A significant 21% of the rural population of Tajikistan still depends on surface water, while a staggering 90% resort to outdoor pit latrines, according to the World Bank report. Despite a hefty investment of $6.1bn in the Rogun HPP project, Tajikistan grapples with substantial infrastructure deficiencies, especially in transport, with unpaved roads accounting for 83%. The current Public-Private Partnership portfolio, encompassing nine projects, is valued at approximately $34 mn.

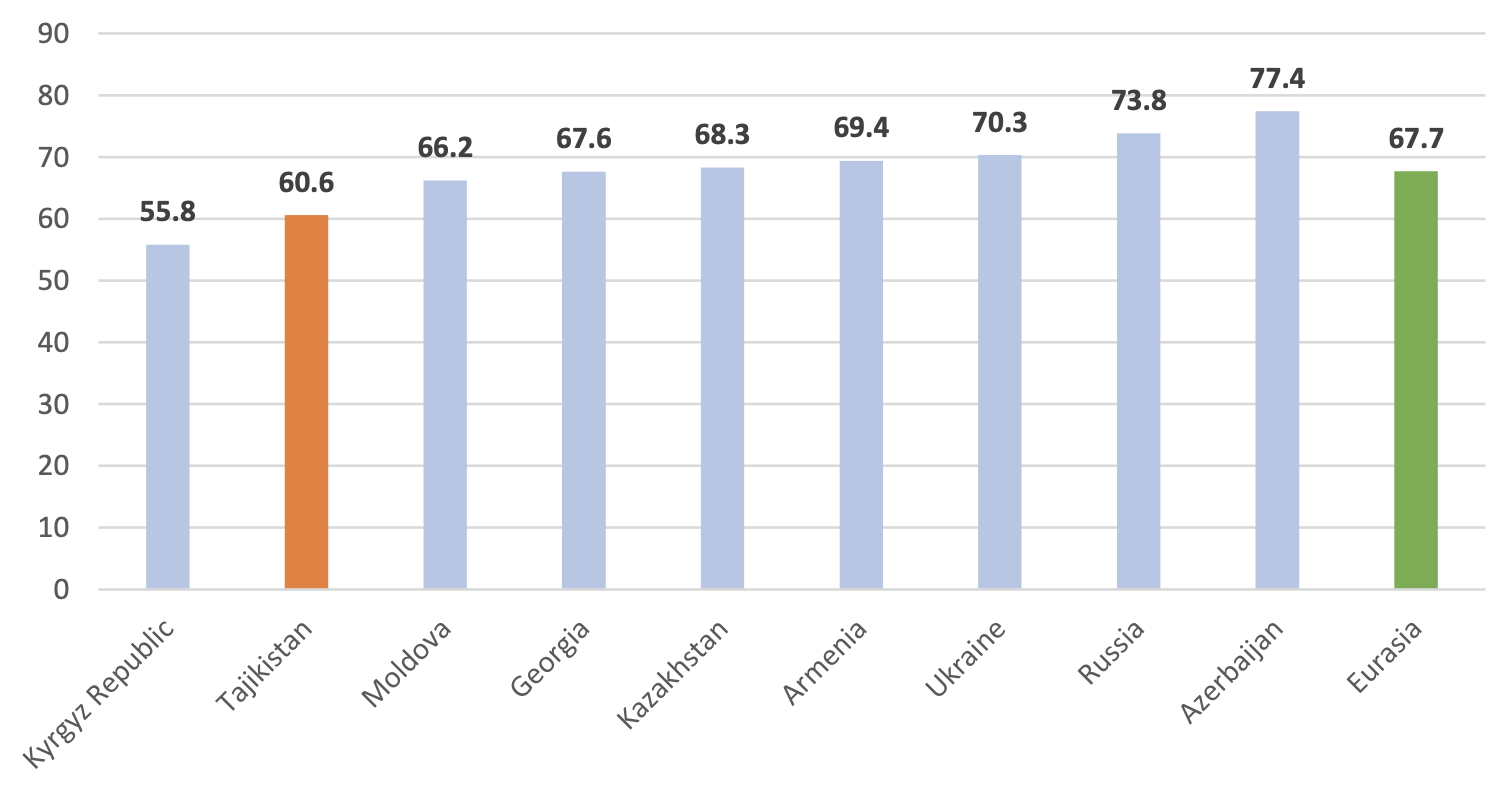

The quality of infrastructure in Tajikistan remains one of the lowest in the region, according to the World Economic Forum (2019). This inadequate quality and scale of infrastructure pose a development challenge and present health and environmental risks. Although electricity is almost universally available, frequent and widespread outages mean that Tajikistan cannot guarantee to fully meet the domestic electricity demand, especially during the winter months.

