The state debt profile of the Republic of Uzbekistan as of January 1, 2023, reflects a balanced and strategic approach to fiscal management, resulting in notable achievements in debt sustainability and economic growth. This information is given in the overview of state debt situation and dynamics published by the Ministry of Economy and Finance.

State debt profile

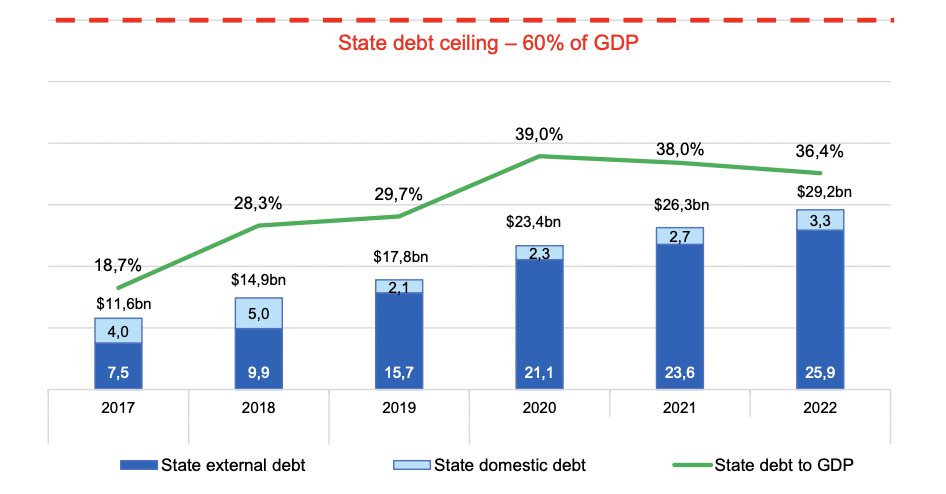

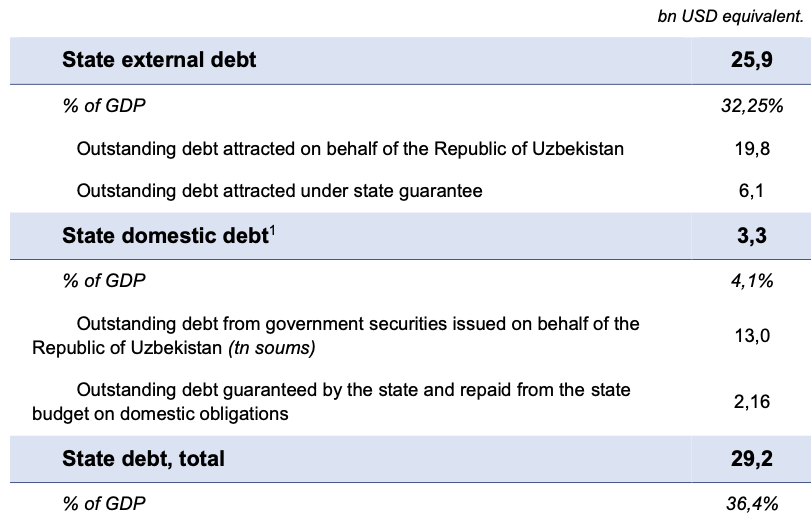

With a total outstanding state debt of $29.2 bn, comprising $25.9 bn in state external debt and $3.3 bn in state domestic debt, the debt-to-GDP ratio stands at 36.4%. This ratio has shown consistent improvement from 39.0% at the beginning of 2021 to 36.4% on January 1, 2023, indicating successful efforts in maintaining a manageable debt burden relative to the country's economic output.

The classification of the Republic of Uzbekistan's state debt as "moderate" by the International Monetary Fund underscores the country's effective debt management practices. Despite a $2.9 bn increase in state debt in 2022, the rapid expansion of the US dollar-denominated GDP by $11.1 bn facilitated a decrease in the state debt-to-GDP ratio.

These positive outcomes are attributed to a series of well-executed measures, including:

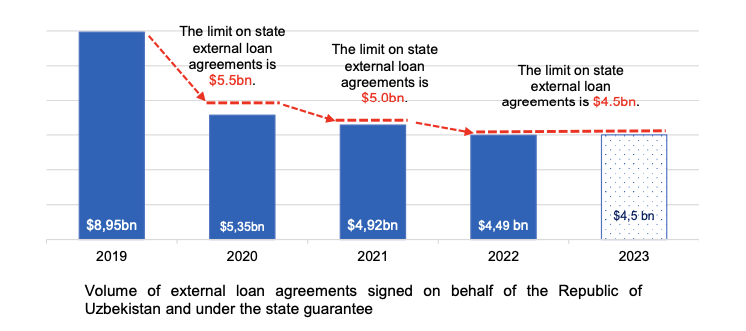

Prudent Borrowing Limits: The introduction of legal limits on annual state external debt borrowing and guarantees has led to a controlled approach to debt accumulation. Borrowing limits of $5.5 bn were set for 2020, and subsequent years saw similarly strategic caps.

Diverse Funding Sources: Efforts to diversify the state debt portfolio included the issuance of sovereign Eurobonds in local currency, enhancing financial resilience and mitigating currency risks.

Enhanced Transparency: International credit ratings for state-owned enterprises and banks, along with increased publication of debt-related information, have improved transparency and access to global financial markets.

