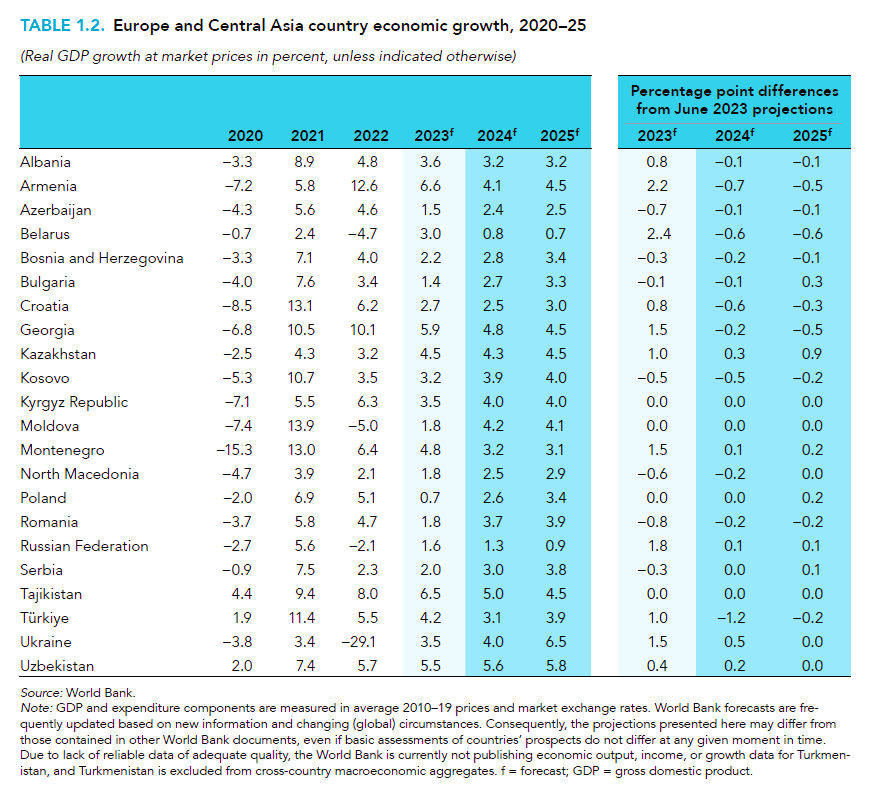

The World Bank's recent Economic Update for the Europe and Central Asia region states that the expected economic growth for emerging market and developing economies (EMDEs) has been revised upwards to 2.4% for 2023. This growth is largely due to improved forecasts for war-torn Ukraine and Central Asia, as well as consumer resilience in Türkiye and better-than-expected growth in Russia. The region's output is expected to grow by 3% in 2023 if Russia and Ukraine are excluded. However, growth remains weak compared to pre-pandemic levels, with about half of the Europe and Central Asia countries expected to experience slower or little change in growth in 2023 compared to 2022.

For 2024-25, the expected growth is 2.6% per year, which is lower than the pre-pandemic levels. Factors responsible for this include weak expansion in the European Union, high inflation, and tighter financial conditions. The World Bank Vice President for the Europe and Central Asia region, Antonella Bassani, has identified "a cost-of-living crisis, and climate risks are creating formidable challenges in Europe and Central Asia." Consequently, countries in the region will need to adopt a new approach to revive productivity growth, improve economic and social outcomes, enhance resilience, and accelerate efforts to decarbonize the economy.

The outlook for the EMDEs in Europe and Central Asia is clouded by downside risks, including persistently high inflation due to volatility in global commodity markets and a surge in energy prices. Additionally, tightening financing conditions may make global financial markets more volatile and restrictive. Global growth for 2020-2024 is weaker than during any five-year period since 1990 and may weaken further.

The rising cost of population aging, higher interest payments, the needed investment for climate mitigation and adaptation, and managing other overlapping crises will keep up the pressure on government budgets. Fiscal deficits are broadly unchanged this year despite earlier plans to implement fiscal consolidation after large increases in spending over the last several years due to COVID and the cost-of-living crisis.

Ukraine's economy is expected to grow by 3.5% this year after contracting by 29.1% in 2022, the year when Russia invaded the country. This growth is thanks to a more stable electricity supply, increased government spending, ongoing donor support, a better harvest, and the rerouting of some exports through the country's western borders. Türkiye is set to grow by 4.2% this year, reflecting reduced policy uncertainty and resilient consumer demand. However, growth is likely to slow to an average of 3.5% in 2024 and 2025 as domestic demand cools in the face of rising interest rates and gradual fiscal consolidation.

In Russia, surging government spending and resilient consumption are expected to result in growth of 1.6% in 2023, but this is expected to weaken to 1.3% in 2024 and 0.9% in 2025 due to capacity constraints and slowing consumer demand. In Central Asia, growth is expected to strengthen to 4.8% this year and is expected to average 4.7% for 2024 and 2025, assuming that inflation moderates.

Growth in the Western Balkans is projected to slow to 2.5% this year, with a projected pick up to 3.3% for 2024 and 2025, reflecting moderation of inflation pressures, a gradual recovery of exports, and increasing public spending on donor-backed infrastructure projects. Albania, Kosovo, and Montenegro have had resilient consumption due to the recovery in tourism but weakened in Bosnia and Herzegovina, North Macedonia, and Serbia due to weaker export demand from the EU. Some economies, notably in Central Asia and the South Caucasus, have experienced stronger trade and larger inflows of money and people, supporting economic activity. Armenia, Georgia, and Tajikistan remain top growth performers in the region for the second year in a row.

Follow Daryo's official Instagram and Twitter pages to keep current on world news.

Comments (0)