Rural Infrastructure Challenges

Market accessibility mapping highlights the lack of infrastructure integration outside the largest cities. In 2019, in rural areas, 21% of the population still relied on surface water as their main drinking water source, and 90% of the rural population was reliant exclusively on outdoor pit latrines. Furthermore, almost 90% of waste disposal sites did not meet sanitary-epidemiological norms.

Infrastructure development strategy

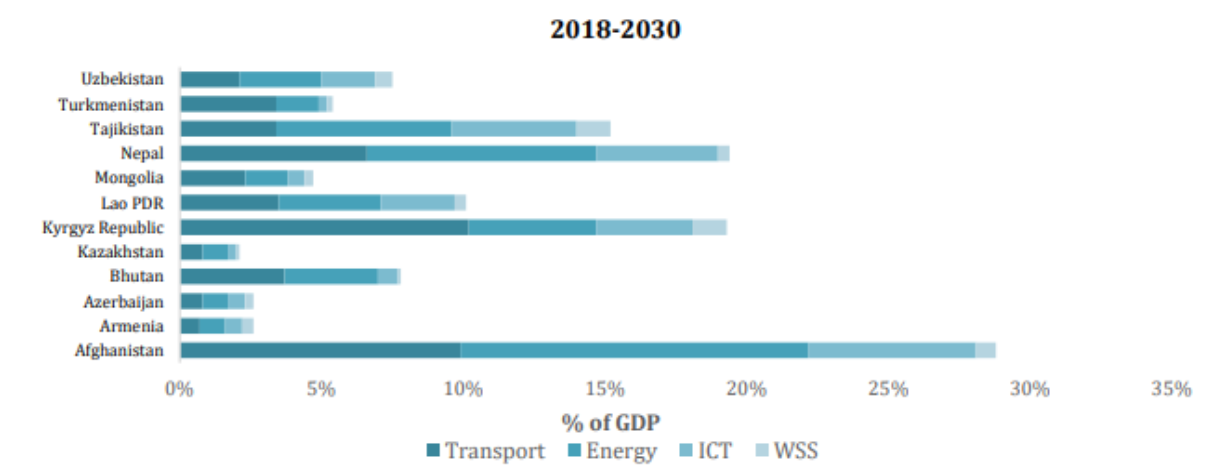

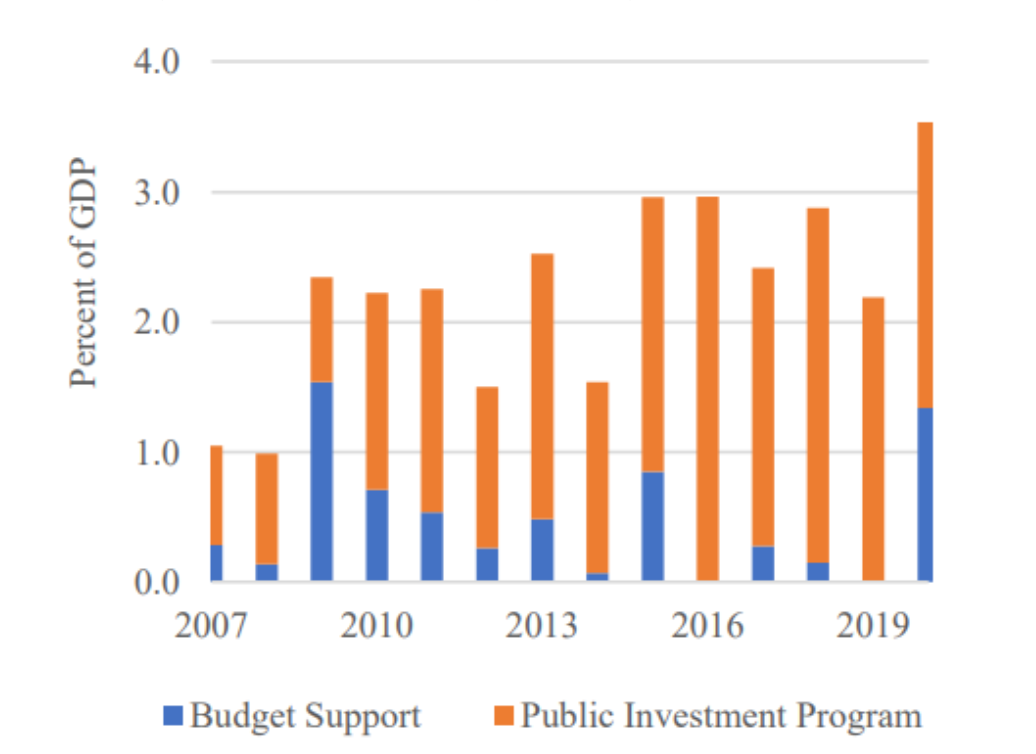

Tajikistan’s development strategy relies on large infrastructure projects. The remaining construction of the Rogun HPP is projected to cost $6.1bn (58% of 2022 