Stronger regulations reduce Uzbekistan banks' loan risks - Fitch Ratings

The introduction of stronger lending regulations in Uzbekistan aims to mitigate overheating risks in the retail lending market and gradually enhance the quality of banks' loan portfolios, as per to reports from Fitch Ratings on June 10. Despite these measures, asset-quality pressures are expected to intensify in 2024-2025 as legacy loans issued under less stringent underwriting standards mature.

Regulatory Measures to Strengthen Lending Practices

The Central Bank of Uzbekistan (CBU) and the government have enacted several regulatory initiatives over the past few years to tighten banks' underwriting standards in higher-risk segments and reduce credit risk. Key measures include:

- Increased regulatory risk-weights up to 200% for loans issued at interest rates significantly above the CBU key rate.

- Implementation of maximum payment-to-income limits on all retail loans (60% from July 2024 and 50% from 2025).

- Loan-to-value limits on mortgages and car loans.

- A 25% cap on the proportion of car loans in banks’ loan portfolios from Q4 2023.

- Tighter conditions on subsidized family business lending.

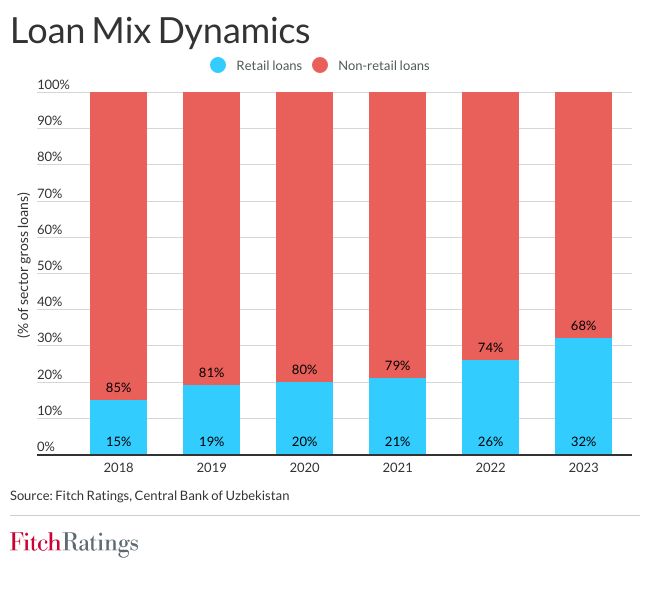

These measures respond to rapid retail loan growth, which saw a 39% compound annual growth rate (CAGR) from 2019 to 2023 and a 50% annual increase in 2022 and 2023. Retail exposures rose to 32% of total loans by the end of 2023, more than doubling the proportion at the end of 2018, with expectations to approach 50% in the next few years.

Rapid Growth and Its Implications

The surge in retail lending began from a low base following the start of market reforms in 2017, driven by pent-up consumer demand, higher household incomes, and the removal of several lending restrictions. Despite this growth, Uzbekistan remains significantly underbanked, with retail loans equivalent to just 14% of GDP at the end of 2023, indicating substantial growth potential.

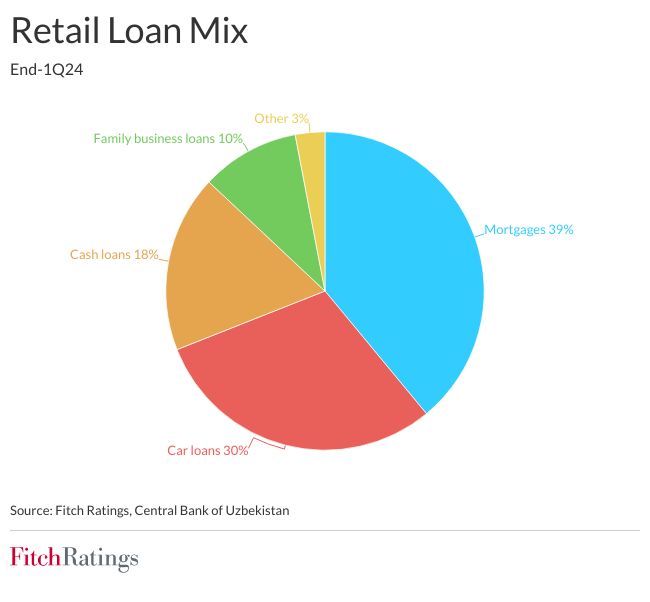

However, retail loans tend to be riskier in economically volatile emerging markets like Uzbekistan. The rapid credit growth at high interest rates—averaging 25% on retail loans by the end of Q1 2024—particularly in unsecured cash and car loans, could lead to a heavy debt burden on retail borrowers, risking significant loan-quality deterioration during economic downturns.

