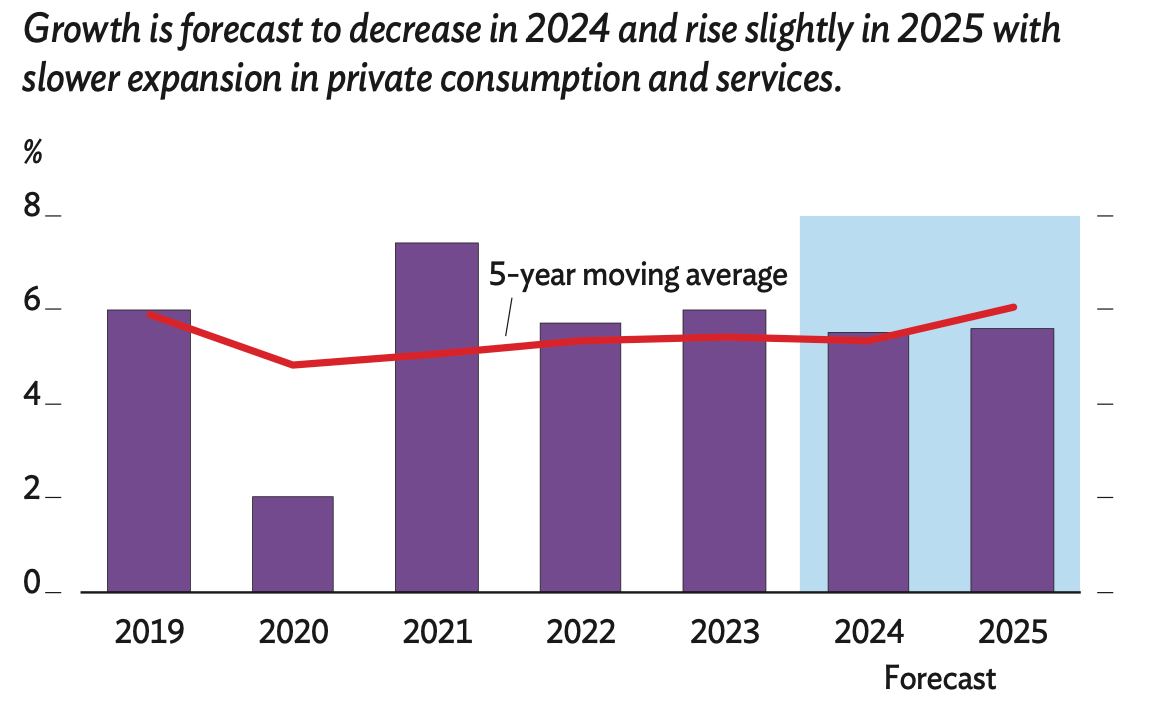

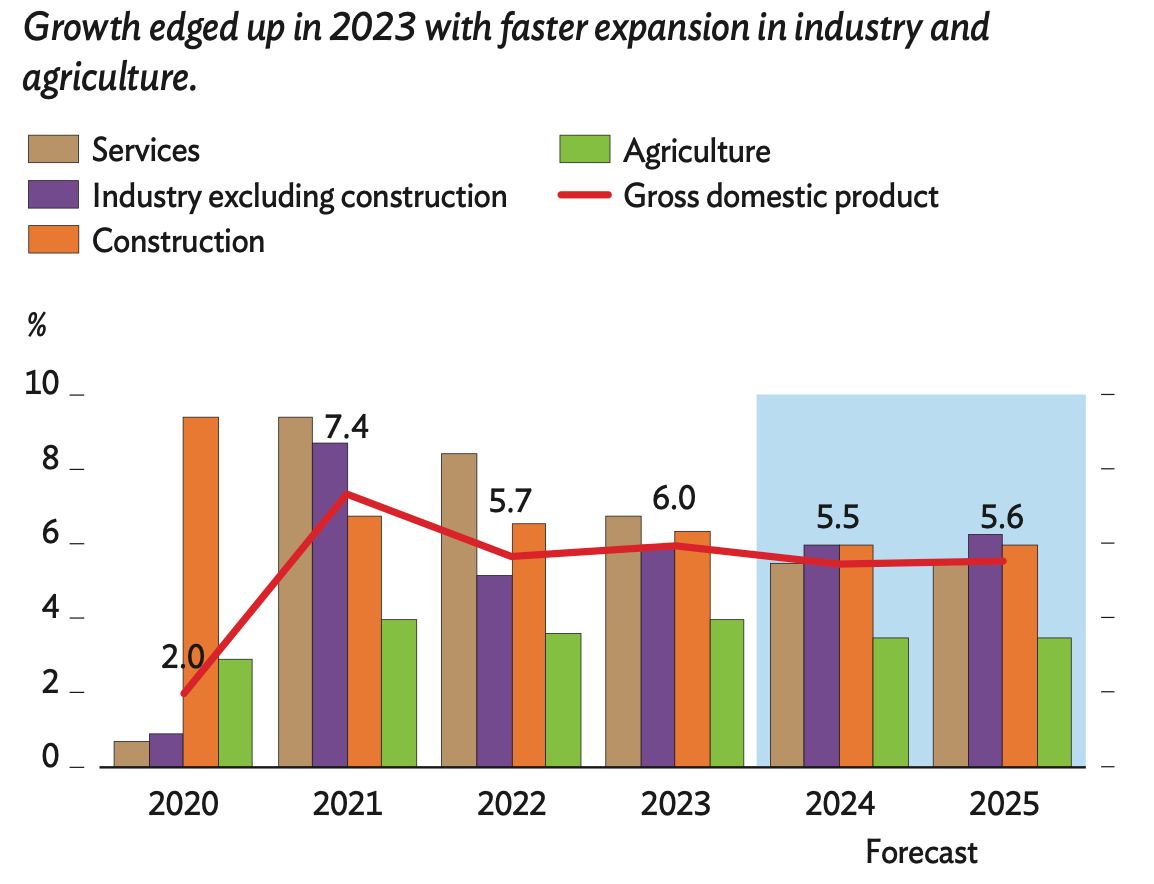

Uzbekistan's economic growth is expected to slow to 5.5% in 2024, primarily due to weaker performance in services and agriculture, the Asian Development Bank reports. However, a slight recovery is forecast for 2025, with growth improving marginally to 5.6% driven by a resurgence in industrial activity.

On the supply side, services are projected to grow at a consistent rate of 5.5% in both years, reflecting reduced demand for food, accommodation, storage, and transportation services. Agriculture is likely to face challenges, with growth anticipated to slow to 3.5% in 2024 and 2025, largely due to expected water shortages affecting cotton and wheat irrigation.

The construction sector is forecast to experience a growth rate of 6.0% over the next two years, with a deceleration in housing developments, local