On September 12, the European Bank for Reconstruction and Development (EBRD) has set its sights on Central Asia with the launch of the Youth in Business (YiB) program. In a comprehensive market assessment spanning 13 countries and involving 122 stakeholders, the initiative aims to address the challenges faced by young entrepreneurs in the region and pave the way for inclusive growth. Mr. Benedikt Wahler, Managing Partner and Senior Expert in Inclusive and Digital Finance at ConsumerCentriX / CCX Inclusive Business presented his market assessment of Central Asia.

Market Dynamics and Regional Significance

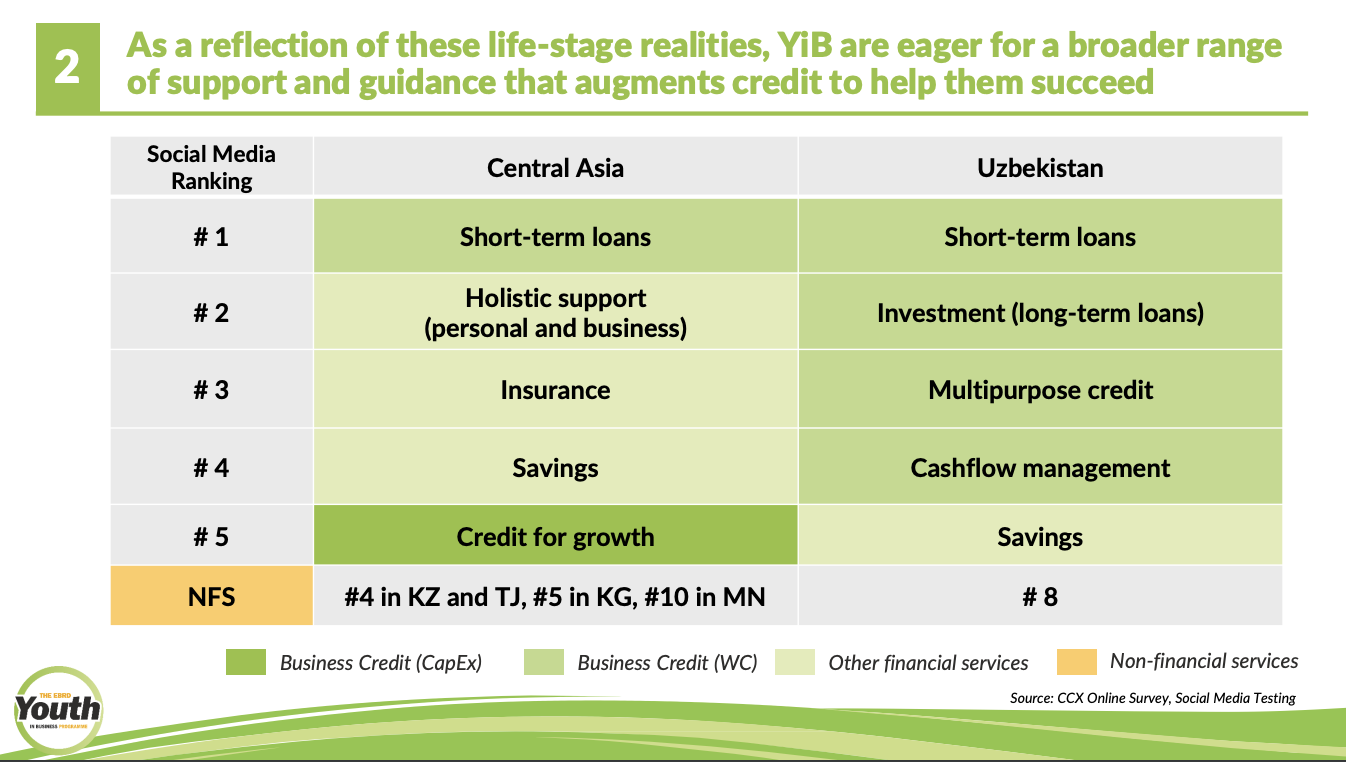

The assessment reveals a growing momentum with financial institutions in seven countries already collaborating with the EBRD, indicating a strong foundation for the YiB program's expansion. Social media testing reached over 1.6mn people, underlining the widespread interest and potential impact of the initiative. With 2537 survey respondents and 133 focus group discussions, the research provides a nuanced understanding of the landscape.

