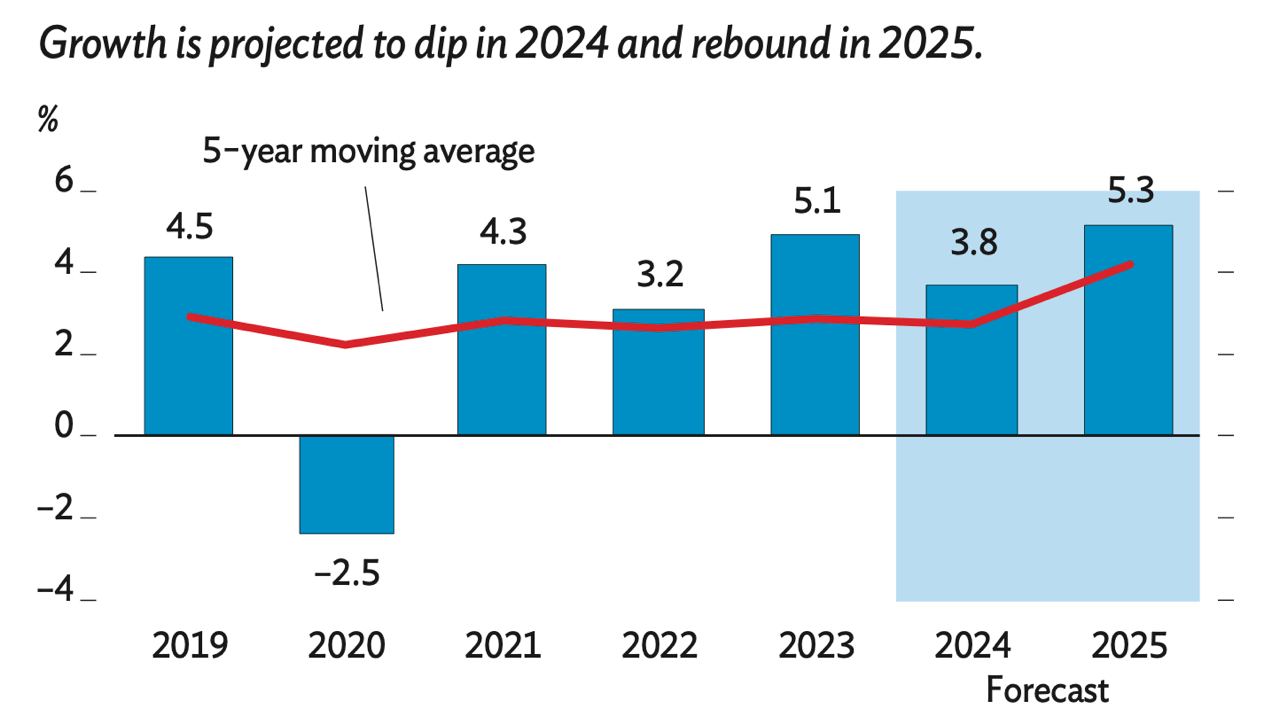

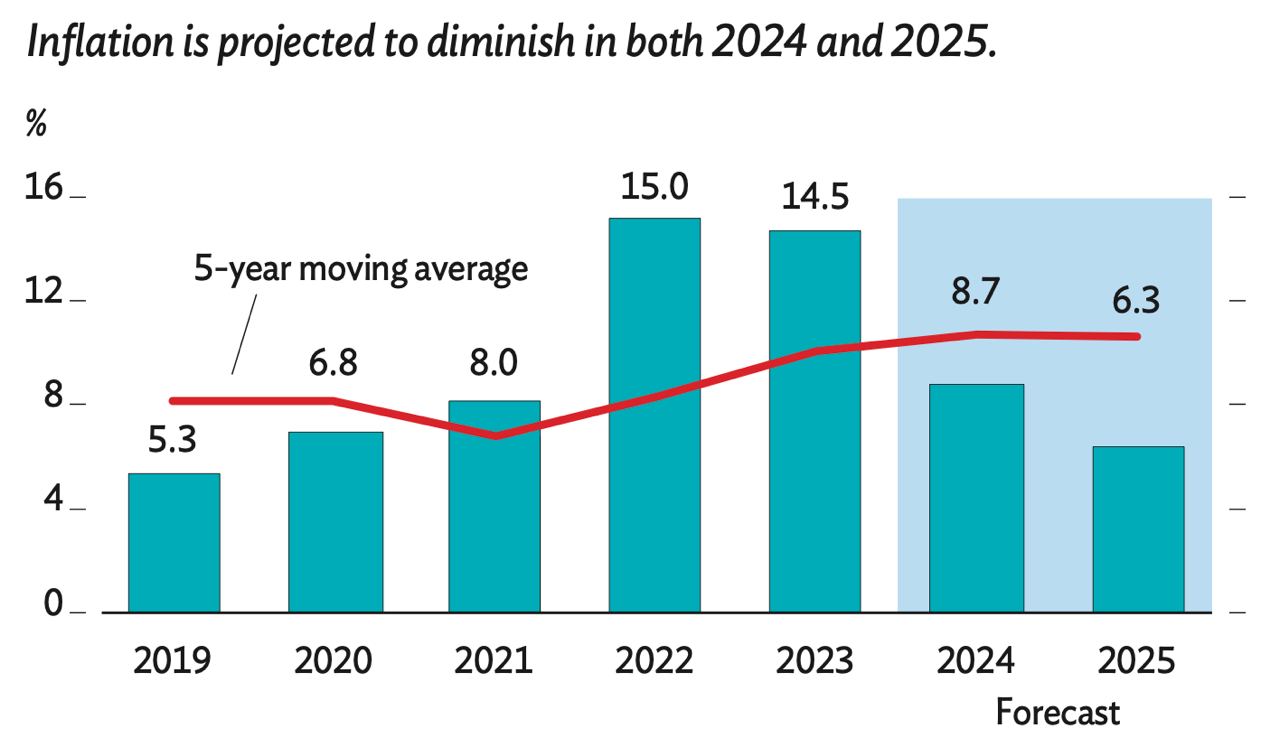

Kazakhstan is projected to experience a GDP growth rate of 3.8% in 2024 with a rebound to 5.3% anticipated in 2025 due to expansions in the Tengiz oil field, the Asian Development Bank reports. Inflation is expected to decrease gradually to 8.7% in 2024 and to 6.3% in 2025, assuming the implementation of strict monetary controls and stable exchange rates.

Service prices, influenced by governmental adjustments in utility costs, are projected to be a primary inflation driver, with an expected increase of 9.8% in 2024 and 8.1% in 2025.

The ADB identifies several factors that could potentially impact the economic forecast negatively, including the ongoing geopolitical tensions due to Russia's invasion of Ukraine, slower growth in Kazakhstan’s major trading partners, and possible disruptions to oil export channels. The vulnerability of Kazakhstan’s economy, heavily reliant on commodities, underscores the need for structural reforms to improve economic resilience and sustainability.

