In 2023, the Agency of the Republic of Kazakhstan for Regulation and Development of Financial Market released a report highlighting the banking sector’s robust performance. Key indicators surpassed 2022 levels, with consumer loans and second-tier bank equity seeing significant growth of 34.1% and 31.3%, respectively. However, mortgage lending and individual loans did not follow this trend. The surge in consumer loans led to a total of KZT 10.3 trillion ($22.9mn), while the equity of second-tier banks reached KZT 6.9 trillion ($15.3mn).

Capital to assets ratios

The ratios of fixed capital to assets, denoted as k1 (the ratio of fixed capital to the number of assets, taking into account the risk ratio) and k2 (the ratio of equity to the number of assets, taking into account the risk ratio), were reported at 19.2% and 21.5%, respectively. These figures are significantly higher than the established norms.

Loans to individuals and economy

Loans to individuals increased by 28.9% from 2022 to 2023, totalling KZT 18.2 trillion ($40.4mn), down from 31.8%. Loans to the economy rose by 22.4%, reaching KZT 27.9 trillion ($62mn). Loans to legal entities saw an increase of 11.9%, amounting to KZT 9.7 trillion ($21.6mn). Total loans to business entities, including individual entrepreneurs, increased by 16.7%, totalling KZT 11.2 trillion ($24.9mn).

The assets of the banking industry increased by 15.4%, amounting to KZT 51.4 trillion ($114.3mn). Liquid assets amounted to KZT 15.1 trillion ($33.6mn), or 29.3% of the total.

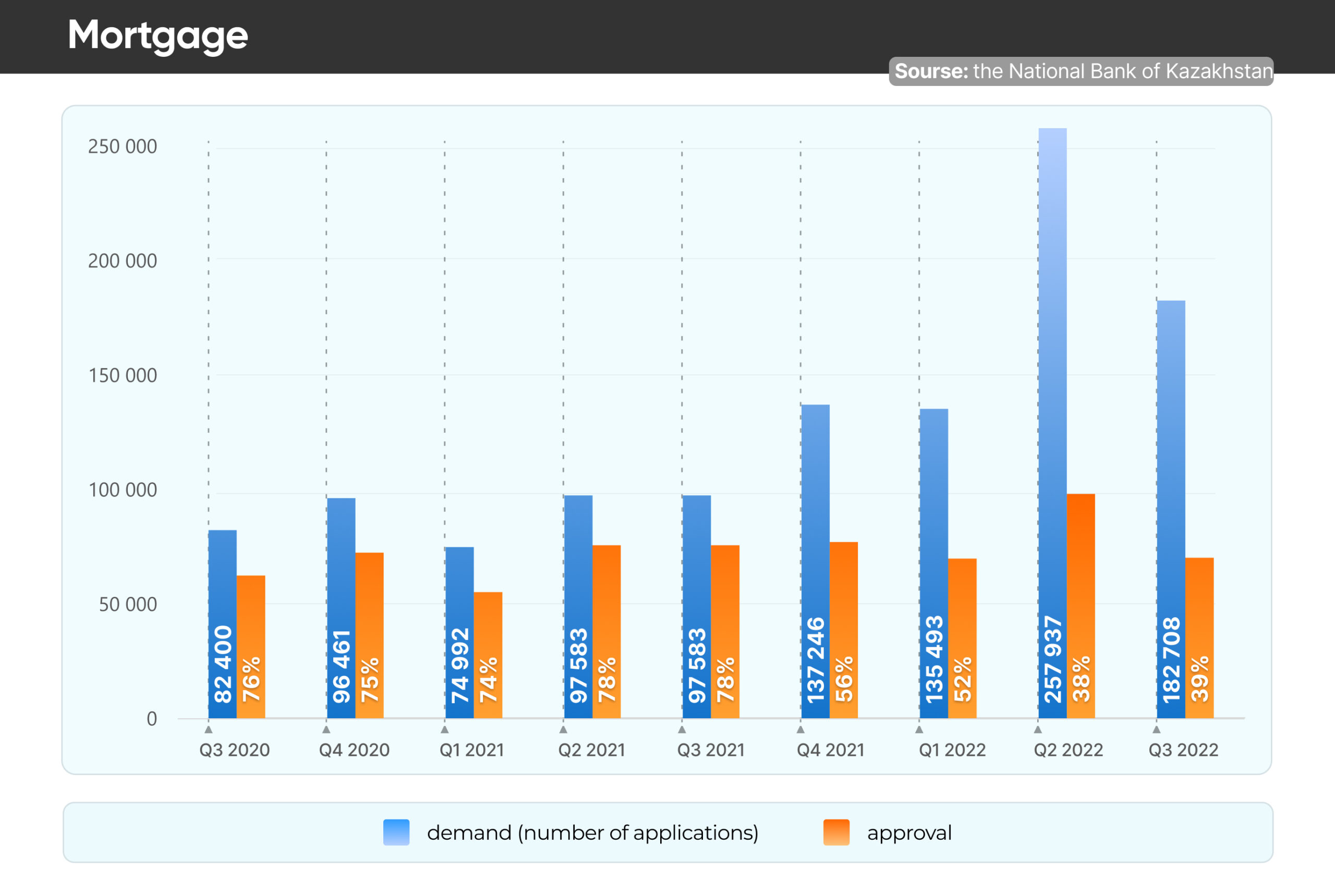

Mortgage lending and bank liabilities

The growth of mortgage lending slowed to 14.9%, or KZT 5.4 trillion ($12mn), compared to an increase of 42.4% in 2022. This slowdown was due to a change in the conditions of the preferential mortgage program “7-20-25” and a decrease in the volume of allocation of pension savings of citizens. Bank liabilities increased by 13.3%, amounting to KZT 44.6 trillion ($99.1mn), primarily due to the growth of deposits of the population by 20.6%, totalling KZT 35.1 trillion ($78mn).

Bank income in 2023

According to statistics from the National Bank, the income of Kazakhstan banks in 2023 increased by 49.4% in annual terms, amounting to KZT 2.2 trillion ($4.9mn). In terms of income, banks are ranked as follows: Halyk bank - KZT 673.7bn ($1.5mn) (+24.8%), Kaspi Bank - KZT 475.5bn ($1.1mn) (+31.4%), Otbasy - KZT 146.9bn ($326,600) (+46.5%), Jusan - KZT 140.7bn ($312,700) (+58.8%), Bank CenterCredit (BCC) - KZT 130.5bn ($289,800) (-10%).

Earlier, Daryo reported that in 2023, the National Fund of Kazakhstan saw a threefold increase in management and audit expenditures compared to 2022. This escalation was attributed to additional fees and bonuses awarded to external managers for superior returns. The fund’s management and audit costs escalated from $48.8mn in 2022 to $155.4mn in 2023.

The Ministry of Finance reported that the National Fund yielded returns of $3.9bn in 2023, following a loss of $1.7bn in 2022 and returns of $3.7bn in 2021. In 2015, the fund achieved a record investment profitability of $22.6bn, primarily driven by the revaluation of assets predominantly denominated in foreign currency. During this period, the costs associated with the fund’s asset management stood at $26.6mn.

Follow Daryo's official Instagram and Twitter pages to keep current on world news.

Comments (0)