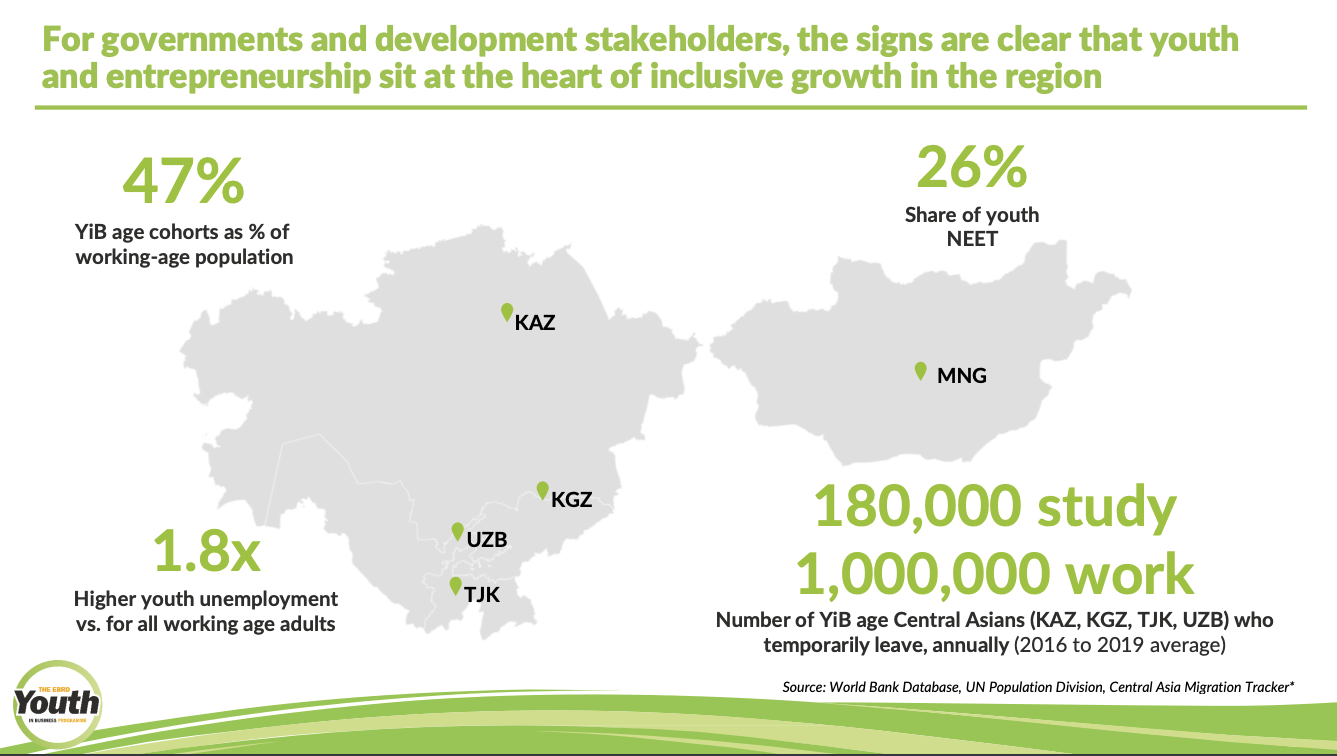

For governments and development stakeholders, the signs are clear: youth and entrepreneurship are integral to fostering inclusive growth in the region. The market assessment highlights the significance of the youth demographic, with a focus on Central Asians in the 18-34 age range. Notably, the number of young Central Asians temporarily leaving their countries annually is a crucial factor, emphasizing the need for initiatives like YiB.

