BeOne Uzbekistan, with the support of B1 Group and in partnership with the National Agency for Prospective Projects of Uzbekistan (NAPP), hosted a conference aimed at businesses preparing to sell their shares to the public through an Initial Public Offering (IPO) on May 21.

The primary objective of the conference was to demystify the essential steps for a successful IPO and to foster stronger relationships between businesses and regulators during the crucial pre-IPO stage. The event featured a comprehensive workshop with a Q&A session, followed by an informal discussion period.

The conference attracted a host of participants, including representatives from the Ministry of Economy and Finance of Uzbekistan, the State Assets Management Agency of the Republic of Uzbekistan, and the Tashkent Republican Stock Exchange. BeOne Uzbekistan and B1 Group experts provided valuable updates on current IPO readiness requirements and shared insights into emerging trends and opportunities in the IPO market.

Navigating IPO Complexity

Anton Ustimenko, Partner at B1 Group and head of IPO preparation services, discussed the challenges an IPO presents and emphasized the importance of collaboration with IPO organizers, key preparation aspects, investment history, valuation approaches, and other relevant IPO issues.

“An IPO accelerates existing company problems, necessitating faster solutions and changes due to its chaotic and complex nature," Ustimenko stated.

He highlighted the critical role of promoters in shaping compelling investment narratives to attract investors and stressed the importance of careful stock exchange selection and tailored IPO strategies, informed by market dynamics and regulatory requirements.

