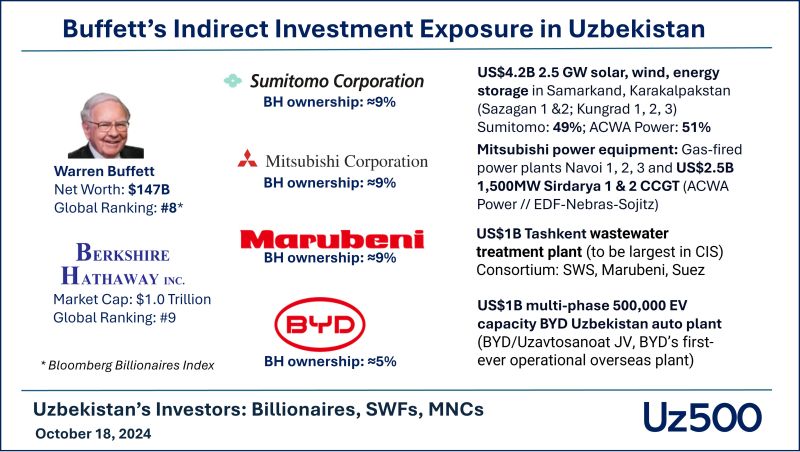

Uz500, a wealth advisory and private sector development organization has initiated an analysis of foreign direct investments in Uzbekistan, focusing on the involvement of global billionaires, sovereign wealth funds (SWFs), and multinational corporations (MNCs) with direct and indirect stakes in the country. Leading this review is Warren Buffett, the world-renowned investor, whose holdings through Berkshire Hathaway give him substantial, though indirect, exposure to Uzbekistan’s growing economy.

Since 1965, Warren Buffett transformed Berkshire Hathaway from a struggling textile company into a trillion-dollar conglomerate. While the majority of Berkshire’s investments are rooted in American businesses, it holds equity stakes in eight non-U.S. companies, including five Japanese conglomerates: Mitsubishi Corporation, ITOCHU Corporation, Mitsui & Co., Ltd., Sumitomo Corporation, and Marubeni Corporation, with average ownership nearing 9%. Additionally, Berkshire holds a 5% stake in China’s electric vehicle (EV) giant, BYD.

Intriguingly, half of these international portfolio companies have expanded their operations into Uzbekistan, contributing to the nation’s rapidly growing energy, infrastructure, and manufacturing sectors.

In September, Sumitomo Corporation deepened its presence in Uzbekistan by acquiring a 49% stake in several renewable energy assets from Saudi-listed ACWA Power. Together, they are set to invest $4.2bn to develop 2.5 GW of solar and wind energy, as well as 968 MW of battery storage capacity.

Moreover, in August 2024, a consortium comprising Marubeni, TAQA Water Solutions, and SUEZ signed a $1bn joint development agreement with the Government of Uzbekistan to construct the largest wastewater treatment facility in the CIS region, based in Tashkent.

Mitsubishi Corporation plays a pivotal role in Uzbekistan’s power sector, with its advanced power equipment powering 90% of the country’s large-scale gas-fired generation. Notable projects include the Navoi 1, 2, and 3 plants, as well as the US$2.5 billion Syrdarya 1 and 2 combined-cycle gas turbine (CCGT) plants.

In June 2024, the first electric vehicles (EVs) were produced at the BYD Uzbekistan joint venture plant, marking BYD’s first operational overseas manufacturing site. This milestone comes as the world’s largest EV maker expands globally, with plans to establish plants in Thailand, Brazil, Turkey, and Hungary.

Uz500 anticipates that Itochu and Mitsui, two other Berkshire Hathaway portfolio companies, will follow the lead of their Japanese peers by seeking opportunities in Uzbekistan’s fast-growing economy. Possible future investments could include renewable energy and infrastructure projects or the development of uranium and critical mineral resources.

Given the current investments by Mitsubishi, Sumitomo, and Marubeni, Berkshire Hathaway’s indirect exposure to Uzbekistan, already worth several hundred million dollars, is expected to grow significantly in the coming years through new projects and acquisitions.

Follow Daryo's official Instagram and Twitter pages to keep current on world news.

Comments (0)