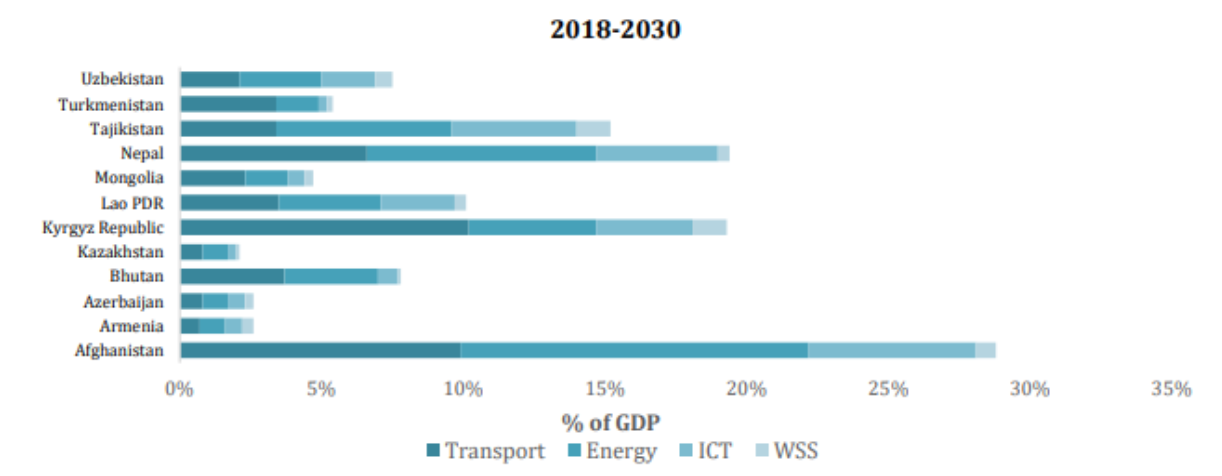

Road infrastructure in Uzbekistan is on the brink of a colossal expansion, with a projected increase of 486% by 2030, and a staggering 1,365% by 2050, according to a recent World Bank report on Uzbekistan's infrastructure government assessment. Despite Uzbekistan’s annual infrastructure needs being projected at around 10% of GDP from 2018 to 2030, lower than neighbouring landlocked developing countries like Afghanistan (nearly 30% of GDP), Kyrgyz Republic (20%), and Tajikistan (15%), the country’s financing needs to bridge gaps in sectors such as transport, energy, ICT, and water and sanitation remain substantial.

Enhancing public sector transparency

The government has taken substantial steps to eliminate regulatory constraints that previously sustained state-owned enterprises (SOEs) at the cost of private sector growth. Measures to strengthen public sector transparency have been implemented, including new public procurement legislation and regulations that promote competitive and transparent tendering processes, an electronic auction system for the sale of government land and assets, and continued efforts to increase fiscal and debt transparency.

Reducing corruption has recently become a GoU priority, with the National Development Strategy 2022-2026 highlighting the need to eliminate corruption in the public sector.

Bridging infrastructure gap

Uzbekistan’s strategic location makes it an excellent candidate to become a main transit node between China and Europe. However, it faces one of the most serious infrastructure investment gaps in the region. Despite an extensive network of roads and rail, logistics bottlenecks remain a major impediment to increasing the country’s connectivity due to low efficiency and poor service quality. The road sector backlog in deferred maintenance is estimated at $1 bn annually. Road infrastructure capacity must increase by 486% by 2030 and by 1,365% by 2050 to meet the expected volume of freight that will pass through Uzbekistan.

Infrastructure challenges amid rapid reforms

Despite the fast pace of reforms, Uzbekistan currently faces large investment needs to maintain service performance. Transport and water infrastructure have not kept pace with demographic and economic changes, largely due to underinvestment in the maintenance of existing assets. Approximately 35% of the population does not have access to good quality drinking water, and fewer than one in five urban households receive water 24 hours per day, posing even more challenges in rural areas.

Energy sector inefficiencies

The energy sector is also faced with inefficiencies, annually costing the economy around $1.5 bn. Almost 40% of Uzbekistan’s available generation capacity is past service life, leading to frequent power outages. This is confirmed by the Enterprise Survey 2019, as nearly 12% of firms identified electricity and 9% transportation as some of the main obstacles they face.

Road ahead: attracting investments

Uzbekistan’s infrastructure requirements to close the infrastructure gaps in transport, energy, ICT, and water and sanitation (WSS) are annually projected to be around 10% of GDP from 2018 through 2030. Attracting private and foreign direct investment (FDI) has become a GoU priority. Notable progress has been made since 2016 to address a range of systemic business regulation problems and overcome the dominance of state monopolies, but more is needed to further unlock all benefits of FDI for the economy.