infrastructure enhancements, and upgrades to manufacturing facilities. Conversely, the industry is expected to sustain a growth rate of 6.0% in 2024 and increase to 6.3% in 2025, buoyed by rising external demand for food and textiles, along with robust domestic demand for mining and quarrying.

Inflation and monetary policy

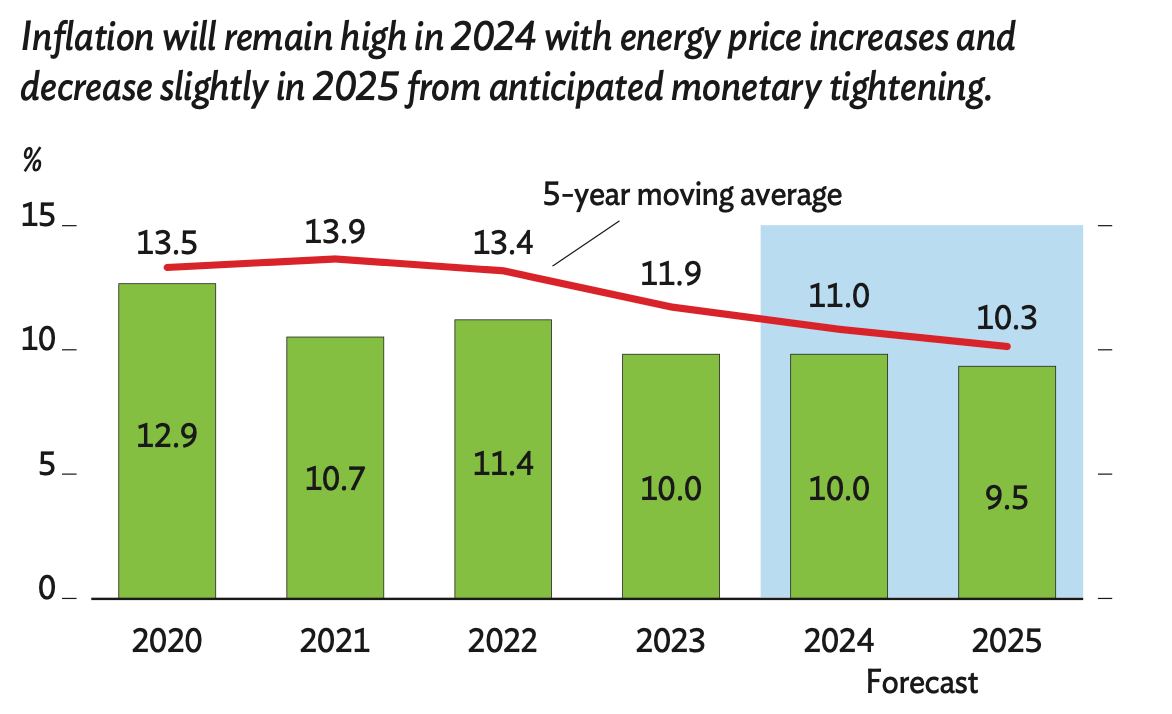

Inflation rates are projected to remain relatively stable despite ongoing tight monetary policy measures, with structural energy reforms leading to administered price increases. Y/y inflation, which slowed to 9.1% in January 2024 from 12.1% a year earlier, is expected to stabilize at around 10.0% in 2024 and decrease slightly to 9.5% in 2025. This is partly due to the delayed effects of energy price hikes initiated in October 2023 and anticipated increases in domestic energy prices over the next two years.

