, the exchange rate could now be 26,000 or 260,000.

Hamrayev emphasized that the soum's exchange rate is actually favorable for investors.

"If we look at the value of the soum since 2019, it has appreciated by 10.6 points when adjusted for inflation in our trading partners. In fact, the soum has strengthened over time," he concluded.

The dollar exchange rate is increasing

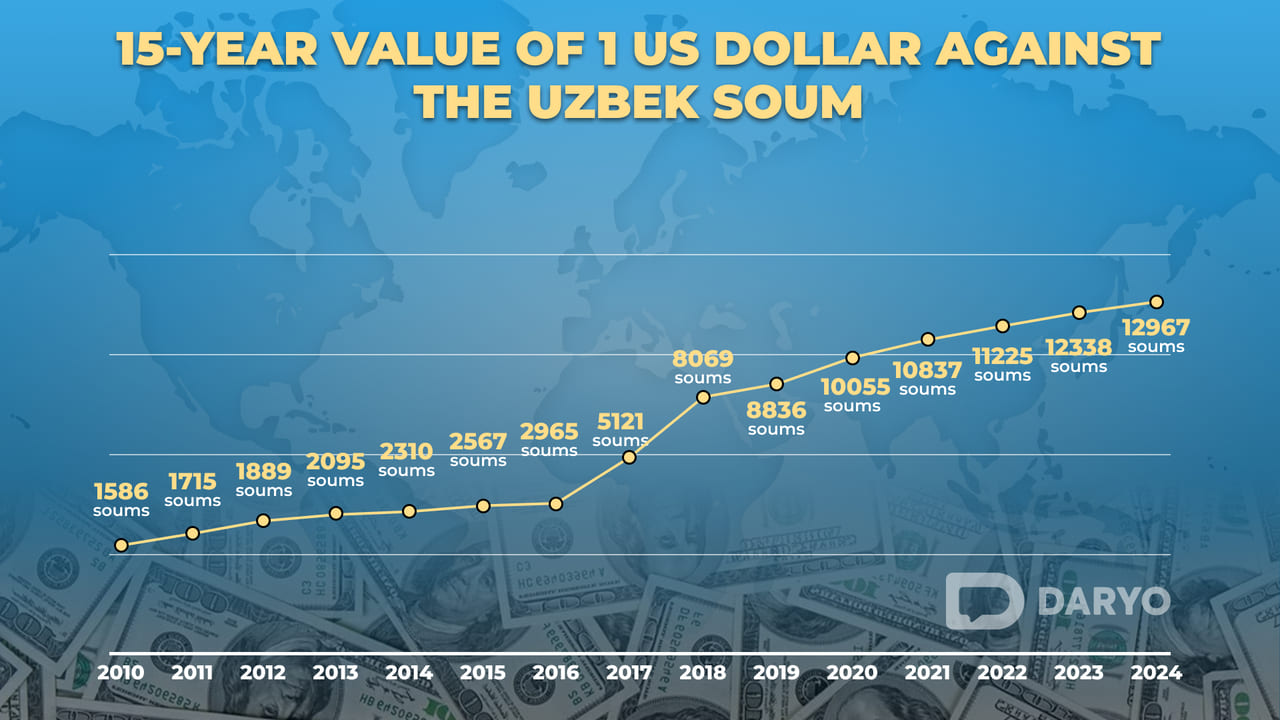

The exchange rate of the dollar against the soum has been gradually increasing since the introduction of the soum banknotes on July 1, 1994, when $1 was valued at UZS 7. Over the years, the value of the dollar in soums has steadily risen. According to the Central Bank, the exchange rate in recent years has evolved as follows:

- 1,586 soums in 2010

- 1,715 soums in 2011

- 1,889 soums in 2012

- 2,095 soums in 2013

- 2,310 soums in 2014

- 2,567 soums in 2015

- 2,965 soums in 2016

- 5,121 soums in 2017

- 8,069 soums in 2018

- 8,836 soums in 2019

- 10,055 soums in 2020

- 10,837 soums in 2021

- 11,225 soums in 2022

- 12,338 soums in 2023

- 12,967 soums in 2024

The rise in the dollar exchange rate in the fall of 2017 occurred following the presidential decree on primary measures to liberalize currency policy, which marked a shift from the previous state rate of UZS 4,210 per $1.

In 2017, the liberalization of currency conversion policies caused a shift in the exchange rate. Before the change, the exchange rate on the official market was UZS 4,210 per $1. However, on September 5, 2017, the rate surged to UZS 8,100, reflecting a 50% devaluation of the soum.

The dollar exchange rate has continued to rise year after year. The Central Bank regularly monitors inflation expectations from the public and entrepreneurs. Recent surveys reveal that 55% of the population and 52% of enterprises expect the exchange rate to continue increasing over the next 12 months. This expectation is seen as one of the primary factors contributing to anticipated price hikes.

Forecasts for the next three years

As of January 20, the Central Bank set the value of $1 at UZS 12,967. The state budget for 2025 anticipates an average dollar exchange rate of UZS 13,250, with projections rising to UZS 13,725 in 2026 and UZS 14,150 in 2027.

International rating agency S&P has also made projections for the dollar exchange rate over the next three years:

- End of 2025: UZS 13,650

- End of 2026: UZS 14,300

- End of 2027: UZS 15,000

However, accurately predicting the exchange rate is challenging due to the influence of various economic and political factors. The government considers potential financial risks when determining budgetary indicators. For example, if the soum depreciates by UZS 100, it could increase annual state budget expenditures by UZS 240bn ($18.6mn). A 5% depreciation in the soum this year could lead to an increase in budget expenditures exceeding UZS 1.5 trillion ($116mn).

Follow Daryo's official Instagram and Twitter pages to keep current on world news.

Comments (0)