GDP, in current $), with expected completion by 2035. This project will become the main pillar of Tajikistan’s electricity system and has significant potential to contribute to decarbonising electricity systems in Central Asian countries. Other large projects underway include the construction of the Turkmenistan-China gas pipeline (part of the Belt and Road Initiative) and the modernization of the TALCO aluminium plant.

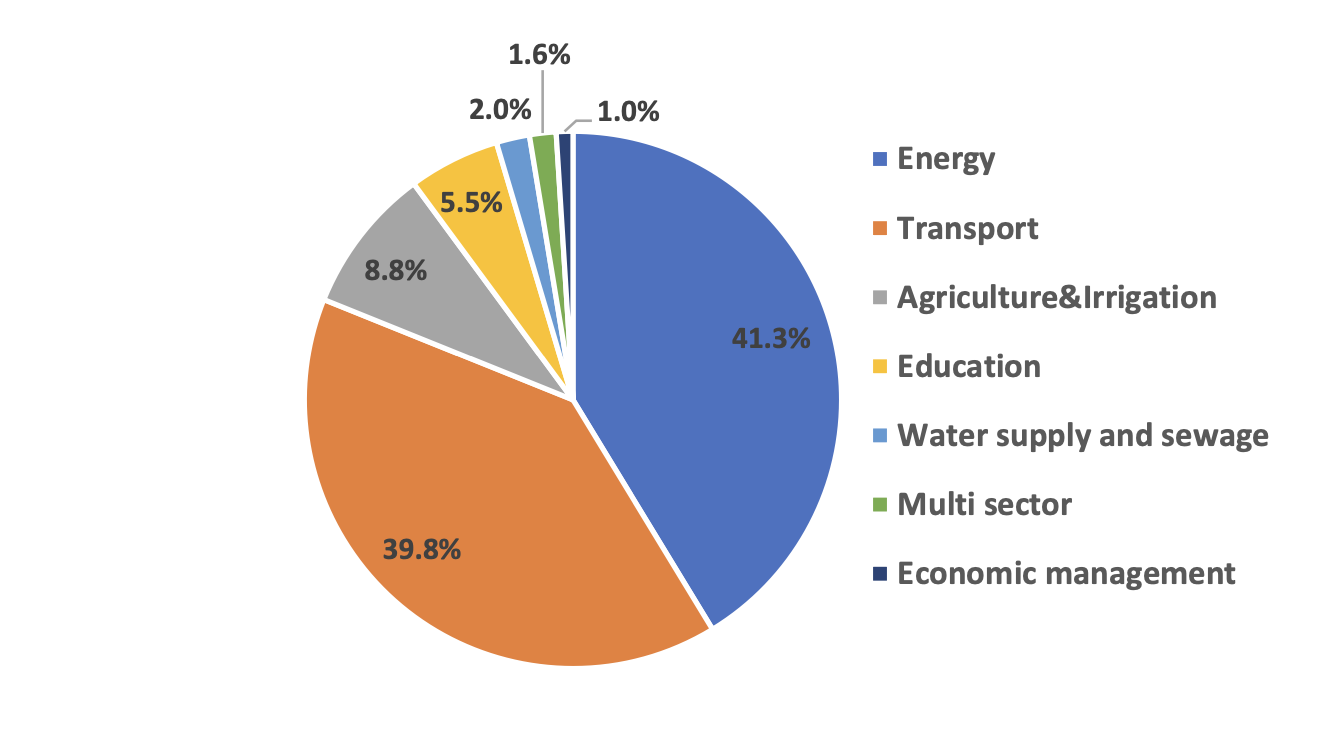

The National Development Strategy 2030 puts the highest priority on improving connectivity-related infrastructure at both the domestic and regional levels. Public investment in Tajikistan has been dominated by energy and transport projects.

