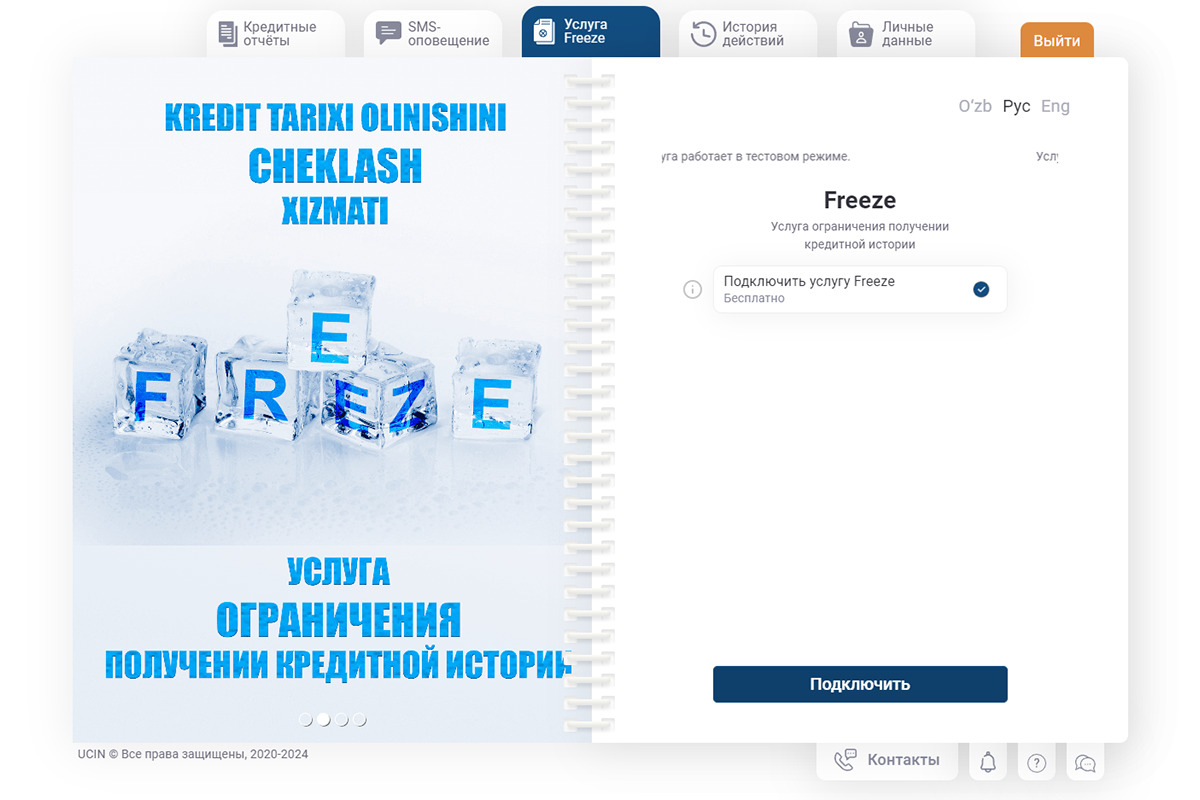

The Credit Information Analytical Center (CIAC), Uzbekistan's leading credit bureau, has introduced a new service called FREEZE, aimed at enhancing the protection of individuals' credit information. This service, launched in test mode, is now available on the bureau's official website and is designed to safeguard credit data against unauthorized access and potential fraud.

Credit history is a crucial component in the financial landscape, serving as a comprehensive record of an individual's borrowing activities. It includes detailed information on all loans taken out, such as the type of loan (e.g., car loan, mortgage), amounts borrowed, payment statuses, and any overdue debts. Banks and financial institutions rely heavily on this data to assess an individual's creditworthiness when making lending decisions.

The FREEZE service addresses the increasing concerns over data security and privacy. The service enables individuals to restrict the access to their credit information without their consent. This feature becomes particularly important in light of rising concerns about data breaches and online fraud.

Under the FREEZE service, users can prevent unauthorized access to their credit history, thereby mitigating the risk of identity theft and fraudulent activities. The introduction of this service is a proactive measure to ensure that credit information remains secure even in the event of a potential data breach.

Until the end of 2024, the FREEZE service will be offered free of charge to all users. Starting January 1, 2025, the service will be available for a nominal fee of approximately 10,000 soums ($0.79) at the current exchange rate. Access to the service will be facilitated through OneID, a secure authorization platform.

Comments (0)