In Kyrgyzstan, 83% of the 1.1 mn households lack access to district heating, resorting to individual solutions, according to the World Bank report. The number of citizens without access to sewerage systems has grown from 91% in 2018 to 93% in 2020. The country ranks 103rd out of 140 in the World Economic Forum’s 2019 Global Competitiveness Index for infrastructure, with transport infrastructure ranking only 129th. To meet the United Nations Sustainable Development Goals by 2030, an additional expenditure amounting to 6.6% of GDP is required, highlighting the high demand for infrastructure and the need for strategic private capital attraction.

Access to basic services

Piped water supply outside of the capital is intermittent and commonly disrupted by shortages or by noncompliant or unsafe water. Access to district heating is limited to approximately 17% of the 1.1 mn Kyrgyz households. The remaining 907,000 households resort to individual solutions to meet their heating needs during winter. In 2020, the vast majority of citizens lacked access to sewerage systems, and their number is growing—from 91% in 2018 to 93% in 2020.

Disparities in service provision

There are large disparities in basic service provision among rural and urban areas and across regions. Mountain oblasts have fewer basic services than other regions, and, within each region, rural areas are less likely to have basic services than urban areas.

42% of the population of the capital has access to piped sewage, compared with only 3% of the predominantly rural population of the Batken region. In small towns, 25-50% of the population has regular solid waste service, compared with about 96% of the population in Bishkek and 60% in Osh.

Infrastructure gaps and economic competitiveness

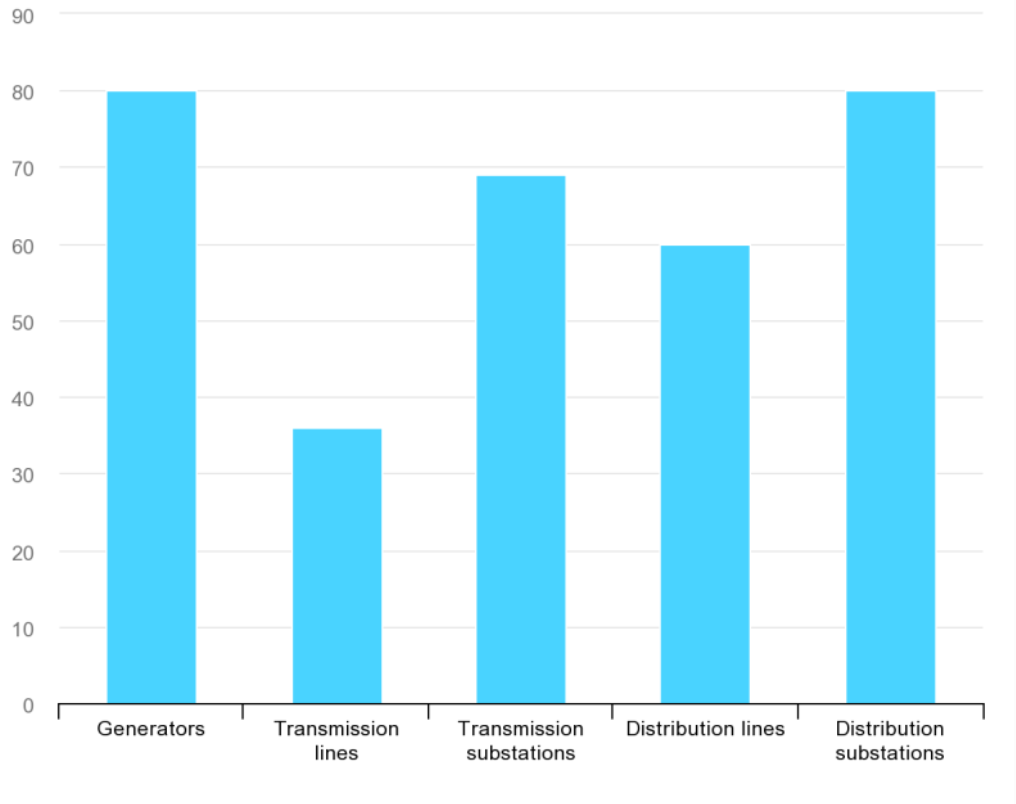

Road and rail densities are low and lag behind regional peers, and the quality of much of the road network is poor. The deficiencies of the transport infrastructure impede growth in rural areas and the development of export industries. Many capital assets are far older than their normal service life and have thus become prone to frequent breakdowns that disrupt power and heating supplies. Consequently, 31% of firms in the 2019 World Bank Enterprise Survey identify electricity as a major constraint on their operations (compared to 24% in the World Bank’s Europe and Central Asia region as a whole).

