Projections indicate continued growth at a rate of 6.5% in 2024 for Uzbekistan's GDP and 6% in 2025, with the potential for market-oriented reforms to enhance foreign investment attraction, the European Bank for Reconstruction and Development (EBRD) disclosed in its latest report, titled "Taming Inflation," providing a comprehensive analysis of economic trends across its regions.

Overall Growth Trajectory

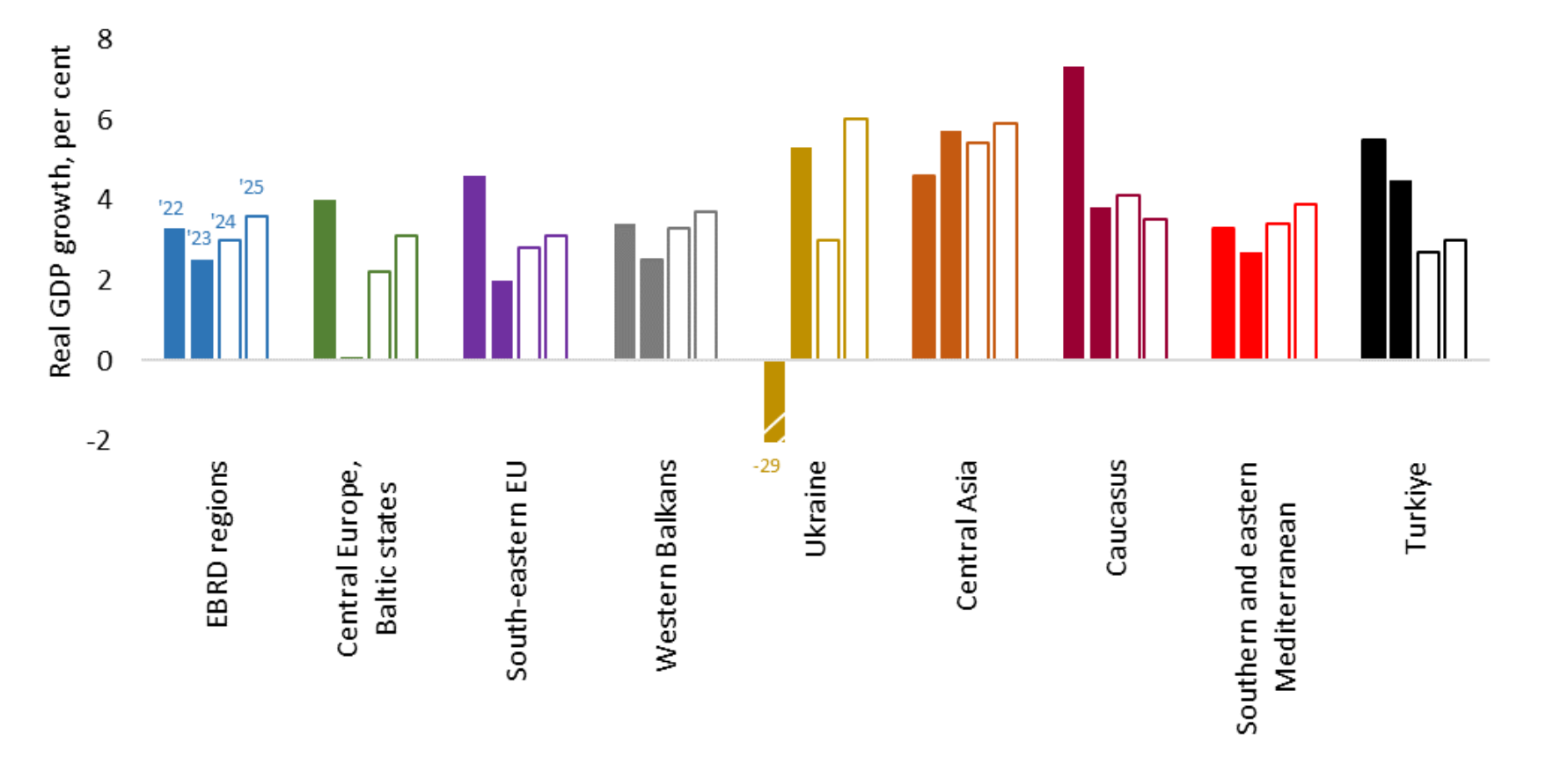

Growth in the EBRD regions experienced a notable slowdown, declining from 3.3 % in 2022 to 2.5 % in 2023. This deceleration, falling below the global average of 2.7 %, was influenced by multifaceted factors, including the enduring repercussions of the Ukraine conflict, sustained high energy prices in Europe, and a tapering post-Covid recovery in the services sector.