To control inflationary pressures, commercial banks are expected to maintain restrictions on microcredit and consumer lending, including auto loans. Furthermore, the government plans to reduce energy subsidies and policy lending while improving the targeting of social protection payments, aiming to narrow the fiscal deficit to 4.0% of GDP in both 2024 and 2025.

Fiscal management and economic development

Structural reforms and increased social spending are set to limit fiscal consolidation efforts, with the fiscal deficit projected to narrow slightly from 4.0% of GDP in 2024 to 3.5% in 2025. Revenue levels are anticipated to remain stable at 33.0% of GDP for both years, supported by steady tax income from state-owned enterprises in sectors such as mining and quarrying that benefit from high commodity prices.

Expenditures are projected to decrease to 37.0% of GDP in 2024 and further to 36.5% in 2025.

External debt and investment

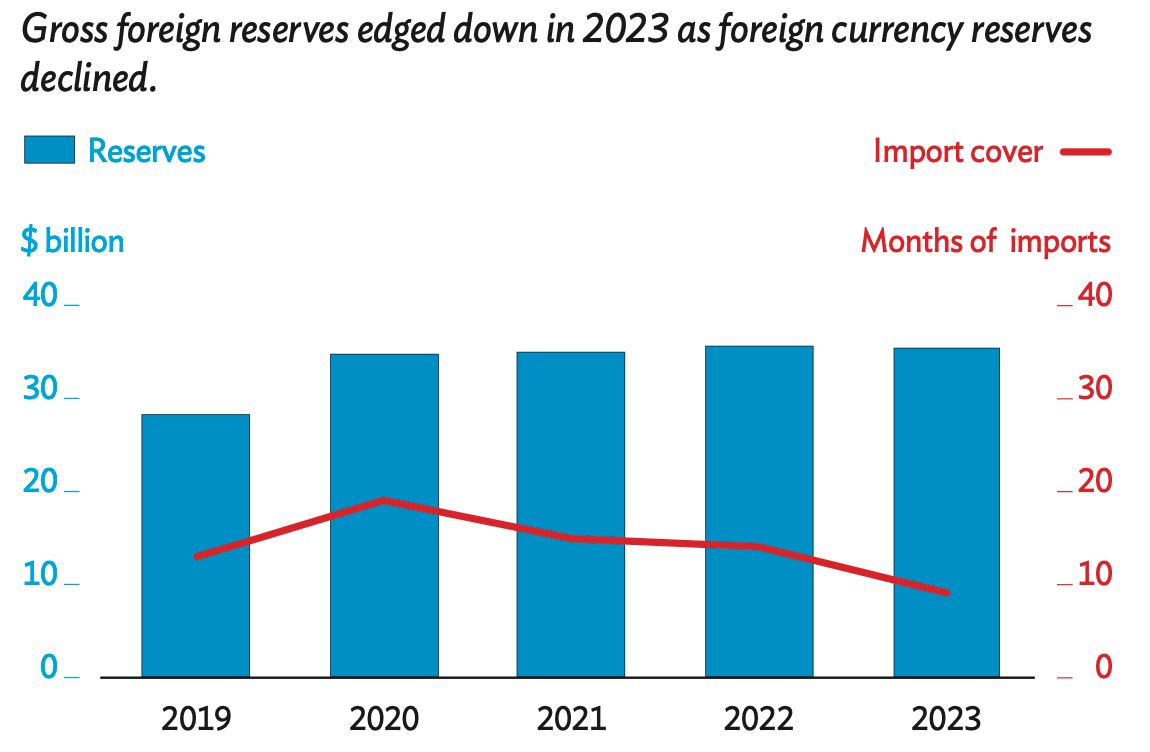

Uzbekistan's gross foreign reserves are expected to reach $36 bn in 2024 and remain steady into 2025, providing substantial coverage for import needs. The government has set a $5 bn ceiling on external borrowing for 2024 to keep total public debt below 60.0% of GDP in the next two years. External public debt is currently below 38.0% of GDP and is anticipated to maintain a level of about 37.0% through 2024 and 2025.

With significant capital investment in the petrochemicals, mining, and quarrying sectors, foreign direct investment in Uzbekistan is projected to grow by 10.0% annually. This investment is crucial for sustaining long-term economic stability and growth in the nation's key industries.

Follow Daryo's official Instagram and Twitter pages to keep current on world news.

Comments (0)