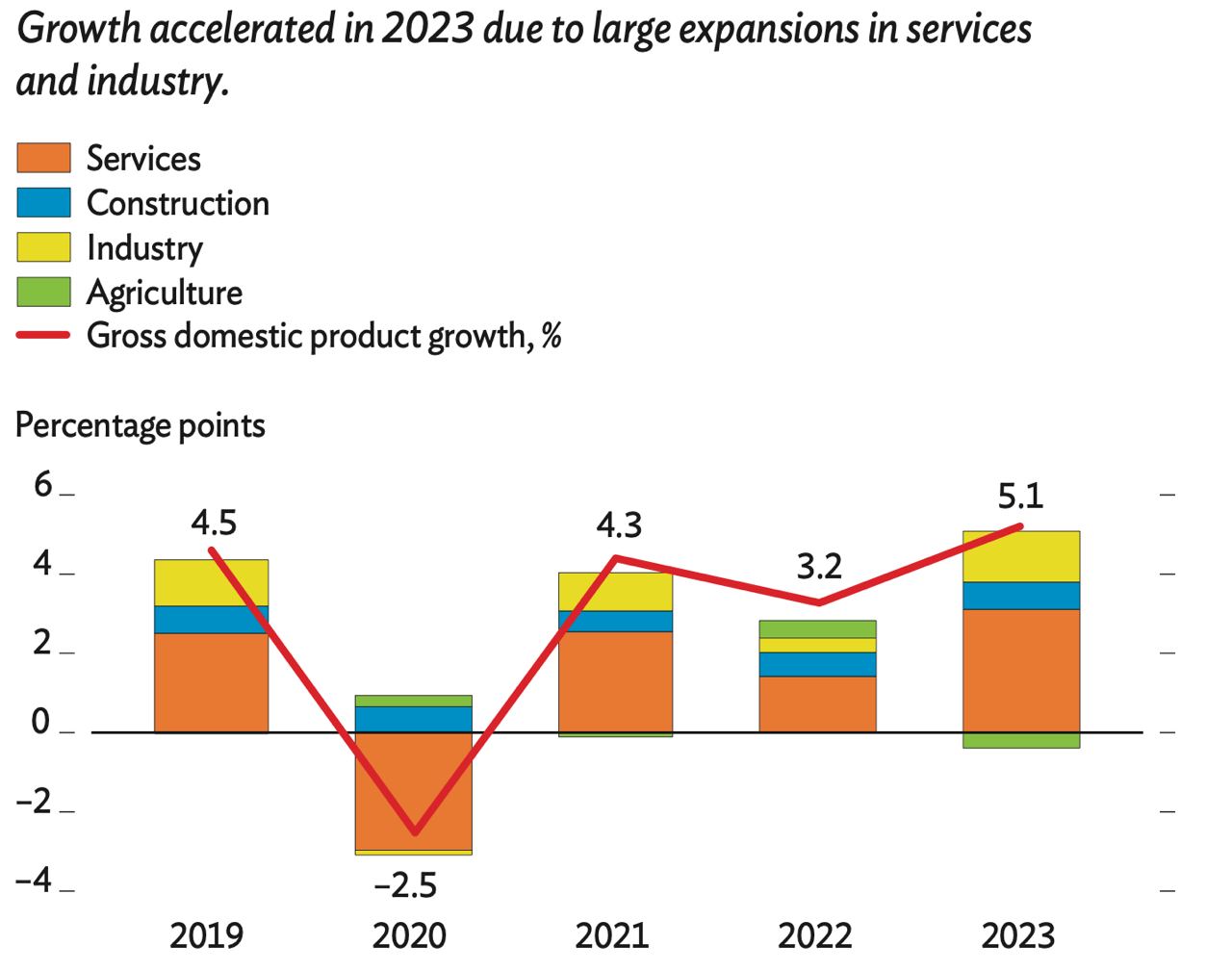

Growth in the services sector is expected to decrease to 4.7% in 2024 and slightly improve to 4.9% in 2025, facilitated by growth in trade, transport, and hospitality. Industrial growth is forecasted to decelerate to 3.5% in 2024, followed by a rebound to 5.7% in 2025, aligned with the increase in oil production.

In 2023, despite elevated policy interest rates, bank lending rose by 20.3%. The growth was supported by a 34.2% increase in consumer lending and a 14.2% rise in mortgage lending, bolstered by government-subsidized programs. The banking sector also saw a decrease in nonperforming loans and a reduction in the proportion of foreign currency deposits and loans.

The ADB suggests the need for the government to address distortions caused by state-subsidized lending, recommending the disclosure of the full impact and opportunity costs of these practices. Additional recommendations include adopting alternative financing mechanisms and setting clear objectives and sunset clauses for subsidized programs.

Since Kazakhstan joined the ADB in 1994, the bank has committed approximately $7 bn in loans, grants, and technical assistance. The ADB continues to support the aim of achieving a prosperous, inclusive, resilient, and sustainable Asia and the Pacific region.

Follow Daryo's official Instagram and Twitter pages to keep current on world news.

Comments (0)