High demand for infrastructure and limited fiscal space

The high demand for infrastructure and limited fiscal space necessitate a strategic approach to attract private capital. For instance, national infrastructure investment needs for 2010–20 were estimated at close to $9bn or 13.3% of GDP, primarily to ensure maintenance of the existing stock and towards transport and electricity.

Meeting the United Nations Sustainable Development Goals

The IMF provided estimates of the additional spending required to achieve the United Nations Sustainable Development Goals in five sectors over the period 2019-30. Three infrastructure sectors—roads, water, and electricity—required additional expenditure amounting to 63% of 2018 GDP (nearly two-thirds of which is accounted for by investment in roads), while the health and education sectors required additional expenditures of 18% and 25% of 2018 GDP, respectively.

Assuming the average annual real GDP growth of 4.5% during 2019–30, the total additional expenditure required by these five sectors to meet the Sustainable Development Goals amounts to 6.6% of GDP throughout the 12-year period, of which 3.9% of GDP is composed of expenditures in the infrastructure sectors and 2.7% of GDP expenditures in the education and health sectors.

Infrastructure financing gap

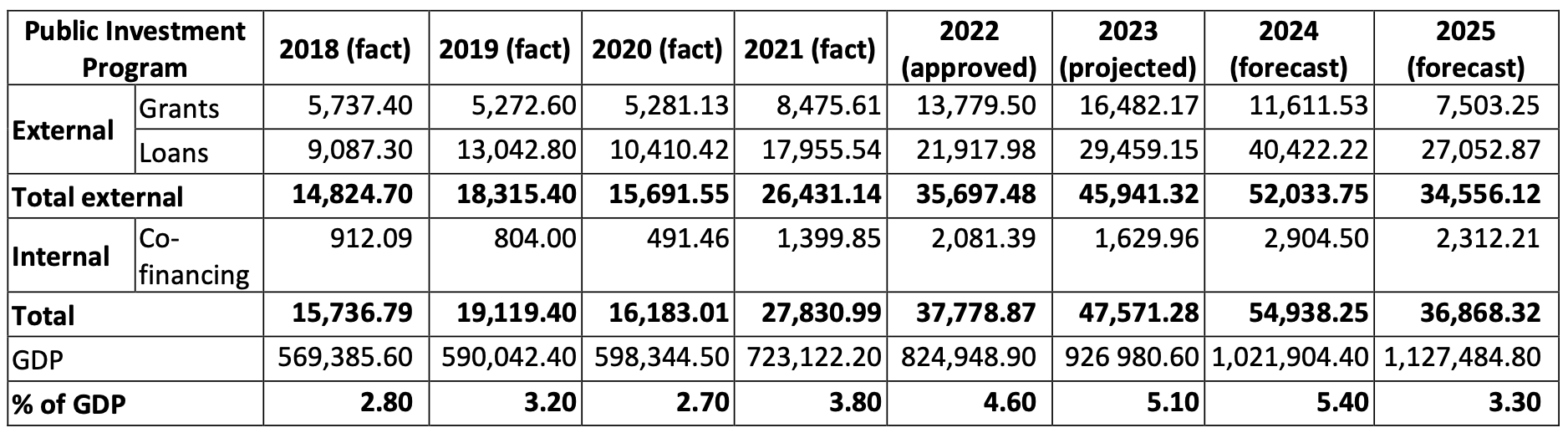

The majority of the total public investment is being funded through external sources; however, there is still a significant gap in infrastructure financing. In 2023-2025, the total amount of public investment budget from all sources will reach KGS 139,377.9 mn ($1.6bn). The share of external funding through foreign loans and grants will amount to KGS 132,531.2 mn or $1.5bn (95.1% of the total public investment) while only KGS 6,846.7 mn or $76.7 mn (4.9%) will be allocated from domestic sources to co-finance the public investment projects.

