In the fiscal year of 2023, organizations operating within the service sector in Uzbekistan made substantial tax contributions, totaling more than UZS 27.5 trillion ($2.2bn). This figure was reported by the Tax Committee, highlighting the significant financial impact of the service industry on the country's economy.

Out of the total tax revenue, a notable portion amounting to over UZS 4.8 trillion ($382mn), equivalent to 17.7%, was contributed by just 20 organizations. These entities reported a substantial trade turnover exceeding UZS 55 trillion ($4.4bn), with tax benefits applied amounting to almost UZS 3.7 trillion ($294.5mn).

Breakdown of Tax Revenues

The tax payments from these top 20 taxpayers in the service sector were further categorized by type:

- Value-Added Tax (VAT): UZS 1.1 trillion ($87.5mn)

- Excise Tax: UZS 941.2 billion ($74.9mn)

- Personal Income Tax: UZS 878.3 billion ($69.9mn)

- Social Tax: UZS 765.5 billion ($60.9mn)

- Income Tax: UZS 675.5 billion ($53.8mn)

- Property Tax: UZS 80 billion ($6.4mn)

- Land Tax: UZS 64.7 billion ($5.1mn)

- Other Taxes: UZS 323.4 billion ($257.4mn)

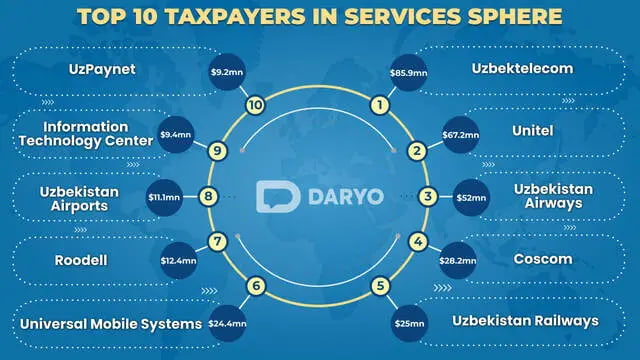

Top 10 Taxpayers

Among the leading contributors in the service sphere, the top 10 taxpayers were identified, with notable organizations and their corresponding tax contributions as follows:

- Uzbektelecom - $85.9mn

- Unitel - $67.2mn

- Uzbekistan Airways - $52mn

- Coscom - $28.2mn

- Uzbekistan Railways - $25mn

- Universal Mobile Systems - $24.4mn

- Roodell - $12.4mn

- Uzbekistan Airports - $11.1mn

- Information Technology Center - $9.4mn

- UzPaynet - $9.2mn

Earlier, it was reported that in the first two months of 2024, Uzbekistan's major taxpayers have contributed to the country's revenue, with more than UZS 17 trillion ($1.3bn) collected from 2,186 large taxpayers.

Follow Daryo's official Instagram and Twitter pages to keep current on world news.

Comments (0)