The International Monetary Fund (IMF) has revised its forecast for Kazakhstan’s GDP growth downwards to 3.1% from the 4.2% in 2024. However, the outlook for the following year has been upgraded from 4.6% to 5.7%.

The IMF’s pessimistic view for the current year is attributed to potential delays in the expansion project on the Tengiz oil field, a decline in oil prices, potential issues with oil exports, and a slowdown in economic growth in key trading partners, namely the EU and China, as reported by Halyk Finance.

The IMF predicts a 2.3% drop in oil prices to $79.10 per barrel of Brent oil this year, triggered by surges in commodity prices. These surges have been caused by multiple attacks on ships in the Red Sea and disruptions in supply chains. In 2025, this decline is expected to accelerate to 4.8% or $75.31 per barrel.

The IMF has also highlighted that uncertainties surrounding Ukraine and the risk of secondary sanctions could reduce business activity in the region and undermine investor confidence. Furthermore, climate-related issues and ambitious, albeit costly, decarbonization goals could impact Kazakhstan’s economy and financial system.

Contrarily, Halyk Finance holds a more optimistic view of Kazakhstan’s economic growth in 2024. The company’s experts predict a 4.5% growth in Kazakhstan’s GDP, attributing this to the stabilization of inflation, a reduced base rate, and the initiation of large infrastructural projects. They also underscored the significance of last year’s record-high transfers from the National Fund, which are expected to significantly influence GDP growth.

The Kazakhstani cabinet anticipates the economy to grow by at least 5.3% this year. Other institutions have also made their predictions: the Eurasian Development Bank at 5%, the U.N. at 4.8%, the Asian Development Bank at 4.3%, and AERC at 4.2%.

Forecasted Economic Growth of Central Asian Countrries

Uzbekistan

The economic outlook for Uzbekistan in 2024 remains positive, with growth projected to stay above 5%. Despite the need for fiscal consolidation, the external current account deficit is expected to increase modestly due to a decline in gold exports, offset by slower import growth related to public spending restraint.

External risks include potential deterioration of growth in key trading partners, notably China and Russia, and further tightening of external financial conditions. Domestic risks involve contingent liabilities from state-owned enterprises (SOEs) and public-private partnerships (PPPs).

Tajikistan

According to EDB analysts, Tajikistan’s GDP is expected to grow 8.2% in 2023 and 7.3% in 2024. The robust economic growth this year was driven by strong domestic demand. The GDP growth rate in 2024 is expected to remain high at 7.3%, albeit slightly slower than in 2023 due to a deteriorating external economic environment, including slower growth rates in Russia and the world’s leading economies.

Tajikistan’s GDP growth will continue to rely on expanding industrial capacity, particularly in metallurgy, energy, textile, and food industries, and the accompanying investment activity, including government economic development programs.

Turkmenistan

The European Bank for Reconstruction and Development (EBRD) predicts that Turkmenistan’s economy will expand by 6.5% in 2023 and 7.0% in 2024. The September “Regional Economic Prospects” report indicated that economic growth was broad-based, supported by elevated public spending and higher gas exports.

Kyrgyz Republic

The Kyrgyz Republic’s economy is projected to grow more slowly in 2023 due to a slowdown in gold production and the impact of unfavourable weather on agriculture, despite the strong performance of services. The Asian Development Outlook (ADO) September 2023 projects the Kyrgyz Republic’s GDP growth rate to be 3.8% in 2023, lower than ADB’s previous forecast of 4.5%, due to slower-than-expected growth in the first seven months of the year.

The Central Asian nation’s economic growth is expected to accelerate slightly to 4% in 2024. The outlook remains subject to heightened uncertainty and downside risks from a net reversal of capital flows, lower than projected economic growth in the Russian Federation, lower remittances, or secondary sanctions. In this context, policy reforms must continue to raise the country’s growth potential and build resilience to future shocks.