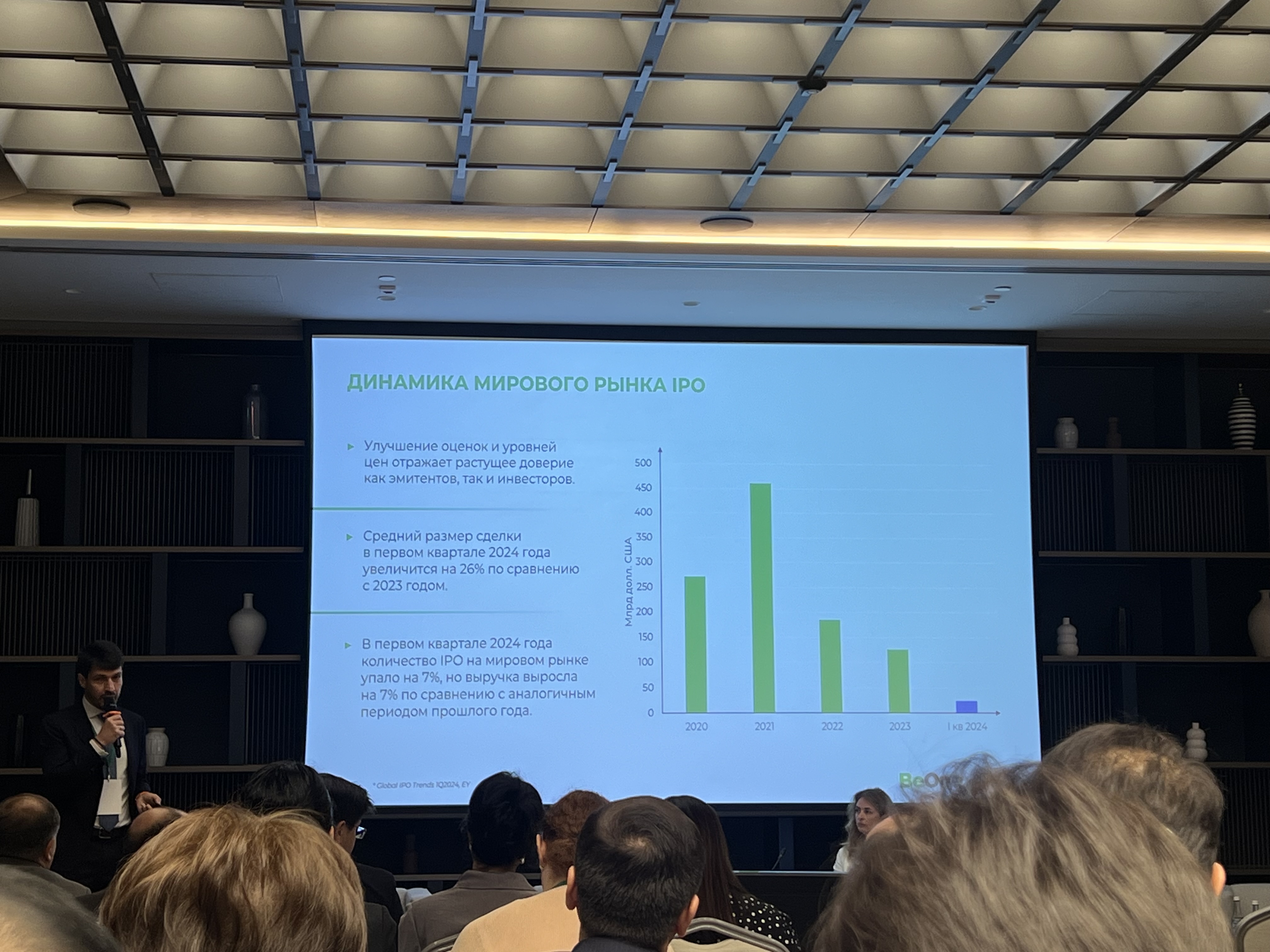

Discussing IPO scale and demand, Ustimenko noted the significant trends of 2021, with banks favoring offerings over $1bn, although typical IPO sizes range from $150 to $200mn, often representing a substantial portion of the company’s value.

“Capital raised through IPOs is often over 10% of the company's worth. In peak years, demand led banks to focus on offerings exceeding $1bn, though typical IPOs are $150 to $200mn, about 15-20% of the company's value,” he explained.

Ustimenko also examined pre-IPO challenges, stressing the need for coherent company narratives, robust corporate governance, and meticulous due diligence. For successful IPOs, he emphasized efficient information dissemination, accurate financial forecasting, understanding global market dynamics, and maintaining a balanced investor composition to avoid overreliance on any single category.

He further stressed the importance of realistic valuations, effective post-IPO integration strategies, and maintaining stringent corporate governance standards to foster investor confidence and ensure long-term viability in public markets.

Stock Market Development Through Privatization

Shokhruh Ohunov, Head of the Department for Preparation for Privatization and Privatization of State Assets at the Agency for Management of State Assets of Uzbekistan (UzSAMA), highlighted privatization's role in stock market development. He stressed that successful IPOs require a well-developed capital market, equal conditions for all market players, and clear legislative roles for owners and regulators.

Key reforms have been made in privatization and corporate governance. In 2021, Uzbekistan approved a strategy to manage and reform state-owned enterprises, reducing state involvement and improving the regulatory framework. The 2001 Law on State Property Management and a recent law on privatization promote equal conditions for state and non-state entities.

Reforms in corporate governance are also essential. Supervisory boards of 142 enterprises now have committees on strategy, audit, appointments, anti-corruption, and ethics. Corporate secretariats are being established, and an updated Corporate Governance Rules draft has been developed with the Asian Development Bank. A Code of Ethics, created by the European Development Bank, is being implemented in 29 large enterprises.

Transparency is enhanced through annual summary reports on state enterprises' performance. A competitive selection process for supervisory board members began in November 2022, leading to public competitions in 57 enterprises and the selection of over 300 candidates from 900 applications.

