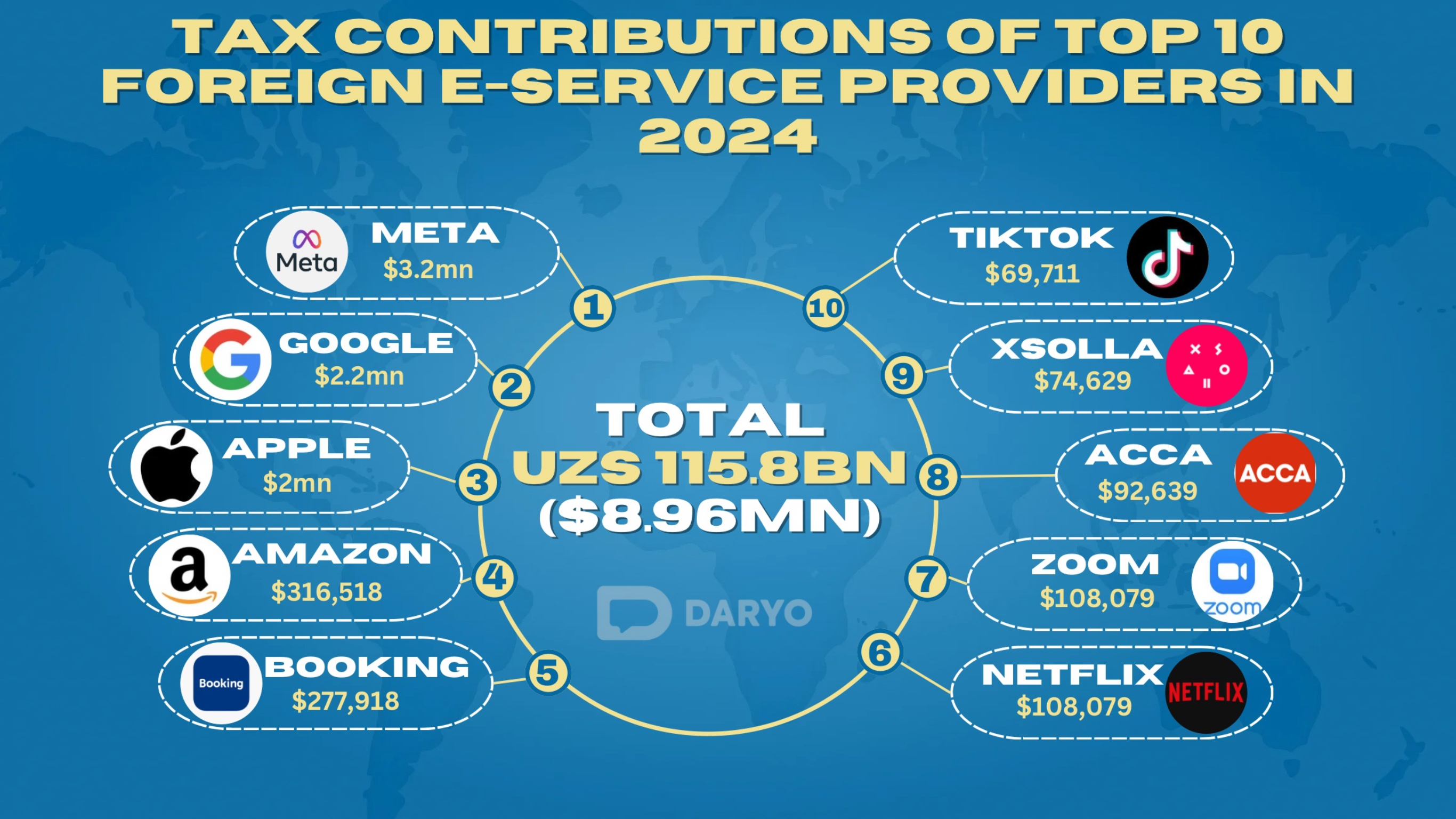

Tax payments by foreign IT companies operating in Uzbekistan surged by 1.5 times in 2024, reaching UZS 115.8bn ($8.96mn) according to the press service of the Tax Committee. This marks an increase from the previous year, with 99.9% of the tax payments coming from just ten major IT companies.

The total volume of electronic services provided by these foreign enterprises also grew by 1.5 times, rising from UZS 635.7bn ($49.1mn) to UZS 959bn ($74mn). Over the year, the number of foreign taxpayers in this sector increased by eight, bringing the total to 63.

Among the top earners, Meta reported UZS 346bn ($26.7mn), up 44% from 2023 paid UZS 41.7bn ($3.2mn) in taxes. Google followed with UZS 240bn ($18.5mn), a 36% increase, contributing UZS 29bn ($2.2mn) in taxes. Apple also saw impressive growth, earning UZS 227bn ($17.5mn), an 88% jump from the previous year, and paid UZS 27bn ($2mn) taxes.

However, not all tech companies saw such growth. Netflix, which had doubled its revenue in 2023, only grew by 15% in 2024, generating UZS 11.7bn ($903,234) and paid UZS 1.4bn ($108,079) in taxes. On the other hand, TikTok made an unexpected appearance in the top 10, earning UZS 7.5bn ($578,996) in 2024. This comes despite the fact that TikTok remains the only service officially blocked in Uzbekistan due to concerns over personal data security.

TikTok, which registered for tax purposes in Uzbekistan in October 2023, paid nearly UZS 903mn ($69,711) in taxes in 2024. This is a significant amount considering the service's restricted access in the country.

In 2023, foreign IT companies paid nearly UZS 70bn ($5.4mn) in taxes, marking a 56.2% increase compared to 2022. Since 2020, foreign companies providing electronic services in Uzbekistan have been required to pay VAT, with the Tax Committee setting up a dedicated office to facilitate registration and tax payments.

Follow Daryo's official Instagram and Twitter pages to keep current on world news.

Comments (0)