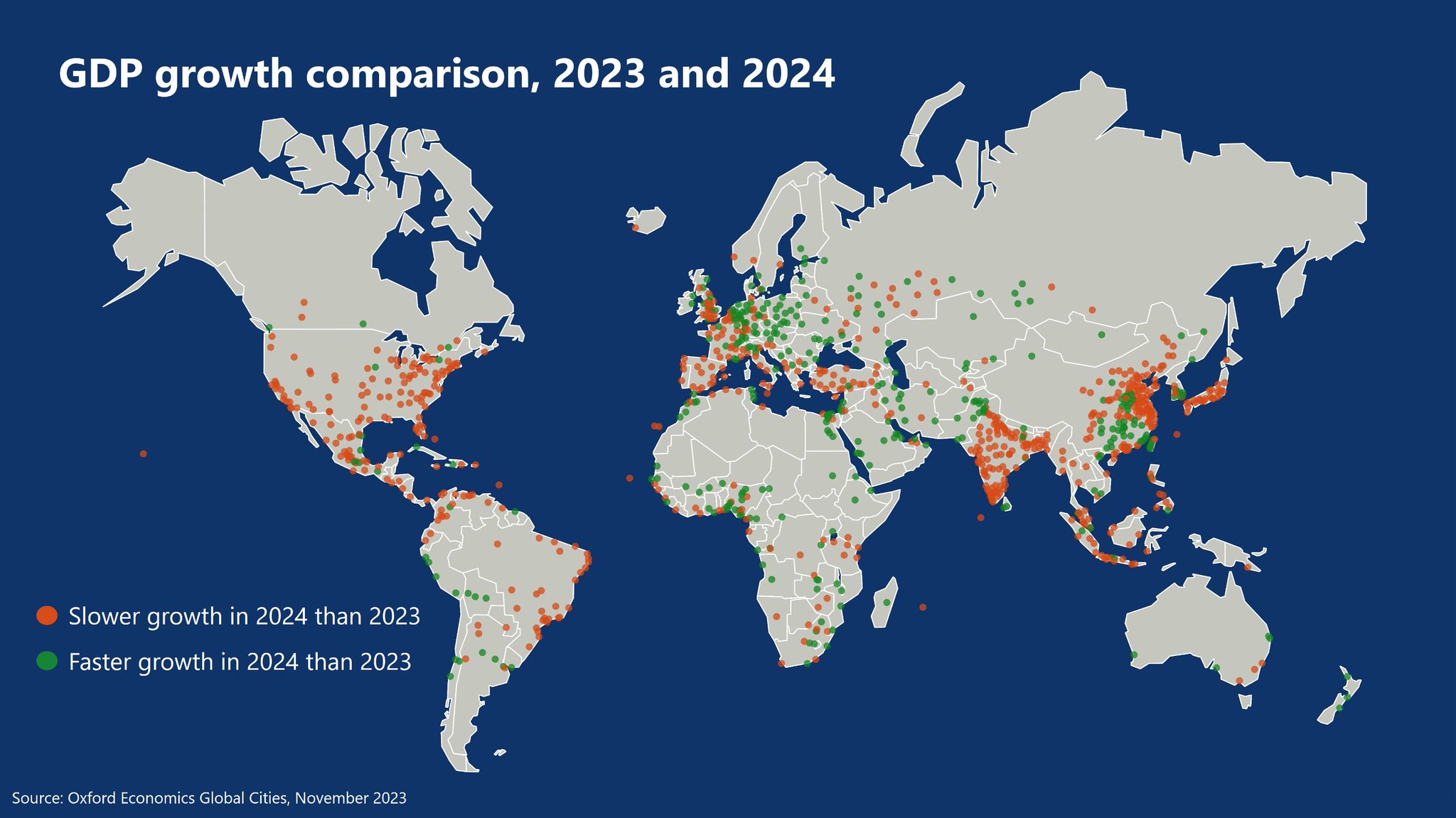

Global Economic Outlook

Follow Daryo's official Instagram and Twitter pages to keep current on world news.

Comments (0)