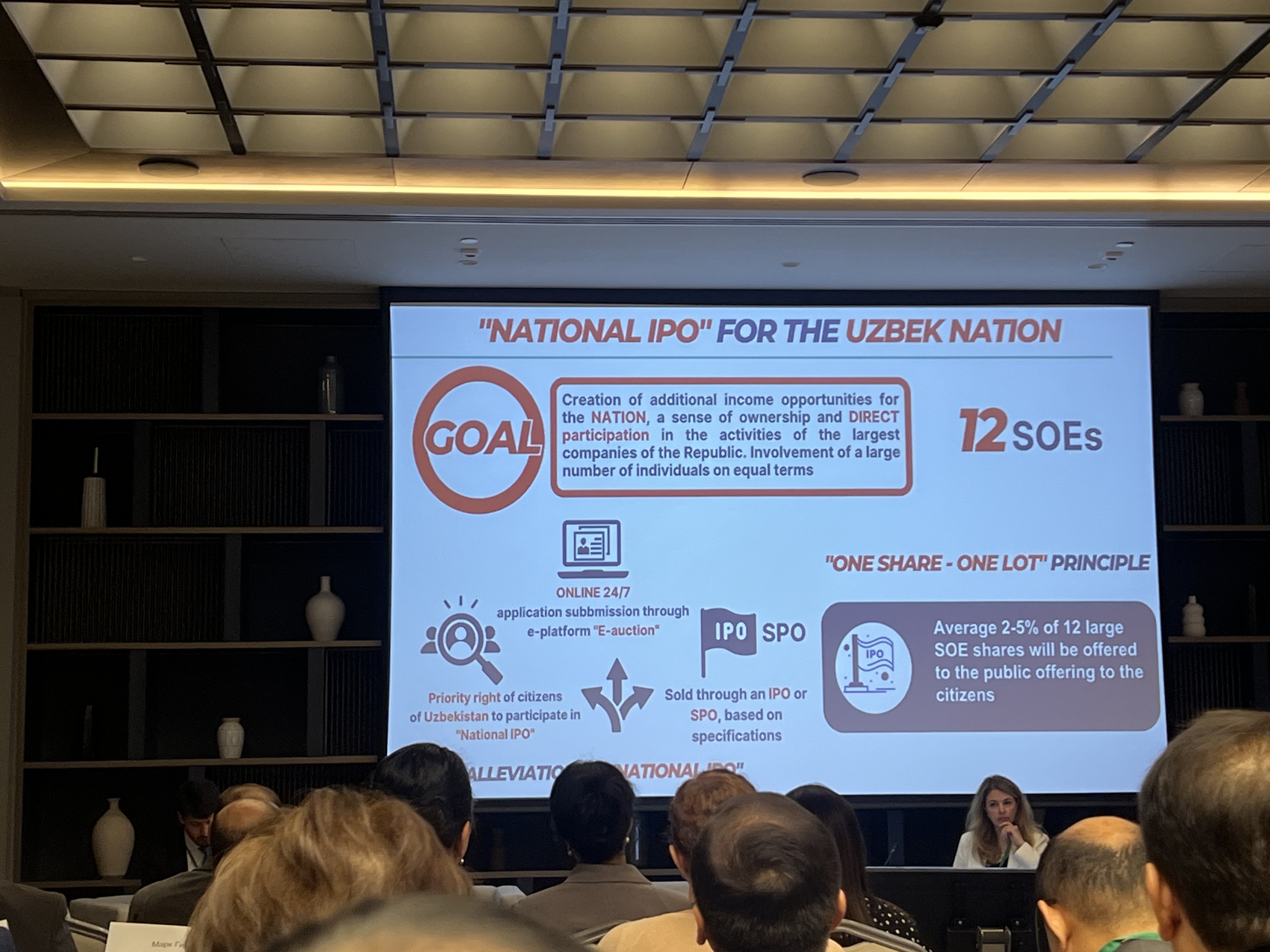

A new privatization program includes over 250 state enterprises, with public auctions planned for 12. Preparations for IPOs are ongoing, with plans to use the eBay platform for auctions and applications, though final placements will occur on the Republican Stock Exchange.

When pressed on the selection criteria and preparation process for state companies eyeing an IPO, Shokhruh emphasized the role of consultants in guiding the selection process.