Rise of PPPs in Uzbekistan

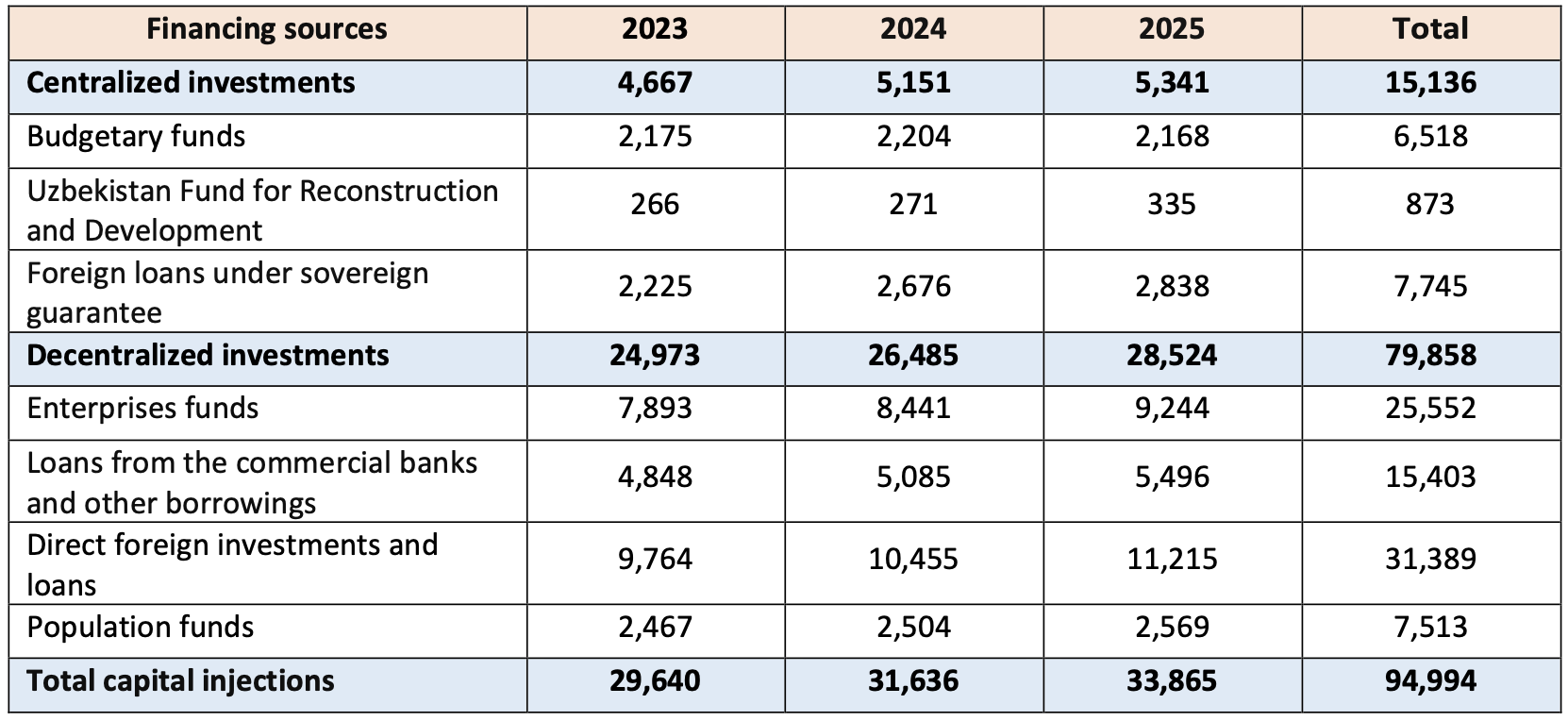

Between 2019 and 2022, Uzbekistan initiated the implementation of 265 PPPs with a total value of $2.9 bn across various sectors including energy, utilities, transport, water management, ecology, and social sectors such as healthcare, education, culture, and agriculture.

National Strategy 2022-2026: aiming high

The National Strategy 2022-2026 sets a goal of attracting $14 bn of private investments into the transport, energy, health, education, and Water Supply and Sanitation (WSS) sectors. This strategy underscores the government’s commitment to fostering private-sector participation in infrastructure development.

Key challenges faced by Uzbekistan:

- Debt Management: Uzbekistan has made significant progress in managing its debt. However, there is a need for more transparency on State-Owned Enterprises (SOE) debt and reduction of contingent liabilities from non-guaranteed debt to further strengthen public finances.

- Public Debt: Public and Publicly Guaranteed (PPG) debt rose from 28% of GDP at end-2019 to 36% by end-2021. Public debt reached $26.2 bn or 34.1% of GDP at the end of Q3 2022.

- Fiscal Rules: The government has not yet addressed the IMF recommendation to develop additional fiscal rules to limit contingent liabilities arising from the non-guaranteed debt of SOEs.

- Corporate Governance: Weak corporate governance of SOEs in Uzbekistan results in significant distortions to the economy.

Follow Daryo's official Instagram and Twitter pages to keep current on world news.

Comments (0)