The arrival of Pakistani tangerines in Uzbekistan has significantly impacted the local market, leading to a remarkable drop in prices. These Pakistani tangerines are being sold at supermarkets in the capital at prices that are at least one and a half times cheaper than those of tangerines imported from other countries, EastFruit, reported.

Specialists at EastFruit have observed a substantial decrease in tangerine prices at wholesale markets in the capital of Uzbekistan, dropping by 38% over the last week. From December 1 to December 8, the average wholesale price for tangerines plummeted from 16,000 to 10,000 soum/kg ($1.30 to $0.81), marking the most significant weekly change in the wholesale price dynamics in the last four months.

Moreover, current wholesale prices for tangerines in Uzbekistan are the lowest they've been in the past five years. As of December 8, the average wholesale price for tangerines is 17% lower than the same date last year, one-third lower than on the same date in 2021, and 23% lower than on the same date in 2019.

Against the backdrop of record-high prices for locally produced fruits like persimmons, pomegranates, and grapes due to low harvests caused by January frosts, Pakistani mandarins are now one of the most affordable fruits for consumers in the Uzbek market, alongside apples.

EastFruit analysts attribute the surge in prices for locally produced fruits to the damage caused by abnormal cold in Uzbekistan in January this year. This led to a low harvest of grapes, persimmons, and pomegranates.

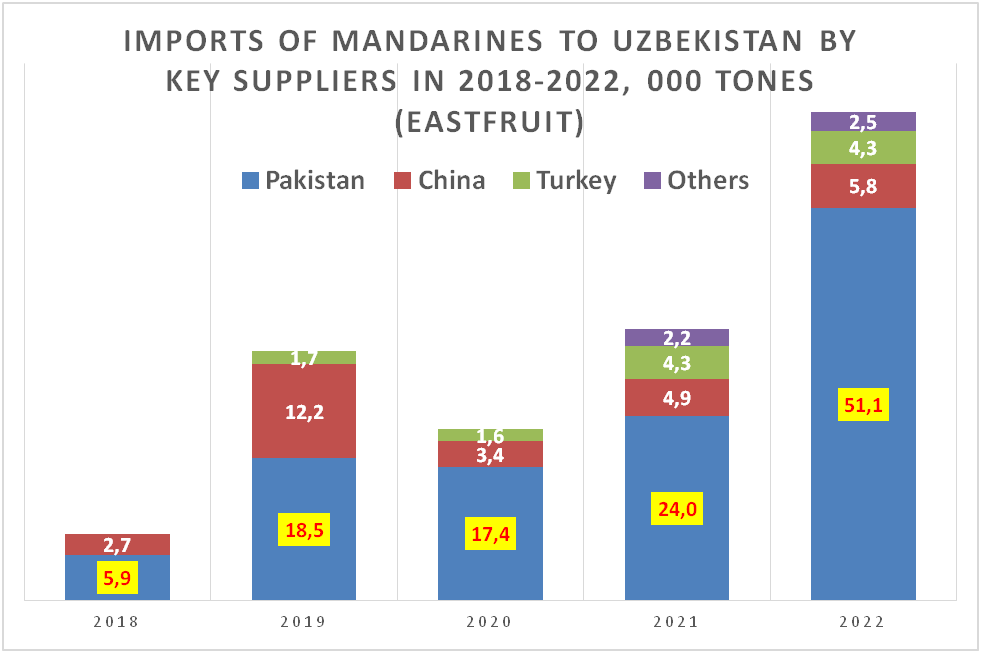

Data from EastFruit indicates that even with a sharp decrease in the total volume of mandarin imports to Uzbekistan in 2020 due to COVID-19 trade restrictions, the volume of Pakistani mandarin supplies only slightly fell. From 2019 to 2022, Pakistan's share in the Mandarin market increased from 56% to 80%, while China's share decreased from 37% to 9% during the same period.

After a decline in 2020, the volume of Mandarin imports to Uzbekistan not only recovered but increased significantly. The largest jump was observed in 2022, with Uzbekistan importing 63.6 tons, 1.8 times more than in 2021 and 2.8 times more than in 2020.

EastFruit analysts predict that by the end of 2023, the total volume of mandarin imports to Uzbekistan will surpass the 2022 figure, ranging between 65,000 to 75,000 tons, solidifying the country as an attractive market for easy peelers.

Follow Daryo's official Instagram and Twitter pages to keep current on world news.

Comments (0)