"For the requirements and preparation for an IPO, we usually hire a consultant to select all the others. Based on the consultant's recommendation, we list and choose these enterprises," Shokhrukh clarified.

Responding to inquiries about the timing of the people's IPO, Shokhruh acknowledged delays but noted progress, including realizing state assets worth $2bn in 2023. He confirmed plans to list at least two out of twelve enterprises this year, in line with the government's resolution to facilitate public participation.

"This year, we plan to conduct at least two out of 12 enterprises' people's IPO," he affirmed.

This commitment aligns with the government's resolution aimed at facilitating public participation in state-owned enterprises. Shokhruh also clarified that the allocation of AMMC shares to UzSAMA was part of IPO preparations.

Uzbekistan's IPO Market and Regulatory Framework

In an interview with Daryo, Xudayberdiyev Saibjan, the Head of Capital Market Regulation Department at National Agency of Perspective Projects (NAPP), delved into the intricacies of initial public offerings (IPOs) and shed light on the current state of Uzbekistan's IPO market.

When queried about the essential steps for companies in Uzbekistan gearing up for an IPO, Saibjan emphasized the significance of meticulous preparation tailored to each company's unique circumstances. He stressed that the preparation process revolves around understanding and meeting the specific requirements pertinent to the organization. Saibjan stressed the importance of factors such as operational efficiency, financial performance, transparency, and the overarching goals of the company and its leadership.

"Preparation, as our speakers said, currently speaking, is mainly about these requirements, exactly what requirements are imposed for. The organization of an IPO here depends on the company itself," he highlighted the nuanced nature of the IPO journey.

Furthermore, Saibjan elucidated the role of regulatory bodies, including the Ministry of Finance, the Agency for Managing State Property, and NAPP, in facilitating the IPO process. He delineated their responsibility as acting as conduits between companies and the IPO market, bridging the gap to fulfill the requisite tasks and regulatory obligations.

"We will be in such circumstances. Circumstances. For. Fulfilling these tasks, so to speak, excuse my Russian," Saibjan remarked.

Addressing the inquiry about prevailing trends in Uzbekistan's IPO market, Saibjan reflected on the nascent stage of the market's evolution. He characterized recent IPOs as pioneering endeavors, citing examples such as Uztelecom and another notable entity, which collectively mark the initial forays into the IPO landscape. While acknowledging the relatively modest volume of these IPOs, Saibjan expressed optimism about their successful execution and hinted at the potential for future growth.

However, he cautioned against premature speculation on emerging trends, advocating for a patient approach to witness the market's trajectory unfold over time.

"Well, it's still early to talk about trends, because this innovation is like, so to speak, pioneering projects, you could say," Saibjan stated.

Regarding future projections for Uzbekistan's IPO market, Saibjan deferred to experts in academia and governmental institutions, emphasizing the pivotal role of the Ministry of Finance and the Agency for State Property Management in formulating strategic directives. He stressed the importance of aligning with overarching governmental strategies and decisions, particularly in light of the substantial state ownership stake in joint-stock companies.

About BeOne Uzbekistan and B1 Group

BeOne Uzbekistan, founded in 2023 and led by Managing Partner Dilovar Mavlonov, boasts a team of professionals with extensive experience in delivering complex projects domestically and internationally. The firm offers a broad spectrum of consulting services, including technology and consulting, transactions, tax, law, and business support. BeOne's strategic partnership network includes over 4,000 professionals across Türkiye, UAE, Russia, and Belarus.

B1 Group, led by Managing Partner Marchello Gelashvili, is a strategic partner of BeOne Uzbekistan, providing a full range of professional services such as assurance, strategy, technology, consulting, transactions, valuation, tax, law, and business support. With over 35 years of experience in Russia, B1 Group has built a robust team with significant expertise in tackling challenging projects.

Follow Daryo's official Instagram and Twitter pages to keep current on world news.

Comments (0)