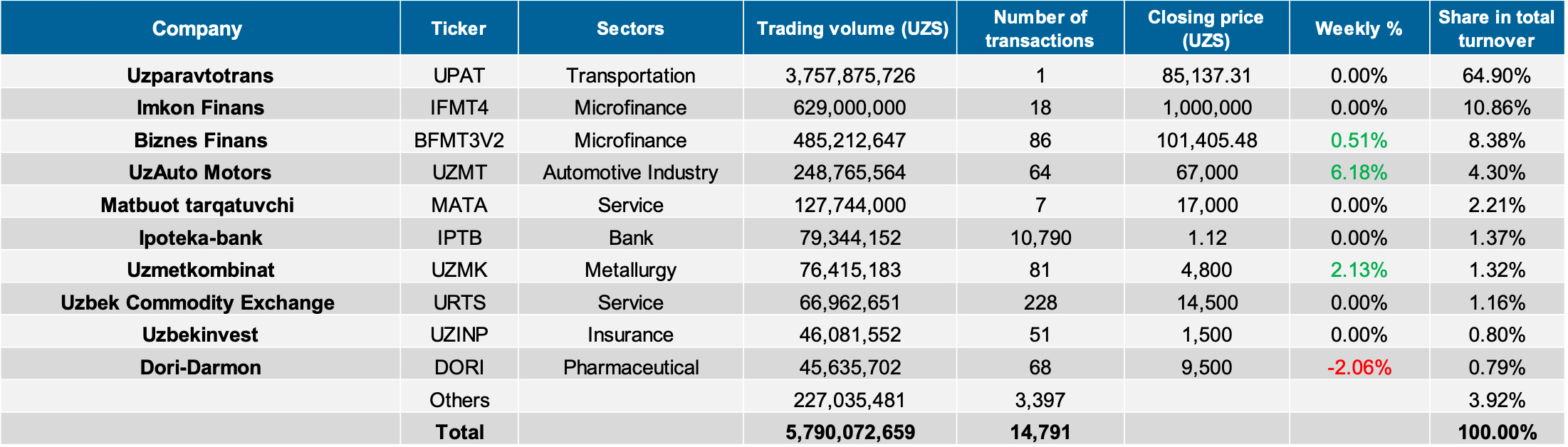

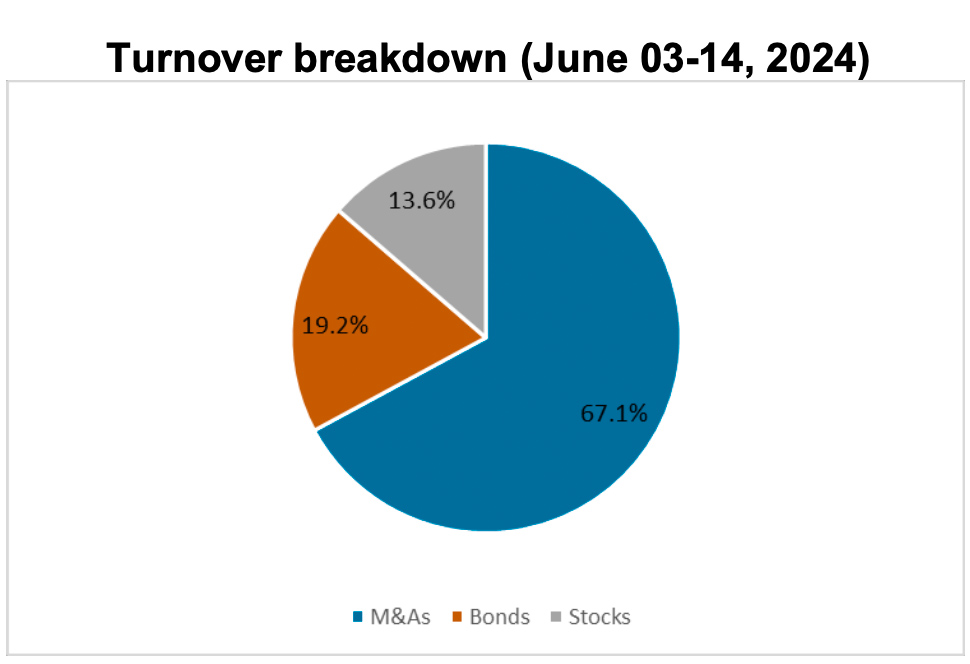

The Tashkent Stock Exchange (TSE) experienced a significant surge in trading volume this past week reaching UZS 5.8bn ($459,187) a 70.5% increase compared to the previous week's volume. However, the number of securities traded decreased to 67 eight fewer than the prior week. UPAT was a major contributor accounting for nearly 65% of the turnover through a substantial M&A transaction worth UZS 3.8bn ($300,846) at UZS 85,137.31 per share.

Bond transactions led by BFMT3V2 and IFMT4, contributed 19.2% to the total trading volume. Additionally, an M&A transaction involving MATA shares amounted to UZS 127.8mn ($10,117.95) at UZS 17,000 per share contributing 2.2% to the turnover.