Central Asian Outlook

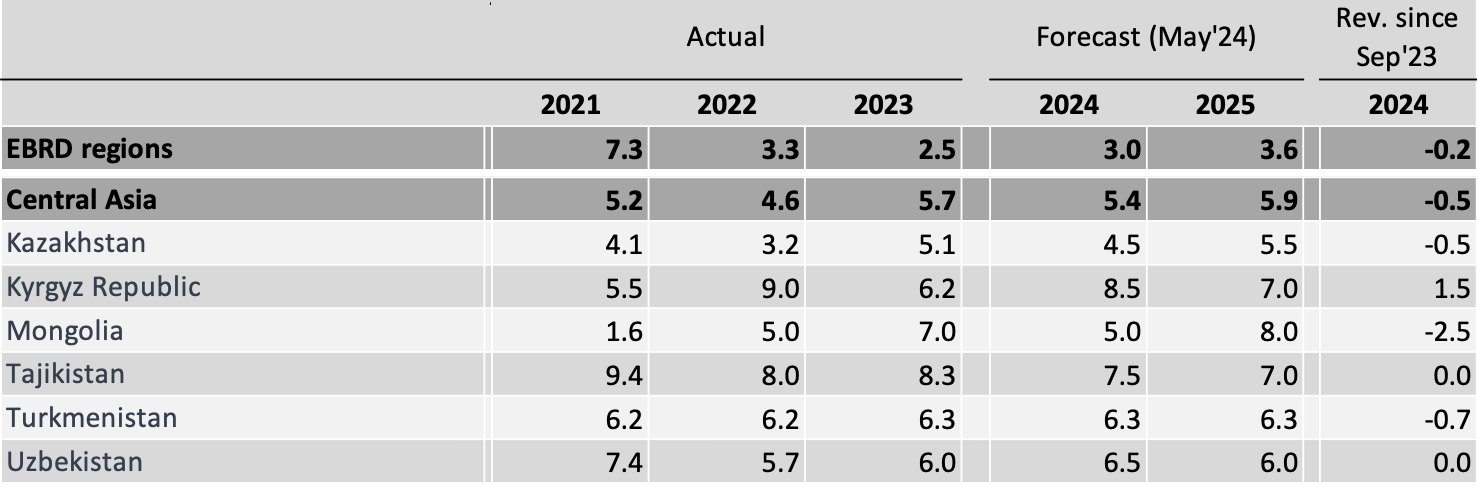

The Central Asian region, including countries like Kazakhstan, Kyrgyz Republic, Tajikistan, Turkmenistan, and Uzbekistan, has demonstrated remarkable economic resilience and growth despite various challenges. In 2023 and the early months of 2024, these nations experienced significant expansion across multiple sectors, driven by robust domestic demand, increased investment, and favorable external conditions.

Uzbekistan

Uzbekistan recorded GDP growth of 6% in 2023, fueled by consumer spending, credit expansion, and export revenues. Fixed capital investment, supported by government initiatives, contributed to growth in the first quarter of 2024. Growth is forecasted at 6.5% in 2024 and 6% in 2025, with potential for market-oriented reforms to attract foreign investment.

Kazakhstan

In Kazakhstan, real GDP grew by 5.1% in 2023, supported by strong domestic demand despite a decline in exports. Unprecedented strength in the labor market, with historic lows in unemployment and significant wage increases, fueled growth in retail and wholesale trade. The economy slowed slightly in the first quarter of 2024 but is forecasted to grow by 4.5% in 2024.

Kyrgyz Republic

The Kyrgyz Republic emerged as a major beneficiary of intermediated trade and money transfers from Russia. Exports surged by 46.7% in 2023, contributing to a robust GDP growth of 6.2%. The economy continued to expand in the first quarter of 2024, with growth forecasted at 8.5% in 2024 and 7% in 2025, driven by remittances, construction, and strong domestic demand.

Tajikistan

Tajikistan recorded GDP growth of 8.3% in 2023, driven by mining, manufacturing, and agriculture. Strong domestic demand, supported by remittances and credit expansion, fueled growth in retail trade and hospitality. The economy continued to grow in early 2024, with inflation under control. GDP is forecasted to grow by 7.5% in 2024 and 7% in 2025, with risks related to climate change and fluctuations in remittances.

Turkmenistan

Turkmenistan's economy grew by 6.3% in 2023, driven by public spending on infrastructure and private sector investment. Strong fiscal management and foreign currency reserves supported economic stability. Growth is forecasted at 6.3% in both 2024 and 2025, with potential for further investment in infrastructure and renewables.