Strategic Relevance and Commercial Viability

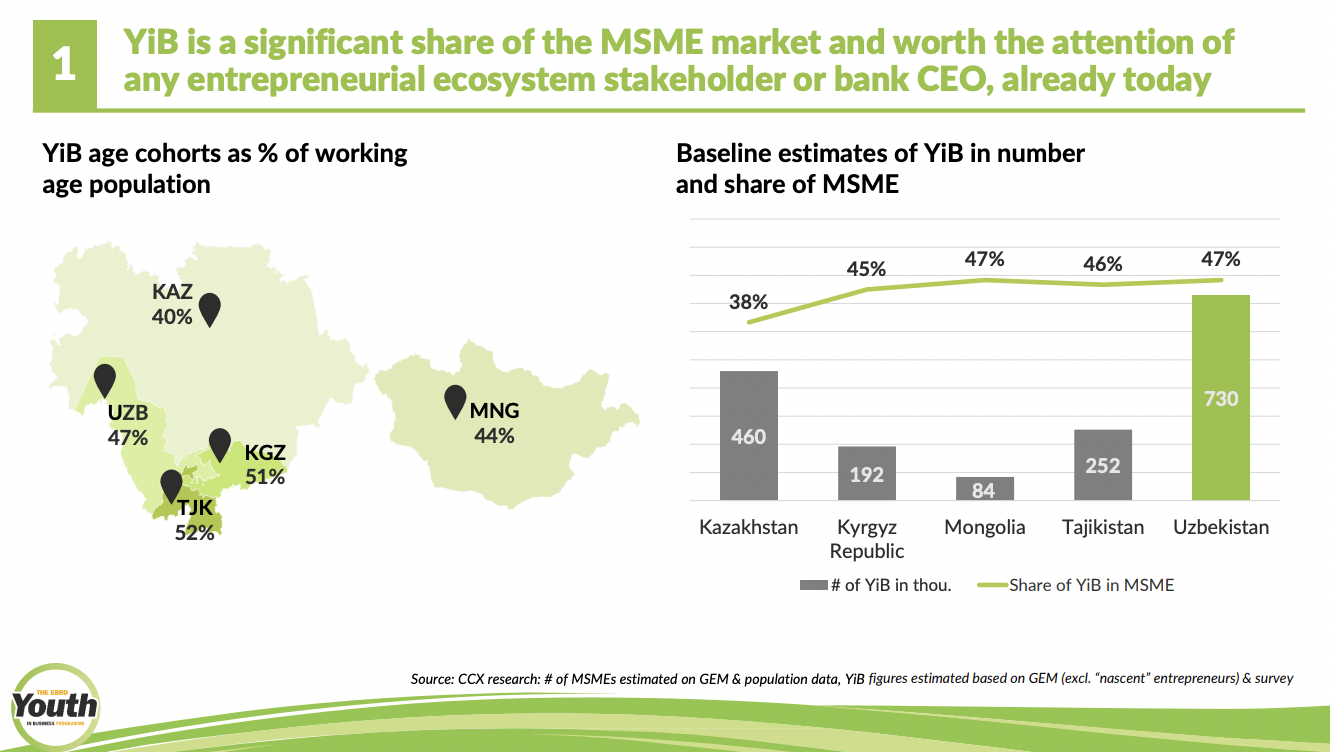

The YiB program identifies young entrepreneurs as a strategically relevant and commercially attractive segment. The market assessment underscores the differentiated needs and challenges faced by young business leaders, presenting an opportunity for first movers to address these gaps. The program distinguishes itself by focusing on financial institutions, emphasizing that Youth-in-Business is not just a corporate social responsibility (CSR) topic but a CEO-level priority.

Demographics and Structural Growth Trends

Demographic factors, such as the youth population's share and a coming wave of family-owned business succession, contribute to the relevance of YiB. Structural growth trends, including circular migration, higher educational achievement, and the rise of the digital economy, further boost the potential impact of the program in Central Asia.