Early Impact and Future Outlook

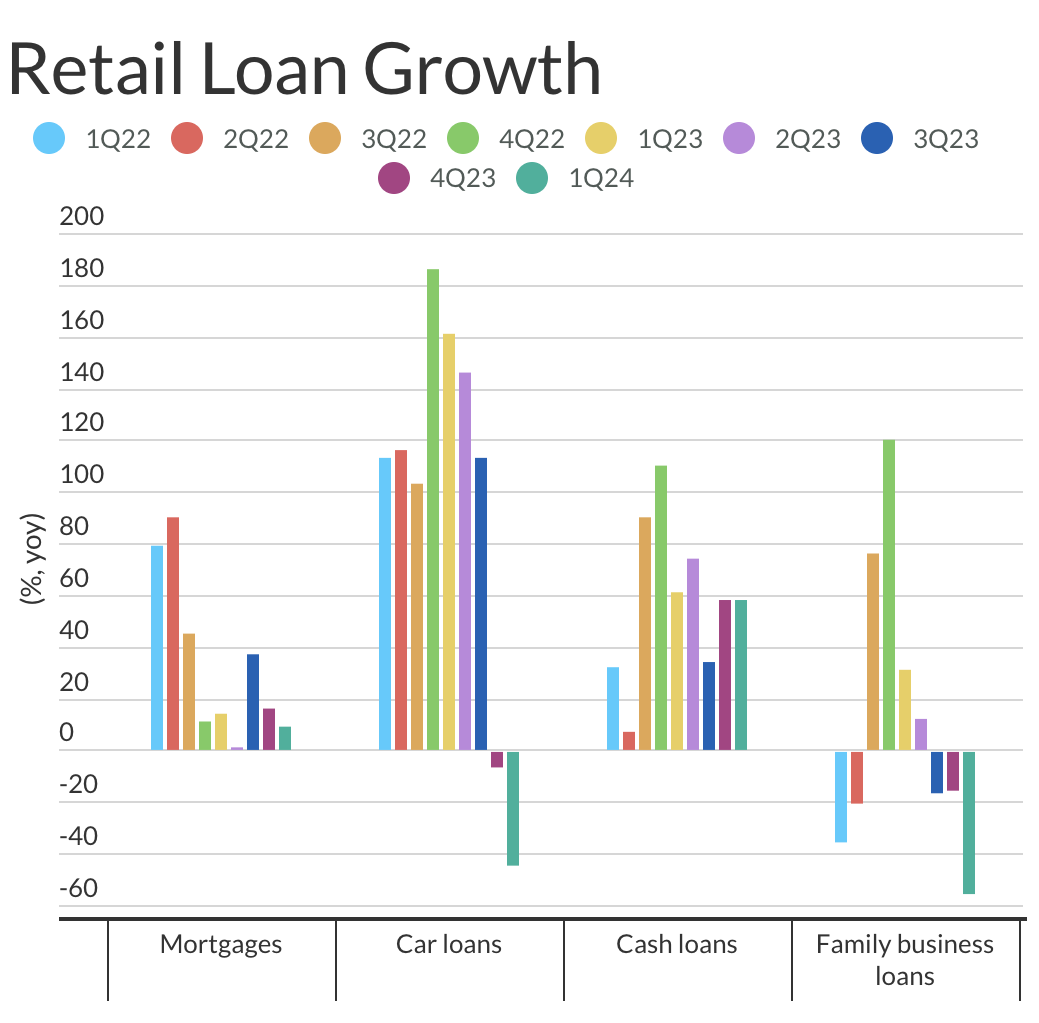

Data from the CBU indicates that the regulatory measures may already be affecting the market, with early signs of cooling, particularly in car loans, which almost doubled in the first nine months of 2023. After introducing the quantitative cap, new car loan issuance decreased by 6% year-on-year in Q4 2023 and 44% year-on-year in Q1 2024.

Family business loans, issued by selected policy banks, declined by 15% year-on-year in Q4 2023 and 55% year-on-year in Q1 2024. This segment is viewed as the riskiest due to weak underwriting standards and a focus on lower-income borrowers, leading to significant credit losses at some banks recently. The gradual winding-down of these loans should help reduce credit risk.

Cash unsecured loans, accounting for 18% of sector retail loans at the end of Q1 2024, were the only segment to grow significantly in Q4 2023 and Q1 2024, with a 58% year-on-year increase in both quarters. Growth is expected to moderate from the second half of 2024 when tighter lending rules take effect, but a 40% year-on-year growth is still anticipated for the full year.

Long-Term Benefits and Challenges

The shift to granular retail lending is expected to strengthen Fitch’s assessment of the local operating environment, currently rated 'b', which is well below Uzbekistan’s 'BB-' sovereign rating. Retail lending in Uzbekistan can only be done in local currency, gradually reducing high loan concentrations by borrower and industry, and decreasing dollarization—key structural weaknesses of the banking sector. Higher margins on retail lending should also improve banks’ profitability and capital buffers, though managing the cost of risk will be crucial.

Comments (0)