Projected Recovery

Despite the recent downturn, growth in the EBRD regions is anticipated to rebound, with a projected growth rate of 3 % in 2024. However, this forecast represents a 0.2 % age point downward revision compared to previous estimates, reflecting slower-than-expected growth in central Europe and the Baltic states, aligned with the subdued economic performance observed in Germany.

Inflation Trends

Inflationary pressures in the EBRD regions have shown signs of moderation, with the average inflation rate decreasing to 6.3 % in March 2024 from a peak of 17.5 % in October 2022. Despite this decline, inflation remains two percentage points above pre-pandemic levels, indicating persistent challenges. Some economies within the region have experienced cumulative price increases exceeding 30 % since February 2022. Expansionary fiscal policies and currency depreciations have contributed to higher peak inflation rates and slower disinflation in these economies.

Bilateral Trade Relationships

Exports to these countries experienced remarkable growth rates in 2023, with inflation-adjusted EU exports to the Kyrgyz Republic increasing by 172 percent year-on-year. This trend signifies the growing importance of Central Asia as a destination for EU exports, driven by increased economic cooperation and investment opportunities.

Intermediated trade via the Caucasus and Central Asia has also played a significant role in facilitating regional trade flows. Despite stabilizing at high levels, intermediated trade continues to provide impetus to intermediary economies, contributing to overall growth in the region.

Looking ahead, while intermediated trade may not mechanically drive growth in 2024, Central Asian countries remain attractive markets for EU-EBRD exports. The potential for continued growth in manufacturing exports to Russia, coupled with opportunities in the IT sector, further underscores the strategic importance of Central Asia in the evolving trade landscape.

FDI Reaction to Geopolitical Fragmentation

The geopolitical fragmentation of trade has triggered significant shifts in foreign direct investment (FDI) patterns, particularly in Central Asia and its neighboring countries. Foreign direct investment from Russia to Central Asia witnessed a sharp increase in 2023, particularly in logistics services that complement the region's expanding intermediated trade. Kazakhstan emerged as a key destination for Russian investment, reflecting its strategic position as a regional economic hub.

Additionally, FDI from Ukraine to Emerging Europe experienced significant growth in 2022, driven by the influx of skilled labor and investments in software and IT services. This trend underscores the role of human capital mobility in driving economic integration and cross-border investments within the region.

Strong growth performance in the Caucasus and Central Asia

The Caucasus and Central Asia (CCA) region witnessed remarkable economic growth in 2022 and 2023, fueled by various factors such as rapid IT sector development, expansion of export-oriented manufacturing, and a surge in the financial sector. Despite limited support from rising commodity prices, the region experienced robust growth, driven by post-pandemic recovery and growing intermediated trade.

Boost to Services

The influx of more than 1 mn individuals, including skilled professionals, from Russia into the Caucasus and Central Asia spurred significant demand-driven growth in service-oriented activities. Sectors such as real estate, hospitality, logistics, and financial services experienced notable expansion, contributing to overall economic growth.

High Growth in ICT Sectors

The CCA region experienced rapid growth in its ICT sectors, driven by an influx of Russian entrepreneurs and tech professionals. Countries like Georgia and Kazakhstan saw substantial increases in the establishment of IT businesses, supported by comprehensive government incentives and absorption packages.

Growth of Export-Oriented Manufacturing

As major international brands exited the Russian market, opportunities arose for other exporters in the CCA region to fill the gap. The textile sector in Kyrgyz Republic, for instance, grew by 42% in 2022, with textile exports accounting for a significant portion of the country's total exports to Russia. Integration with Russian online marketplaces facilitated this growth, leading to increased sales and production expansion in remote regions.

Financial Sector Development

The CCA region experienced a surge in money transfers from Russia, driving growth in the financial sector. In countries like the Kyrgyz Republic, banking-sector deposits surged by about 60-70% relative to the 2021 average, primarily due to an increase in transfer and currency conversion fees. However, with a decline in money transfers since 2023, deposits started to decrease.

The World Bank anticipates Uzbekistan's GDP growth of 5.3% in 2024, influenced by fiscal consolidation and moderated export growth to key trading partners. Inflation is forecasted to increase due to higher domestic energy prices, expected to stabilize around 8% in the medium term.

Meanwhile, the Asian Development Bank predicts Uzbekistan's economic growth to decelerate to 5.5% in 2024, mainly attributed to weaker performance in services and agriculture. However, a slight rebound is projected for 2025, with growth edging up to 5.6%, driven by a resurgence in industrial activity.

Comments (0)