Digital Economy and Financial Services Adoption

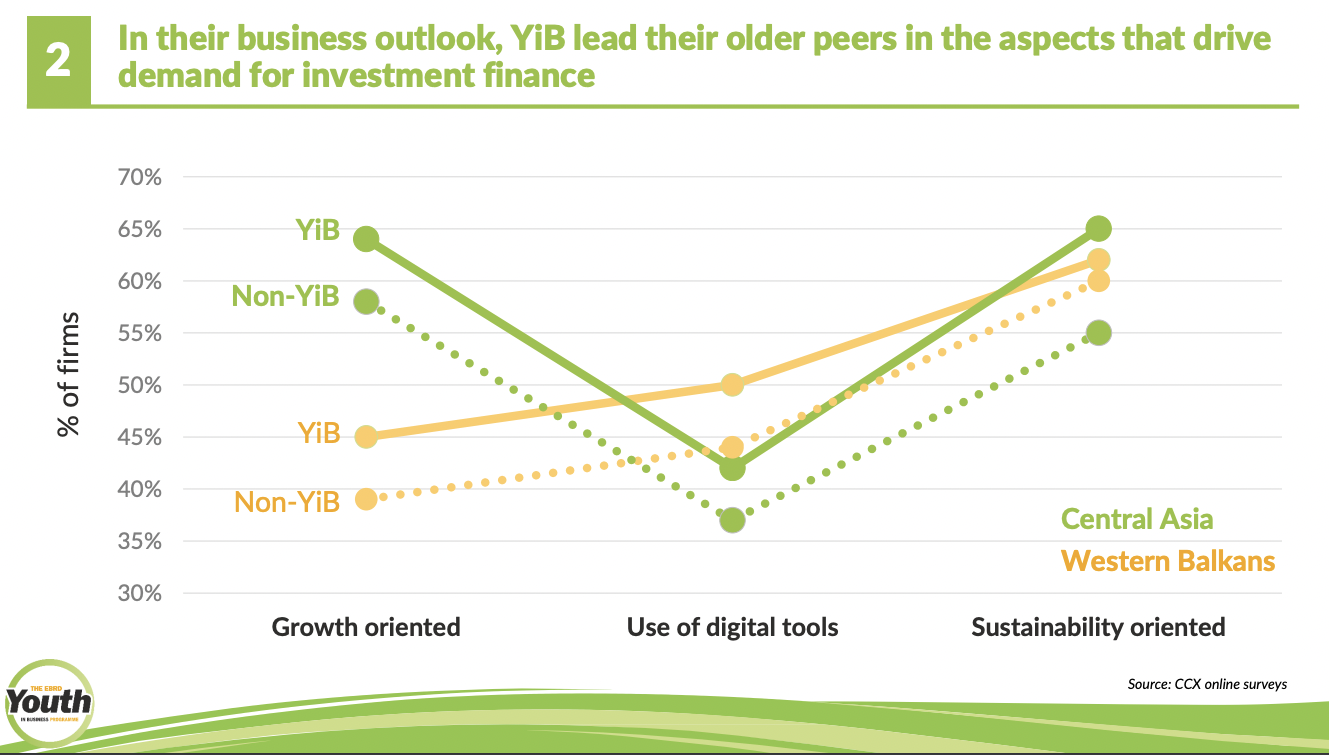

The spread of the digital economy and the adoption of financial services play a pivotal role in YiB's significance. As early adopters, young business leaders become primary targets for disruptors leveraging digital financial services. Their role as aspirational influencers for future affluent retail clients makes them key players in shaping the financial landscape.

Challenges and Opportunities for Financial Institutions

Financial institutions are urged not to wait for YiB to mature but to recognize them as a key segment where the future of SME finance is decided. The market assessment reveals differences in challenges and needs between YiB and their older peers. While YiB lead in aspects driving demand for investment finance, they lag in accessing the funding and support necessary for success.

