Uzbekistan's "Uzpromstroybank" and "Agrobank" could potentially remain under state ownership until the conclusion of 2024, as assessed by credit rating agency Fitch Ratings regarding the privatization outlook of the four major state-owned banks.

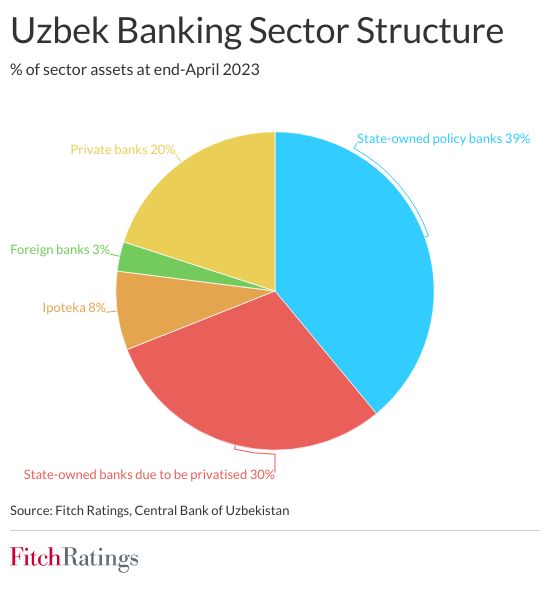

Fitch's report underlines that the extended credit ratings of these state-owned banks, namely NBU, Uzpromstroybank, Agrobank, and Asakabank, are tied to potential government backing and are aligned with Uzbekistan's sovereign rating. More importantly, NBU and Agrobank play an active role in lending to sectors prioritized by the state.

Analysts are also considering state support for Uzpromstroybank and Asakabank, despite Uzbek authorities' intentions to privatize them by the close of 2025.

Fitch's report indicates, "We anticipate that the bank sales will likely exceed the timeframe set in the privatization roadmap, given their ongoing transformation of the business model."

The rating agency predicts that these two financial institutions will remain publicly owned until at least the conclusion of the subsequent year. Furthermore, the government is expected to continue providing assistance to ensure liquidity until it's confident of their substantial capitalization before their eventual sale. Fitch underscores that subsequent to the announcement of privatization plans for state-owned banks, the government began selectively supporting them, facilitating credit activities, and addressing additional reserve requirements.

"Although the banks earmarked for privatization received new capital since 2020, it was primarily aimed at boosting their capital adequacy ratios as they approached regulatory minimums or risked potential breaches of obligations," experts noted.

In the medium term, government backing could become a distinction between larger banks engaged in political funding and those designated for sale.

In August, Shavkat Mirziyoyev endorsed amendments to the privatization strategy of several state-owned banks. Consequently, the focus will shift to the imminent sale of Uzpromstroybank. The aim is to reduce the state's stake in the bank to below 50% by the culmination of 2024.

Timelines for privatization and public share offerings for other banks are also undergoing adjustments:

- The QQB (Qishloq Qurilish Bank) is slated for March 2024 (previously October 2022).

- IPOs for Agrobank, Alokabank, Microcredit Bank, Xalq Bank, and NBU have been extended to January 1, 2025 (earlier set for July 2023).

- The Asakabank privatization target has been postponed to the close of 2025 (previously the end of 2023).

Central Bank Chairman Mamarizo Nurmuratov attributed the delay in state bank privatization to foreign investors' lack of confidence. The geopolitical challenges from the previous year particularly complicated the engagement of foreign investors in the post-Soviet countries' markets.

Follow Daryo's official Instagram and Threads pages to keep up to date on world news.

Comments (0)