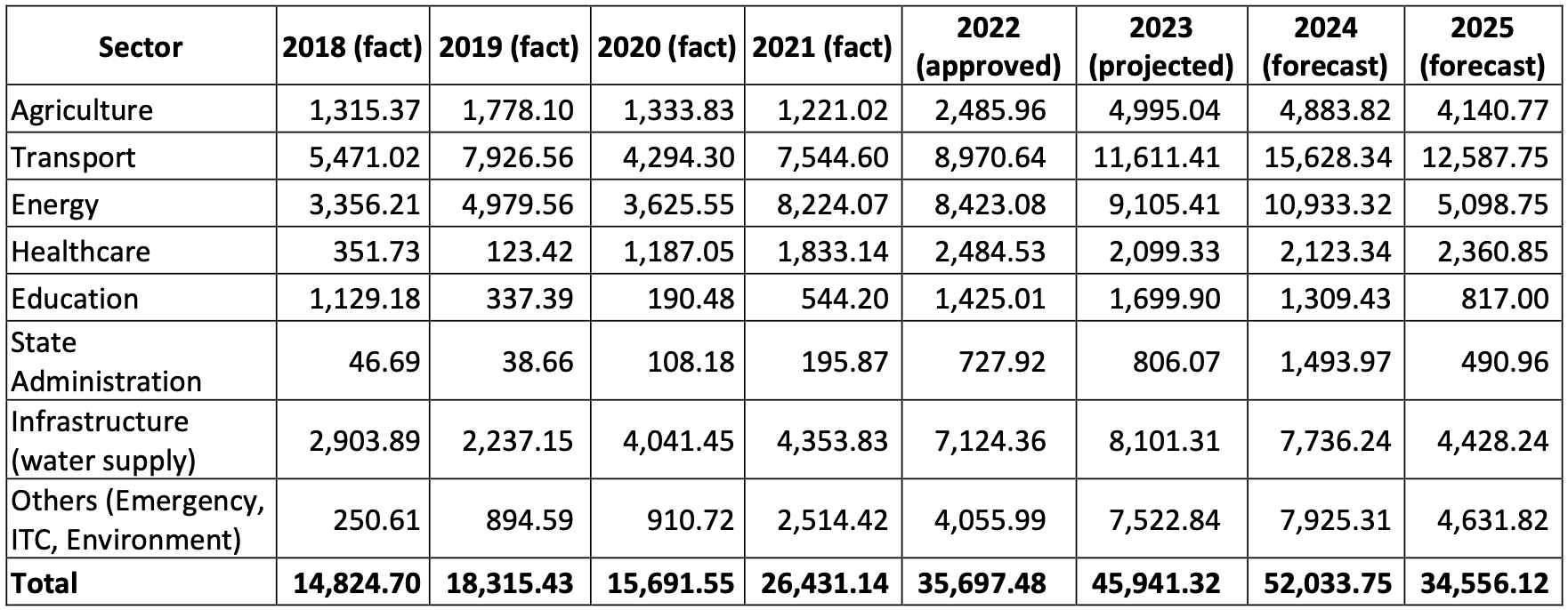

Agriculture, transport, energy, and infrastructure (including water supply) remain the most important sectors, with an expected volume of investment of KGS 128,610.20 mn or $1.4bn (92.3% of total public investment) in 2023-2025.

