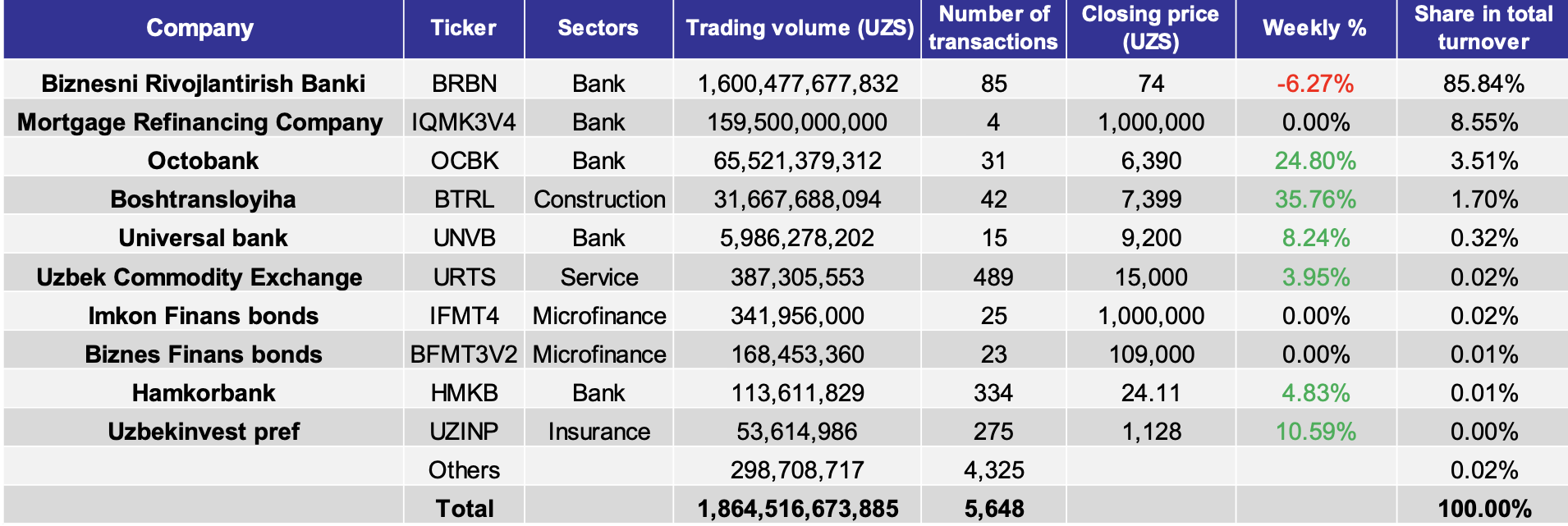

The Tashkent Stock Exchange (TSE) recorded a substantial trading volume of 1.86 trillion soums ($145mn) during the past week. This high turnover was largely driven by mergers and acquisitions (M&A) transactions, which contributed to the increase in overall market activity.

Among the most notable transactions, the Biznesni Rivojlantirish Banki (BRBN) saw trading volume reaching a remarkable 1.6 trillion soums ($125mn), accounting for approximately 86% of the total market turnover. This was the primary contributor to the exchange's high trading volume for the week.

Following BRBN, Mortgage Refinancing Company IQMK3V4 reported 159.5bn soums ($12.4mn) in trading volume, contributing 8.6% to the total turnover. This transaction marked an important milestone as the Mortgage Refinancing Company of Uzbekistan (MRC) conducted its fourth bond placement for 250bn soums ($20mn) with a three-year maturity and an expected return of 19%. Bonds accounted for nearly 9% of the week’s total turnover, reflecting growing interest in fixed-income securities among investors.

Stock Performance

In terms of stock price performance, the week saw an overall positive trend for most securities. Boshtransloyiha (BTRL), Octobank (OCBK), and Uzbekinvest Pref (UZINP) stood out for their growth. The closing price of BTRL increased by 35.8%, OCBK rose by 24.8%, and UZINP appreciated by 10.6%. These gains indicate strong investor confidence in these securities, which could be attributed to positive company news or broader market trends favoring certain sectors.

Conversely, BRBN saw a decline of 6.3% in its closing price, marking the only notable decrease among the major stocks. This suggests that while the overall market sentiment was positive, there were some challenges or profit-taking activities in certain sectors.

AVEX Index

The Avesta Equity Index (AVEX), a key barometer for the Uzbek stock market, rose by 3.6% during the week. The AVEX Index, which tracks the performance of leading companies listed on the Tashkent Stock Exchange, reached 2,190.2 points, though it experienced a 1.01% decline on November 15 compared to the previous day. Over the past three months, the AVEX Index has fallen by 12.99%, and it is down 12.07% year-on-year, suggesting that while the market has shown some resilience in recent weeks, it has faced challenges in the longer term.

Currency and Exchange Rate Movements

The exchange rate for the Uzbek soums (UZS) saw some fluctuations during the week. The USD/UZS exchange rate stood at 12,800.1 soums on November 15, marking a slight decline of 0.06% compared to the previous week. Over a three-month period, the exchange rate has appreciated by 2.04%, while it has increased by 1.41% year-on-year, reflecting the relatively stable performance of the som in the foreign exchange market.

The EUR/UZS exchange rate experienced a 1.07% decline during the week, standing at 13,467.0 soums, while the RUB/UZS exchange rate fell by 0.87%, reaching 129.0 soums. Both of these movements suggest some volatility in Uzbekistan’s exchange rates, particularly with respect to the European euro and Russian ruble.

Comments (0)