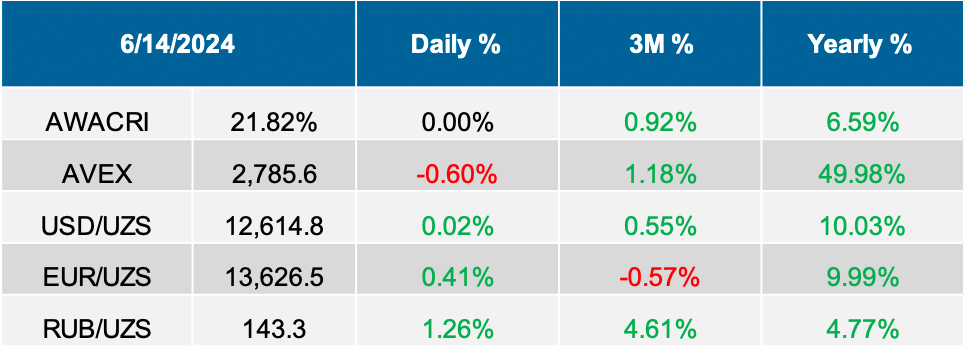

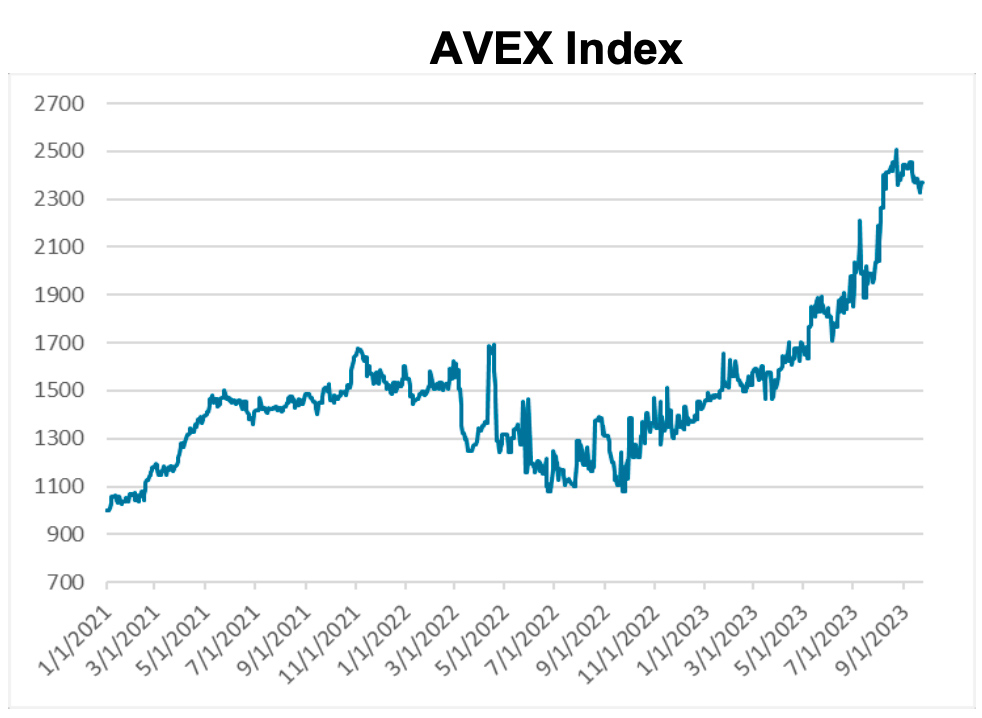

Despite regular trading activity, there was minimal price volatility among the top 10 securities by volume. Notable movements included UZMT and UZMK, which saw closing prices increase by 6.2% and 2.1% respectively while DORI's closing price declined by 2.1%. AVEX also decreased by 2.5% during the week.

In economic developments the Uzum ecosystem decided to abandon its merger with Click to focus on its own fintech services. Afghan Zalal Mowafaq announced plans to construct a $130mn plant for manufacturing non-alcoholic beverages. The average rent yield in Uzbekistan decreased by 10% in the first five months of 2024. Car sales in May saw a year-on-year increase of 36.5% reaching 90,000 units, with electric vehicle sales rising by 30% compared to the previous month. In 2023, Uzbekistan accounted for 10% of uranium supplies to the United States. The Central Bank of Uzbekistan maintained the key interest rate at 14%. The World Bank revised its GDP growth forecast for Uzbekistan in 2024 from 5.5% to 5.3%. There are no free high-quality warehouses left in Uzbekistan with availability dropping from 4.5% to 0% in the first quarter of 2024. Cargo flights from China to Uzbekistan commenced this week. The average local currency retail deposit rate reached 21.6% in April reflecting a slight increase of 0.2%. Uzbekistan, Kyrgyzstan and Kazakhstan signed an agreement to prepare for the construction and operation of the Kambarata-1 hydropower plant in Kyrgyzstan. Uzbekistan's foreign reserves hit a record $36.6bn marking a 4.3% increase. Fitch Ratings highlighted risks in the banking sector due to increased retail lending with stronger regulations potentially helping to mitigate these risks. Asset-quality pressures are expected to rise in 2024-2025 as legacy loans become a concern with retail loans growing by 39% CAGR from 2019-2023 and by 50% annually in 2022-2023. Cash unsecured loans alone increased by 58% in the first quarter of 2024. The Central Bank of Uzbekistan invested in foreign government securities to diversify its reserves.

In corporate developments, the supervisory board of Biokimyo JSC (BIOK) recommended paying dividends of UZS 2,400 per share. Uzbekistan Airports JSC established Airports Training Center LLC. TBC Bank JSCB is set to provide a UZS 25bn ($1,979,255) loan to TBC Fin Service LLC. Hamkorbank JSCB (HMKB), Uzvtorcvetmet JSC (UIRM) and Akhangarancement JSC (ex.OHSM) approved decisions not to pay dividends for the 2023 fiscal year. Fitch affirmed a BB- rating with a Stable outlook for Almalyk Mining JSC (AGMK) and assigned a BB- rating with a Stable outlook for TBC Bank Uzbekistan.

Follow Daryo's official Instagram and Twitter pages to keep current on world news.

Comments (0)