In a recent joint report published by Multilateral Development Banks (MDBs), it has been revealed that 2022 saw a remarkable increase in MDB climate finance, breaking all previous records. This announcement coincides with the gathering of delegates in Marrakesh, Morocco, for the World Bank Group and International Monetary Fund Annual Meetings. A central theme of the discussions is the urgent need to bolster public climate finance, especially for low and middle-income economies.

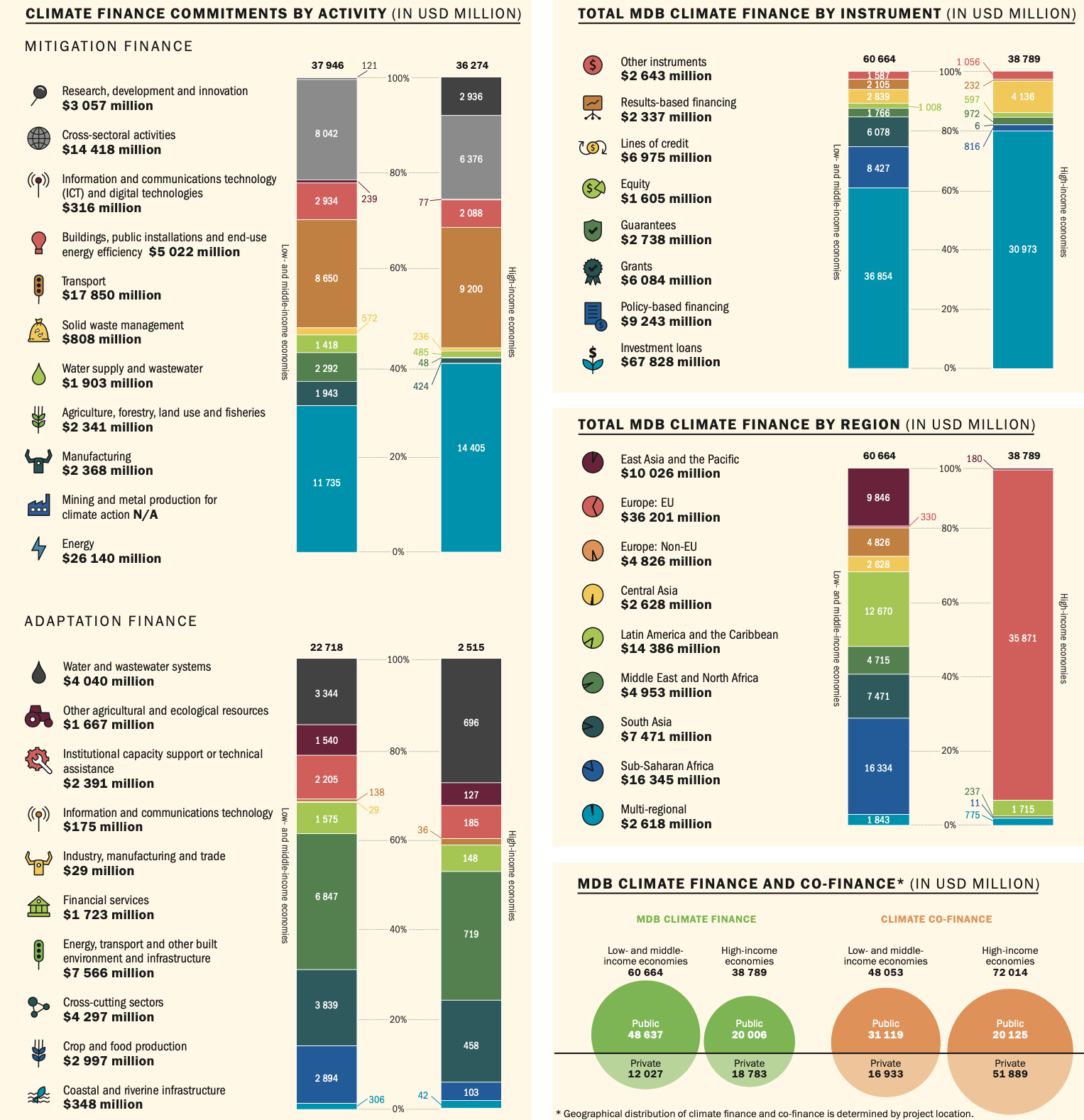

Last year, a substantial $60.7Bn was allocated to support climate action in low and middle-income economies, with a notable $22.7Bn designated for climate change adaptation. The global MDB climate finance reached an impressive nearly $100Bn, a considerable rise from $82Bn in 2021. Furthermore, the mobilized global private finance surged to $69Bn, compared to the $41Bn reported in the previous year.

