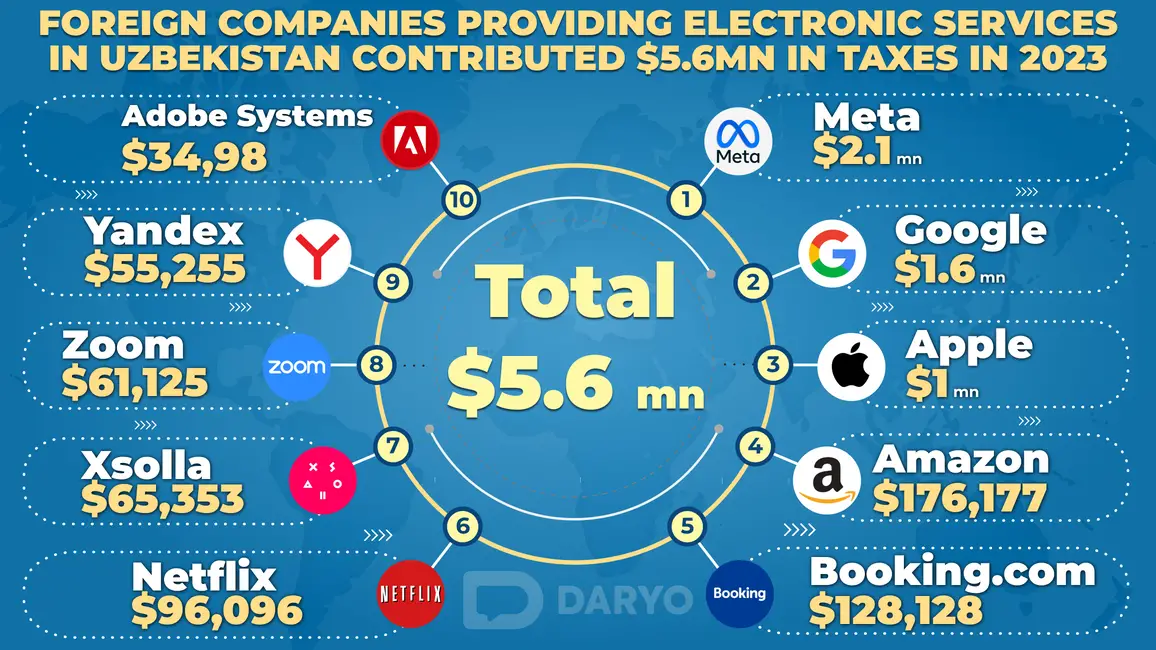

Foreign companies offering electronic services in Uzbekistan have collectively paid $5.6mn in taxes throughout the year 2023, indicating a significant increase compared to the previous year.

Tax Payments Surge

In the period spanning January to December 2023, a total of 56 foreign companies operating in the electronic services sector contributed to the tax revenue of Uzbekistan. The aggregate tax payment of $5.6mn represents a 1.5-fold increase compared to the corresponding period in the previous year.

Dominant Contributors

A significant portion of the taxes, amounting to 96.7%, was attributed to just 10 foreign entities engaged in providing electronic services. The top contributors to the tax revenue include:

- Meta: $2.1mn

- Google: $1.6mn

- Apple: $1mn

- Amazon: $176,177

- Booking.com: $128,128

- Netflix: $96,096

- Xsolla: $65,353

- Zoom: $61,125

- Yandex: $55,255

- Adobe Systems: $34,987

These companies have emerged as key contributors to Uzbekistan's tax revenue, reflecting the significance of their operations within the country's digital ecosystem.

Regulatory Framework

The implementation of the new version of the Tax Code, effective from January 1, 2020, introduced provisions such as the "Google tax" aimed at regulating taxation for foreign internet companies. Subsequently, the State Tax Committee established a VAT office specifically for foreign internet firms to register as taxpayers.

Follow Daryo's official Instagram and Twitter pages to keep current on world news.

Comments (0)