Economists in Uzbekistan are raising concerns over the increasing allocation of state budget funds for pension provision, suggesting that a shift towards a funded pension system could alleviate the mounting pressure. Economists Abdulla Abdukadirov and Otabek Bakirov expressed their concerns during a recent episode of the "Dialog" (Dialogue) project on YouTube.

Otabek Bakirov highlighted the rapid increase in pension costs as a significant concern.

"It's alarming that the amount of transfers allocated from the budget for pensions is increasing year by year," Bakirov stated.

He pointed out that pension-related expenses are growing faster than the country’s economy and budget revenues, posing a serious challenge for Uzbekistan's financial sustainability.

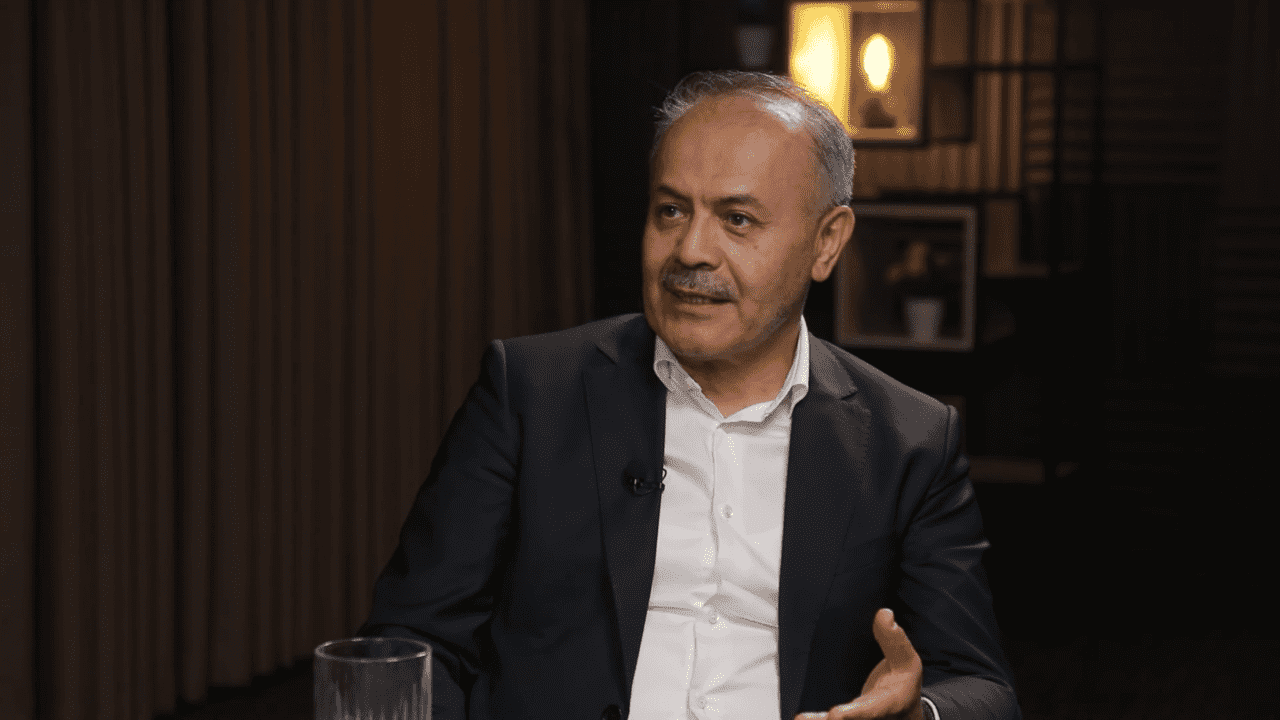

A Growing Discrepancy: Income Tax Payers vs. Pension Recipients

Abdulla Abdukadirov, the first deputy director of the Agency for Strategic Reforms, emphasized the widening gap between the number of income taxpayers and the growing population of pensioners and allowance recipients.

"Today, we have more than 37mn inhabitants. 19mn of them are able to work. However, the number of income taxpayers is only around 5.5mn to 6mn people," Abdukadirov noted.

He expressed concern over the fact that the number of pension recipients is increasing more rapidly than the number of income tax contributors, which could strain the state budget further.