2022 witnessed the allocation of $60.7Bn in MDB climate finance to low and middle-income economies, with a focus on $38Bn (63%) for climate change mitigation finance and $22.7Bn (37%) for climate change adaptation finance. The mobilized private finance for these endeavors amounted to $16.9Bn.

Conversely, high-income economies received $38.8Bn in 2022, with $36.3Bn (94%) devoted to climate change mitigation finance and $2.5Bn (6%) to climate change adaptation finance. Private finance mobilized for these purposes reached $51.9 Bn.

Notably, the MDBs have exceeded their 2025 climate finance targets for the second consecutive year. These targets were initially established at the UN Secretary General’s Climate Action Summit in 2019, with expectations of reaching a collective total of $50Bn in climate finance for low-income and middle-income economies, at least $65 billion globally, doubling adaptation finance to $18Bn, and mobilizing $40Bn in private investment. In comparison to 2019 figures, MDB climate finance for low and middle-income economies has surged by 46%, while global MDB climate finance has increased by 62%.

"We are pleased to have surpassed the $50Bn target for low and middle-income economies for the second year running. In this era of climate crises, addressing climate change has become a top priority for MDBs. The EBRD’s unique operating model, with a three-quarters private sector and one-quarter public sector approach, allows us to engage closely with a broad spectrum of financial and industrial sectors by providing both mitigation and adaptation finance. This enables us to catalyze substantial private sector investment," stated the EBRD’s Managing Director for Climate Strategy and Delivery, Harry Boyd-Carpenter.

According to the report of Vanora Benett, the EBRD’s climate finance commitment for low and middle-income economies increased to $4.3Bn in 2022 from $3.9Bn in 2019, while high-income economies received $2.5Bn, a significant rise from the $1.1Bn reported in 2019. In total, the EBRD’s climate finance for 2022 surged by 35% from 2019, reaching $6.8Bn, with a total climate private mobilization of $10Bn.

Bank, the Asian Development Bank, the Asian Infrastructure Investment Bank, the Council of Europe Development Bank, the European Bank for Reconstruction and Development, the Inter-American Development Bank Group, the Islamic Development Bank, the New Development Bank and the World Bank Group.

The EBRD, recognized as a leading climate finance provider, has committed to making at least half of its investments green by 2025. Since January 1, 2023, the EBRD's activities have been fully aligned with the mitigation and adaptation goals of the Paris Agreement. Its mandate to promote private sector development positions it uniquely among MDBs to mobilize private investment for the substantial investments required for the green transition and to bridge the climate investment gap.

The Joint Report on MDBs Climate Finance is a transparent, collaborative annual effort to publish MDBs’ climate finance figures, along with a detailed explanation of the methodologies used for tracking this finance. This joint report monitors progress in relation to MDB joint climate finance targets, which were announced at the UN Climate Change conference COP21, and the heightened ambitions set for the 2021-2025 period.

This year’s report encompasses the Council of Europe Development Bank and New Development Bank’s climate finance, providing a comprehensive overview of all ten MDBs’ climate finance in the aggregated data. Global climate finance reached $98bn in 2022, even without these two MDBs participating in the reporting. Additionally, this year's report offers an in-depth breakdown of MDB climate finance in the least developed countries and small island developing states.

The 2022 multilateral development bank report, overseen by the EIB, compiles data from ten major institutions, including the African Development Bank (AfDB), the Asian Development Bank (ADB), the Asian Infrastructure Investment Bank (AIIB), the Council of Europe Development Bank (CEB), the European Bank for Reconstruction and Development (EBRD), the European Investment Bank (EIB), the Inter-American Development Bank Group (IDBG), the Islamic Development Bank (IsDB), the New Development Bank (NDB), and the World Bank (WB). This collaborative effort is instrumental in shedding light on the state of climate finance and the progress made towards critical climate targets.

Follow Daryo's official Instagram and Twitter pages to keep current on world news.

Comments (0)