Domestic Market Development: A strong focus on the domestic financial market led to a substantial increase in government securities placement, rising from 597 bn soums (around $50 mn) in 2018 to 13.6 tn soums (over $1.1 tn) in 2022.

Automated Debt Management: The implementation of the Debt Management and Financial Analysis System (DMFAS-6) software package has streamlined debt accounting and reporting processes, contributing to greater transparency.

The Republic of Uzbekistan's disciplined approach to state debt management and its drive to enhance economic resilience have positioned the country on a positive trajectory for sustainable growth and financial stability.

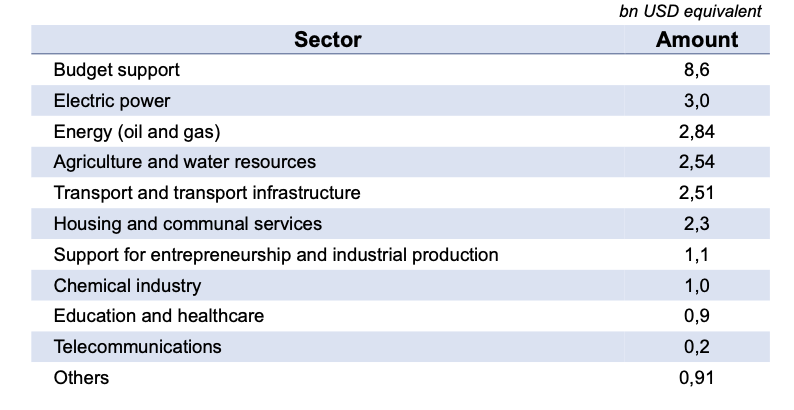

Of the overall debts, $3 bn, or 11.6 %, are directed to the electric power sector, while the energy industry receives $2.84 bn (10.9 %), agriculture and water management receive $2.54 bn (9.8 %), and $2.51 bn (9.7 %) is invested in transport and transport infrastructure.

Additionally, $2.3 bn (8.9 %) of the loans are assigned to the housing and communal economy segments.

Creditors

In Uzbekistan, the outstanding state external debt, acquired from international financial institutions (IFIs), stands at $13.8 billion, constituting 53.2% of the total state external debt. This debt is sourced from IFIs at favorable long-term and concessional interest rates.

Major creditors include the Eximbank of China, China Development Bank, the Japan International Cooperation Agency, and foreign government financial institutions from various countries. These funds are primarily channeled into financing diverse investment programs backed by state guarantees.

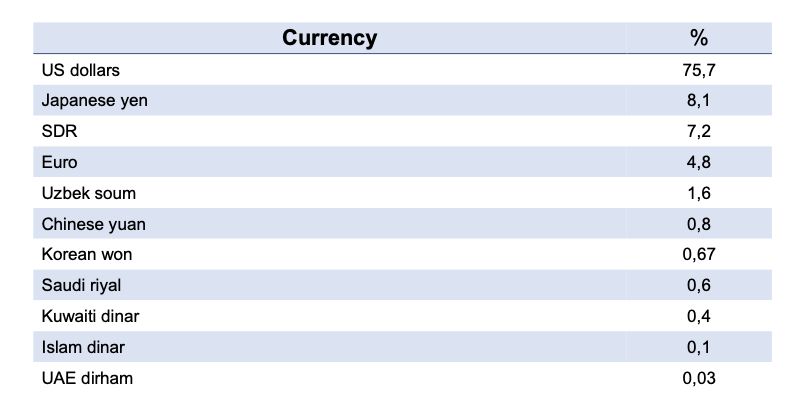

Currency

The distribution of Uzbekistan's State external debt reveals that 75.7% is in US dollars, 8.1% in Japanese yen, 7.2% in SDR (special drawing rights), 4.8% in Euros, 1.6% in Uzbekistani soums, and 2.6% in other currencies.

Uzbekistan's sovereign credit rating has undergone assessment by leading credit rating agencies, each offering distinct perspectives on the country's economic standing and potential.

Fitch Ratings affirmed Uzbekistan's rating at "BB-" (stable) in September 2022. The nation's strengths lie in solid external and fiscal buffers, low government debt, and a history of strong growth. Nonetheless, challenges like commodity dependency, high inflation, and structural weaknesses counterbalance these merits.

S&P Global Ratings maintained Uzbekistan's rating at "BB-" (stable) in December 2022. Amid an environment of multiple global downgrades, Uzbekistan's rating remained unchanged. The country's economic reforms and integration into the global economy hold potential for positive rating shifts, while fiscal, external reserve, and debt concerns could lead to a negative outlook.

Moody's upgraded Uzbekistan's rating from "B1" (positive) to "Ba3" (stable) in January 2023. This elevation is attributed to pivotal reforms, fiscal stability, and growth resilience demonstrated during external shocks. Moody's forecasts a 5.0% economic growth in 2023 and emphasizes the significance of competitive environment creation, fiscal deficit management, and domestic financing for sustaining positive trends.

Collectively, these assessments underscore Uzbekistan's efforts to navigate a complex economic landscape. The country's commitment to structural reforms, fiscal responsibility, and proactive measures to mitigate external shocks reflect its aspiration for sustainable growth and financial stability.

Comments (0)