Uzbekistan's foreign trade turnover in 7M24 reached an impressive $36.8bn, reflecting a 5.3% increase compared to the same period in 2023. The country recorded a significant trade deficit of $7.3bn, as imports, totaling $22.0bn, far outpaced exports, which amounted to $14.8bn. This growing deficit highlights an ongoing trend that has seen the trade gap widen considerably over the past few years.

Year-on-year data reveals several important trends in Uzbekistan's trade dynamics. The 5.3% increase in total trade turnover, rising from $35.0bn in 2023 to $36.8bn in 2024, is a positive indicator of overall economic activity. However, this growth masks underlying challenges, particularly in the export sector, which saw a slight decline of 1.1%—from $15.0bn in 2023 to $14.8bn in 2024. This decline was largely driven by reductions in the export of textile goods and certain raw materials. On the other hand, imports surged by 10.1%, climbing from $19.98bn in 2023 to $22.0bn in 2024. This increase was primarily driven by rising demand for machinery, equipment, and industrial goods.

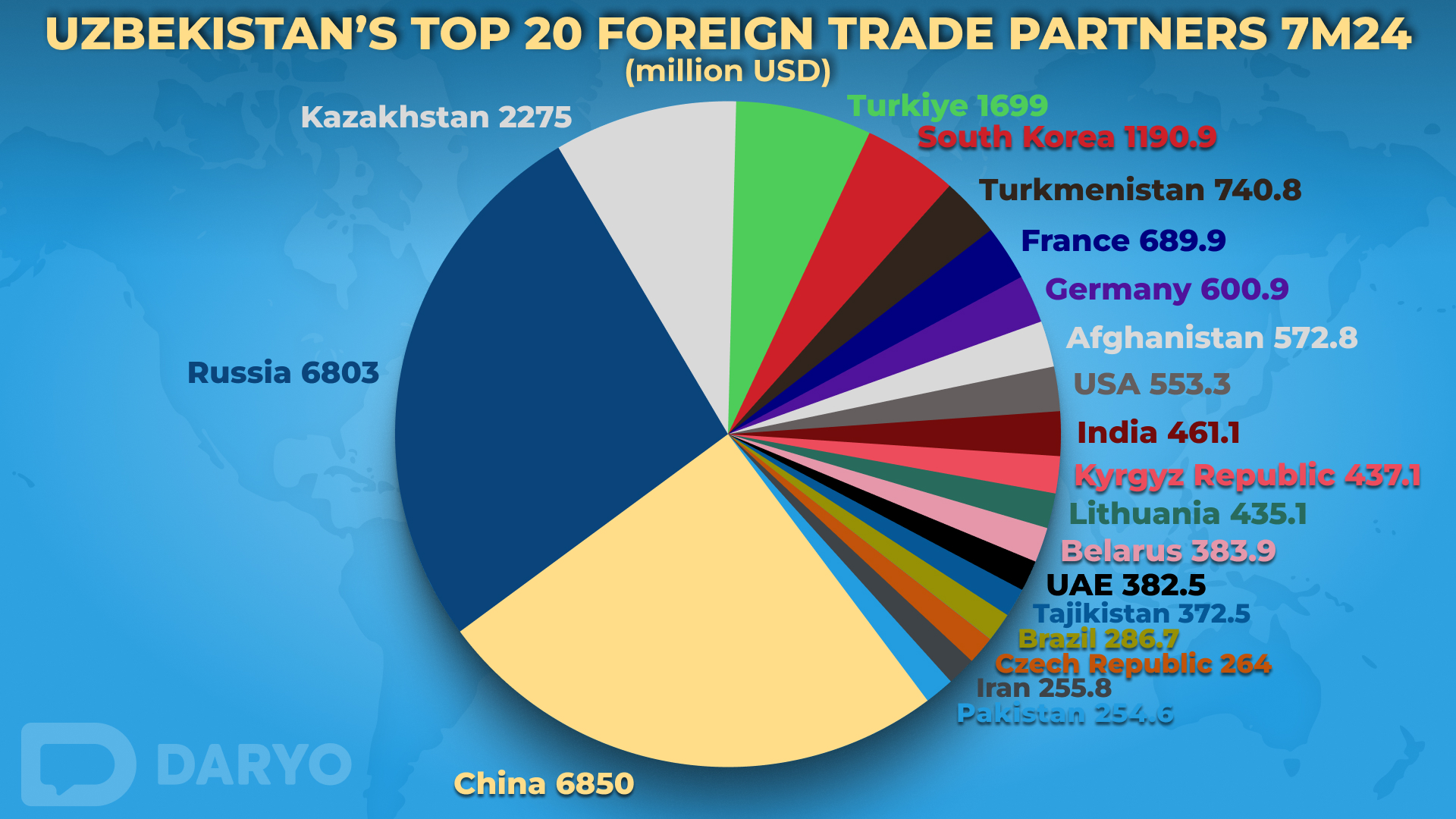

Key Trading Partners

A key aspect of Uzbekistan's trade performance is the role played by its top 10 trading partners, who collectively accounted for over 66% of the country’s total foreign trade. China led the list with $6.84bn, representing 18.6% of the total trade turnover, closely followed by Russia with $6.81bn, or 18.5%. Other significant partners included Kazakhstan ($2.27bn), Turkiye ($1.97bn), South Korea ($1.63bn), Germany ($1.28bn), Turkmenistan ($1.07bn), India ($901.5mn), Kyrgyzstan ($804.1mn), and the USA ($782.3mn).

Changing Trade Dynamics

While China and Russia have maintained robust trade relationships with Uzbekistan, the trade dynamics with some other key partners have shifted over the past two years. Trade with Kazakhstan, Turkiye, and Germany has seen a decline since 2022. Kazakhstan, which remains a crucial partner, has experienced a gradual decrease in trade volume, dropping from $2.5bn in 2022 to $2.27bn in 2024. Similarly, trade with Turkey fell from $2.1bn in 2022 to $1.97bn in 2024, while Germany’s trade volume decreased from $1.4bn to $1.28bn over the same period.

Conversely, trade with South Korea, Turkmenistan, and the USA has shown resilience and even growth. South Korea’s trade with Uzbekistan increased from $1.5bn in 2022 to $1.63bn in 2024, while Turkmenistan’s trade volume rose from $980mn to $1.07bn in the same period. The USA also saw a slight increase, with trade growing from $750mn in 2022 to $782.3mn in 2024. These trends reflect shifting dynamics within Uzbekistan’s international trade relations, where some traditional partners have seen declining shares while others have strengthened their economic ties with the country.