Underserved Yet Ambitious: The YiB Funding Gap

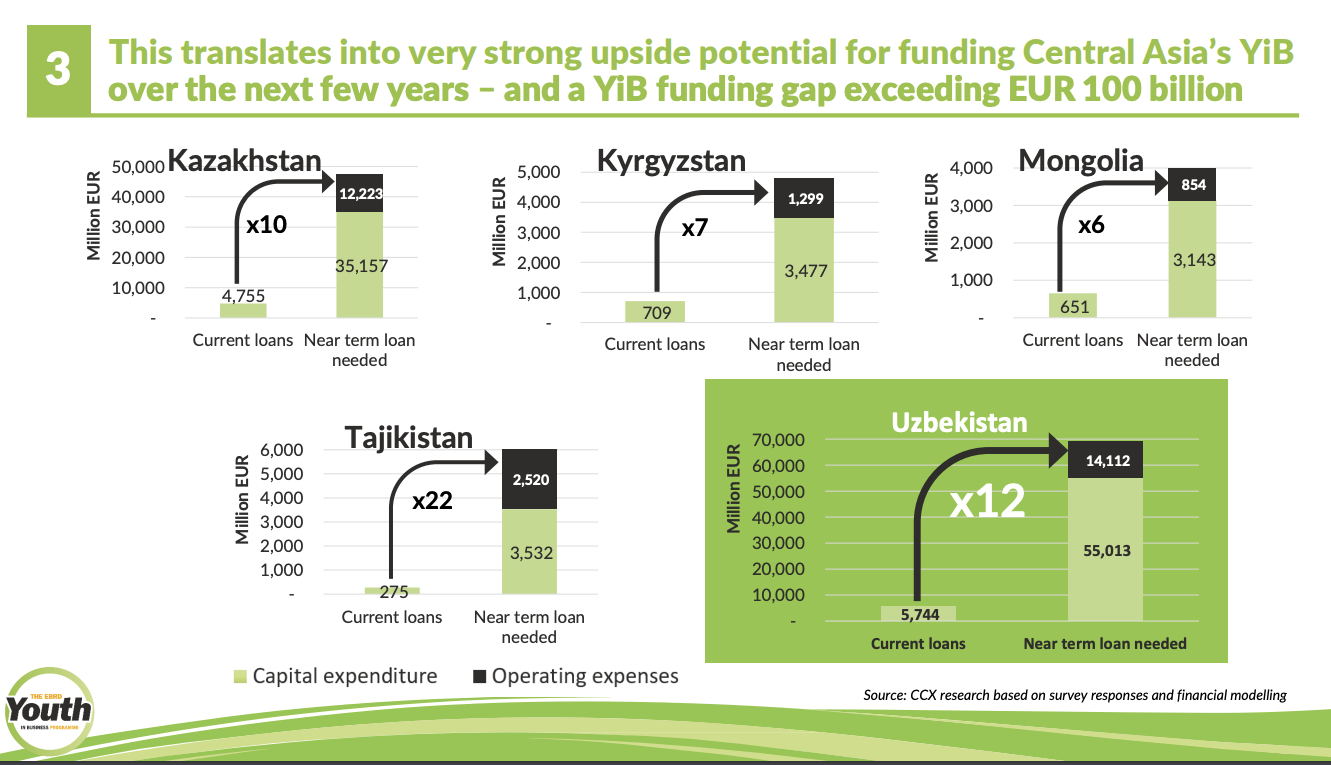

Youth entrepreneurs are currently underserved, presenting opportunities for first movers to address this gap. The YiB program, if executed correctly, should be addressable for formal financial institutions given the clear need and willingness of young entrepreneurs to engage with them.

The funding potential for Central Asia's YiB is substantial, with a projected funding gap exceeding €100bn. This highlights a significant opportunity for financial institutions to play a crucial role in funding the growth of YiB enterprises in the region.

Strategic Concerns and EBRD's Catalytic Role

The market assessment identifies strategic concerns holding back providers in Central Asia from tapping into the YiB potential. The EBRD aims to act as a catalyst, addressing these concerns and paving the way for financial institutions to seize the opportunities presented by the youth-led business segment.

YiB: More Than Just Young and Inexperienced

Contrary to stereotypes, YiB in Central Asia defy expectations. Many of these businesses show solid traction, explore digital business models, and have the substance to take their enterprises to the next level. The market assessment reveals that YiB companies established more than two years ago, with over €10,000 in revenue, and engaging in B2B transactions and digitalization.

Opportunities for Profitability and Overcoming Hurdles

Addressing obstacles with a dedicated approach holds the potential for profitability in the YiB segment. A test and learn approach, building up to loans, exploring risk assessment, and linking to the ecosystem are recommended ways to overcome challenges. Empathy and support are identified as guiding principles for successful engagement with the YiB segment.

Earlier Daryo reported that the focus of the Youth in Business program in Central Asia (YiB CA) is directed towards micro, small, and medium-sized enterprises (MSMEs) helmed or possessed by individuals below the age of 35. The initiative plans to earmark a maximum of €200mn for on-lending to 20 collaborating financial institutions in Central Asia and Mongolia.

Comments (0)