Infrastructure gaps and economic impact

Despite these investments, the economy faces large infrastructure gaps that constitute a constraint on the competitiveness of the economy, especially in the transport sector. Tajikistan has one of the world’s highest trade costs, reflecting its landlocked remoteness, inadequate transport infrastructure, and limited logistics support. In 2019, 83% of the roads in Tajikistan were unpaved.

For a country with underdeveloped road networks (and mountains where roads are often impassable during winter), air connectivity is key to its economic development. However, air transport and civil aviation services are underdeveloped. Tajikistan’s air transport system is expensive and inefficient, a consequence of limited competition.

The country ranked 91 of 141 countries in the infrastructure subindex of the World Economic Forum’s 2019 Global Competitiveness Index, 111 on transport infrastructure, and 121 on airport connectivity. In 2023, the World Bank Logistics Performance Index also ranked Tajikistan 97 of 139 surveyed countries overall and 80 on trade and transport-related infrastructure.

Public-Private Partnership (PPP) Portfolio

The current PPP portfolio in Tajikistan comprises nine projects, six of which are directly negotiated unsolicited proposals (USPs). The total investment value of the portfolio is around $34 mn. The first contract was signed in 2016, and the latest commercial close occurred in December 2021. The PPP Center confirmed that the PPP pipeline contained nearly 100 projects, most of which are in the early initiation stage or just represent a potential project list.

Project implementation and financing

Most of these projects are implemented by the local private sector in local currency. Only one project attracted a foreign investor (the Construction of Transmission lines in Danghara). Chinese Shanxi Coal Chemical Corporation won the tender and financed the deal using hard currency ($22.8 mn). Another project implemented by a domestic private operator but financed using hard currency is an electronic payment system in urban transport in Dushanbe ($2.6 mn) by Avesto Group LLC.

Foreign Direct Investment (FDI)

FDI is another source of private investments in infrastructure in Tajikistan. In 2021, overall FDI doubled to $342 mn, with Chinese investments, which now account for 40% of all FDI, increasing by 75%, to $211 mn. Iran ($32.6 mn) was the second-largest source of FDI in 2021, followed by Turkey ($25.1 mn) and Switzerland ($21.5 mn).

Challenges to FDI

Despite a rising trend line, FDI in infrastructure in Tajikistan has been limited. The country’s weak investment climate, limited market size, and security concerns have been cited as factors that have deterred foreign investors from entering the Tajik market.

Climate change vulnerability and response

Tajikistan is highly vulnerable to climate change effects and disaster risks, including drought, landslides, river flooding, soil degradation, and earthquakes. The country was ranked 71st of 191 surveyed countries in the INFORM 2023 Risk Index, which provides a risk assessment for humanitarian crises and disasters.

Key challenges:

Budget transparency

- Remaining budget classification issues across recurrent and capital expenditure categories in the public investment program (score ‘B’).

- Most ministries and agencies do not publish their performance and service delivery information (score ‘D’).

Open Budget Survey (OBS) 2021

- The country ranked 106 out of 120 countries based on the timeliness and online availability of documents such as the year-end report and audit report.

State-Owned Enterprises (SOEs)

- A lack of transparency, inefficiencies, and weak corporate governance characterizes management of SOEs.

- Large debt burdens of some SOEs in Tajikistan are seen as a risk to the country’s overall fiscal stability.

- SOEs in key infrastructure sectors, such as energy and transport, are consistently loss-making because of underpricing, operational inefficiencies, and high debt burdens.

SOE portfolio

- There is no centralized management or financial reporting and oversight policy.

- MoF’s SOE Monitoring Department (MD) undertakes fiscal risk analyses for the 27 largest SOEs, all of which are 100% state-owned.

Follow Daryo's official Instagram and Twitter pages to keep current on world news.

Comments (0)