Trade within the CIS

Trade within the Commonwealth of Independent States (CIS) countries reached $13bn, marking a 3.1% increase from $12.6bn in 2023. Russia remains the most dominant trading partner within the CIS, contributing $6.81bn to Uzbekistan’s trade turnover, up from $6.4bn in 2023. Kazakhstan and Turkmenistan followed, with trade volumes of $2.27bn and $1.07bn, respectively. Other notable CIS partners included Kyrgyzstan ($804.1mn), Belarus ($451.9mn), and Tajikistan ($398.3mn), all of which recorded modest increases over the previous year.

Export and Import Composition

Exports, while slightly down overall, were dominated by key sectors such as industrial goods (16.8% of total exports), food products (7.3%), and chemicals (6.3%). The textile sector, a vital component of the economy, experienced a 4.4% decline in exports to $1.78bn, down from $1.86bn in 2023, largely due to reduced cotton yarn exports. Conversely, imports saw significant growth, particularly in machinery and transport equipment, which accounted for 35.4% of total imports, up from 34.2% in 2023. Industrial goods and chemicals also saw increases, making up 15.1% and 12.4% of imports, respectively.

Agricultural Sector Performance

The agricultural sector, however, bucked the trend, showing positive growth. Uzbekistan exported 1.21mn tons of fruits and vegetables, marking an 8.1% increase from the previous year. This growth was driven by strong demand in key markets such as Russia, Pakistan, and Kazakhstan. Despite this, regional disparities in trade activity persisted, with Tashkent city contributing nearly 40% of the total trade turnover, up from 38% in 2023, while Surkhandarya remained the region with the smallest share at 0.6%.

Widening Trade Deficit: A Comparative Analysis

Looking back over the past few years, the widening trade deficit has become a growing concern. In 2023, the deficit was approximately $4.98bn, with imports totaling $19.98bn and exports at $15.0bn. The gap has widened significantly in 2024, with the deficit growing by $2.32bn in just one year. This trend becomes even more pronounced when compared to 2022, where the trade deficit stood at $3.7bn, with imports at $18.5bn and exports at $14.8bn. The nearly doubling of the deficit from 2022 to 2024 underscores the challenges facing Uzbekistan's economy as the gap between imports and exports continues to expand.

Comments (0)