Uzbekistan's external debt is expected to decline by nearly 10% in the next five years, the International Monetary Fund (IMF) reports. This projection comes amid the Uzbek government's ongoing efforts to maintain fiscal discipline and manage public debt prudently.

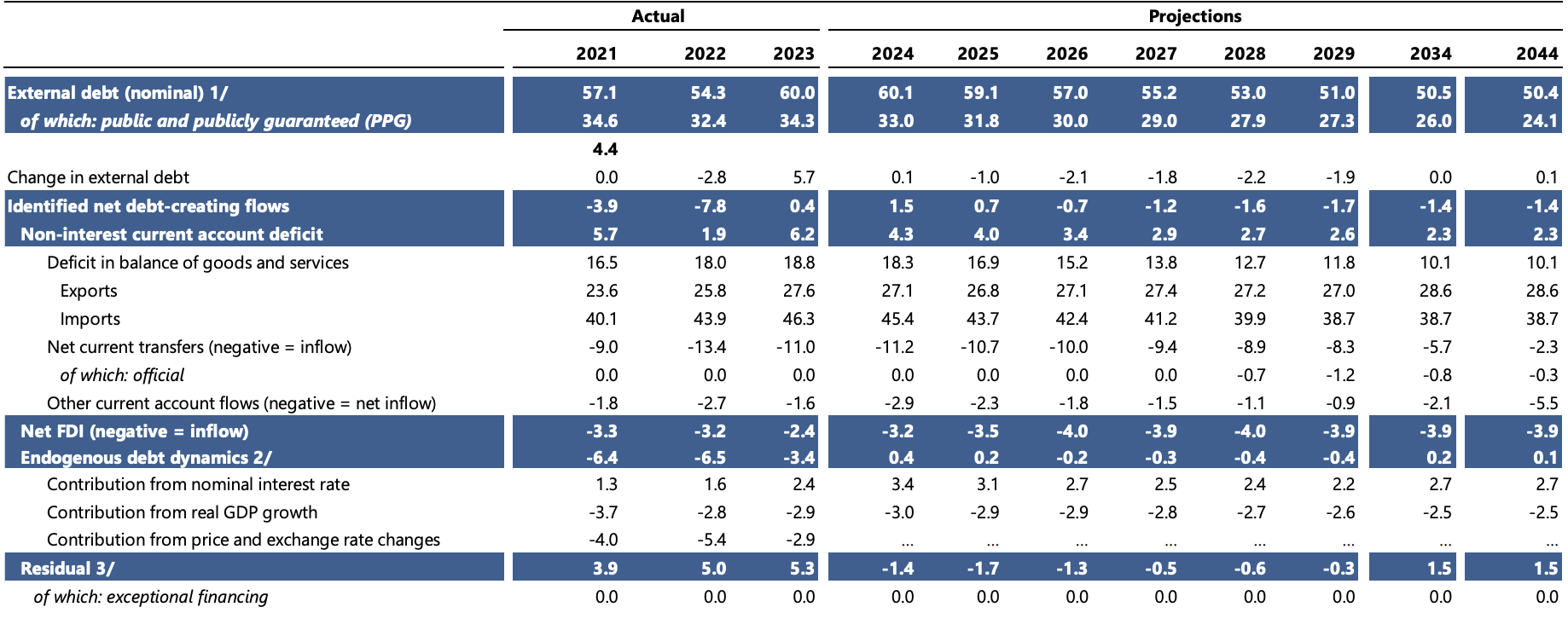

According to the IMF's analysis, the country's total external debt, which stood at 60% of GDP at the end of 2023, is expected to decrease to 51% of GDP by 2029. Similarly, public and publicly guaranteed (PPG) external debt, which was 34% of GDP at the end of 2023, is projected to decline to 27% of GDP by 2029.

Several factors contribute to this positive outlook. The Uzbek government has implemented annual limits on fiscal deficits and new borrowing, aiming to cap the fiscal deficit at 3% of GDP. Additionally, a public debt law enacted in 2023 limits PPG debt to 60% of GDP and mandates proposals to reduce debt if it reaches 50% of GDP.

The data from the IMF's External Debt Sustainability Framework indicates that the projected change in external debt from 2024 to 2029 is due to various factors, including a reduction in net external borrowing and improved fiscal management. Identified net debt-creating flows, such as non-interest current account deficits and changes in net foreign direct investment (FDI), are expected to contribute to this decline.

Key Data Highlights:

External Debt Projections:

- Nominal external debt is expected to decrease from 60.0% of GDP in 2023 to 50.4% of GDP by 2044.

- PPG external debt is projected to decline from 33.4% of GDP in 2023 to 24.1% of GDP by 2044.

Debt Sustainability Indicators:

- The present value (PV) of PPG external debt-to-GDP ratio is projected to decrease from 39.1% in 2023 to 22.0% by 2044.

- PPG debt service-to-exports ratio is projected to decrease from 14.8% in 2023 to 10.3% by 2044.

- PPG debt service-to-revenue ratio is expected to decrease from 9.4% in 2023 to 8.7% by 2044.

The IMF emphasizes that the composition of Uzbekistan's external debt reduces its vulnerability to economic shocks. Most of the debt is owed to official lenders at long maturities and low interest rates, which mitigates the risk of debt distress. The report states, "Uzbekistan’s current level of PPG external debt is moderate and is projected to decline over the medium term. Uzbekistan has relatively high international reserves and most debt is provided by official lenders at long maturities and low interest rates."

Despite the positive projections, the IMF cautions about potential risks. The realization of contingent liabilities, lower exports, and market shocks could impact debt sustainability. To address these risks, the government has set annual caps on total PPG borrowing and introduced measures to limit contingent liabilities from public-private partnerships (PPPs) and state-owned enterprises (SOEs).

The authorities in Uzbekistan have expressed their commitment to maintaining a moderate debt level. The report quotes the Uzbek authorities, stating, "The government’s goal of reducing and maintaining the medium-term fiscal deficit at 3% of GDP would put PPG external borrowing on a downward path as a share of GDP.”

The report also projects steady economic growth for Uzbekistan, with real GDP growth expected to average 5.5% annually over the long term. This growth will support the country’s fiscal consolidation efforts and contribute to the reduction of the debt-to-GDP ratio.

In conclusion, the IMF's projections indicate a favorable outlook for Uzbekistan's external debt situation, driven by prudent fiscal management and structural reforms. The continued focus on maintaining fiscal discipline and managing public and external borrowing will be crucial for sustaining this positive trajectory.

Comments (0)