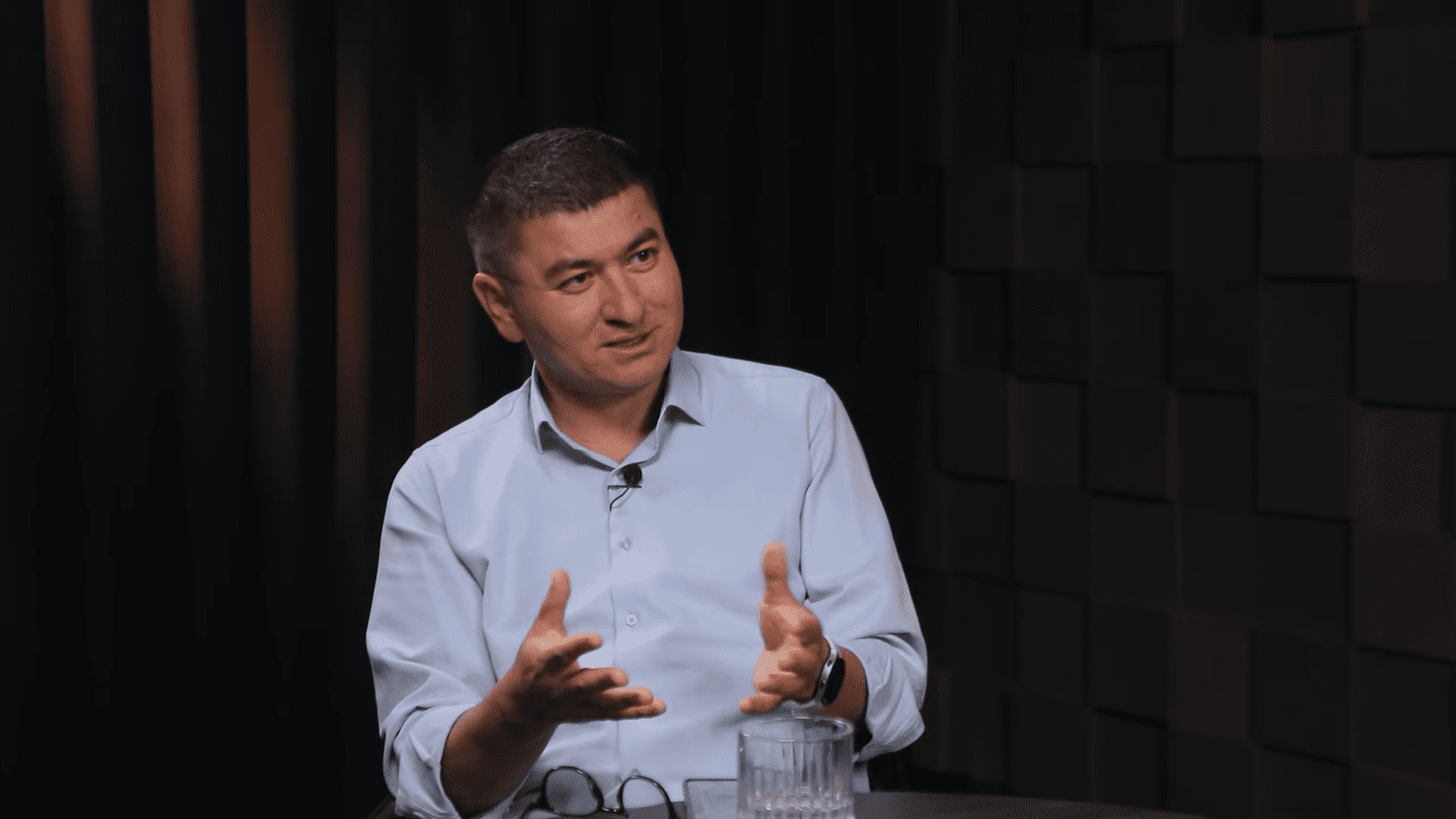

The Case for a Funded Pension System

During the discussion, Bakirov advocated for a transition to a funded pension system. He mentioned that in 2004, Uzbekistan began laying the groundwork for such a system, with a small percentage of salaries being allocated to personal savings pensions.

However, he noted that progress has slowed significantly in recent years, with only a minimal portion of income tax being directed to savings pensions.

“By 2017, this amount reached 2%-3%. I think there were plans to increase it year by year. Now, if I'm not mistaken, 0.1% of the 12% income tax is transferred to the personal savings pension. It has no effect,” Abdukadirov added.

Abdukadirov confirmed that the government is considering a shift towards a funded pension system.

"This issue was raised by the president in 2019, during the coronavirus pandemic. Although it was sidelined temporarily, it is now back on the agenda," he said, adding that the Ministry of Economy and Finance and the Pension Fund are actively working on this transition.

Bakirov projected that it would take approximately 25 years to fully transition to a funded pension system.

"If we start the transition with citizens who are currently 18-20 years old and entering the labor market, the system could be fully operational by 2050," he explained.

Until then, the state pension system would continue to operate alongside the new system, though its share would gradually decrease as the funded pension system grows.

In addition, Abdukadirov also suggested increasing pension allocations and savings through banks. He proposed that the state could establish a pension fund and then hold tenders among banks to manage these funds, ensuring the maximum possible growth.

"The money should be transferred to banks based on a social contract, with multiple banks involved to diversify management," he recommended.

Earlier, Bakirov had suggested auctioning personal pension funds currently held in Xalq Banki to commercial banks offering higher returns. Meanwhile, the Agency for Strategic Reforms has put forward several recommendations for improving Uzbekistan's pension system.

Follow Daryo's official Instagram and Twitter pages to keep current on world news.

Comments (0)