Future infrastructure needs and funding

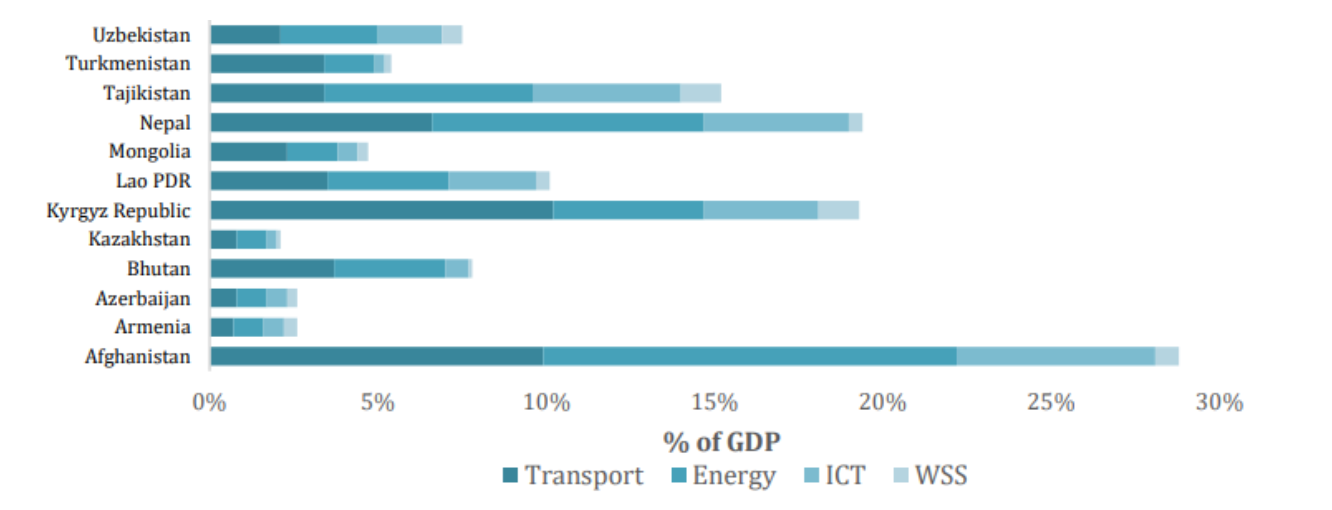

Financing requirements to close the infrastructure gap, such as transport, energy, and ICT, from 2018 to 2030 are estimated at 19% of GDP per year. The current Public Investment Program covers only 3-5% of GDP each year; hence, there is a significant gap in infrastructure financing. To meet the country’s growing spending needs on infrastructure without undermining debt sustainability, further efforts are needed to strengthen all streams of funding/financing.

Governance issues and investment climate

Governance issues are particularly relevant to investors, with nearly 70% of firms citing some aspect of governance as their single largest constraint. When investors cite the top obstacle to the business environment in the 2019 World Bank Enterprise Survey, governance concerns occupy the first, second, and third positions. Among respondents, 62.9% flagged either political instability, informality, or control of corruption.

In 2014, the Asian Development Bank supported the establishment of a PPP Project Preparation Fund with a total capitalization of $4 mn. This Fund can be used for consulting services for PPP project preparation, including the development of a feasibility study or other comprehensive assessments of a PPP project’s feasibility before and during implementation. The winning bidder is responsible for reimbursing the Project Preparation Fund for any resources spent on project preparation. This burden may implicate the fact that, to date, only $1 mn has been spent or committed to project preparation.

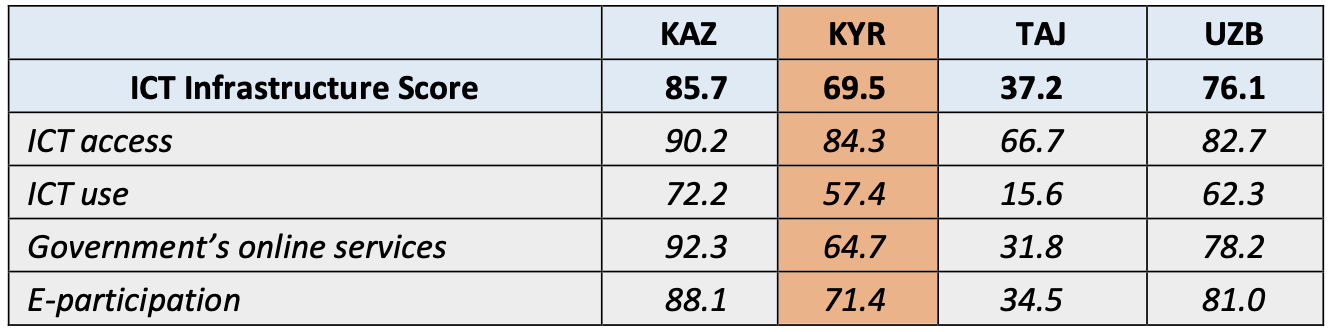

Global Innovation Index 2022

In the Global Innovation Index 2022, the Kyrgyz Republic scored 69.5, placing the country in the bottom third in the ranking of 132 world economies. This score reflects the current state of the country’s digital infrastructure and its capacity to support innovation. The Kyrgyz Republic’s ICT infrastructure scores trail behind Kazakhstan and Uzbekistan. This comparison with regional peers further underscores the necessity to upgrade the ICT infrastructure in the Kyrgyz Republic.

Follow Daryo's official Instagram and Twitter pages to keep current on world news.

Comments (0)