Uzbekistan's economic landscape for 2024 is characterized by stable growth and optimistic forecasts from various international agencies. Key institutions like the Asian Development Bank (ADB), Fitch Solutions, International Monetary Fund (IMF), World Bank, Standard & Poor's (S&P), and Moody's have provided comprehensive analyses and projections for the country's economy. This report delves into these forecasts, highlighting the consistent theme of economic resilience and growth potential in Uzbekistan.

Asian Development Bank (ADB) Outlook

The Asian Development Bank (ADB) revised its GDP growth forecast for 2023 and 2024 to 5.5%, an increase from the previous 5% estimation, indicating a stronger economic outlook for the region. This growth is primarily driven by robust performances in the manufacturing and mining sectors. However, the outlook is challenged by risks such as rising food and energy inflation and a decline in remittance inflows. A significant focus of the ADB report is the transition to a green economy, particularly in Uzbekistan, emphasizing the need to align industrial growth with environmental sustainability. This holistic approach highlights the necessity of balancing economic advancement with sustainable development practices.

Fitch Analysis

Fitch Solutions has updated its GDP growth forecast for 2023, raising it from an initial estimate of 5.0% in April 2023 to 5.3%. This adjustment reflects an optimistic economic outlook, driven largely by state investments and strong external demand, especially in the export sector. Additionally, the forecast acknowledges the role of private consumption and the impact of fluctuations in remittances as significant variables that could influence this growth trajectory. These factors together paint a comprehensive picture of the economic dynamics expected in the upcoming year.

International Monetary Fund (IMF) Perspective

The International Monetary Fund (IMF) has spotlighted Uzbekistan's impressive economic resilience, as evidenced by a substantial 5.7% real GDP growth achieved in 2022. In its assessment, the IMF recommends adopting fiscal consolidation and tight monetary policies to maintain macro-financial stability in the nation. Furthermore, the IMF places a strong emphasis on the necessity of structural reforms, particularly in areas like energy pricing, state-owned enterprises, and the governance of the financial sector. These reforms are deemed crucial for sustaining and enhancing the country's economic health and development.

World Bank's Regional Context

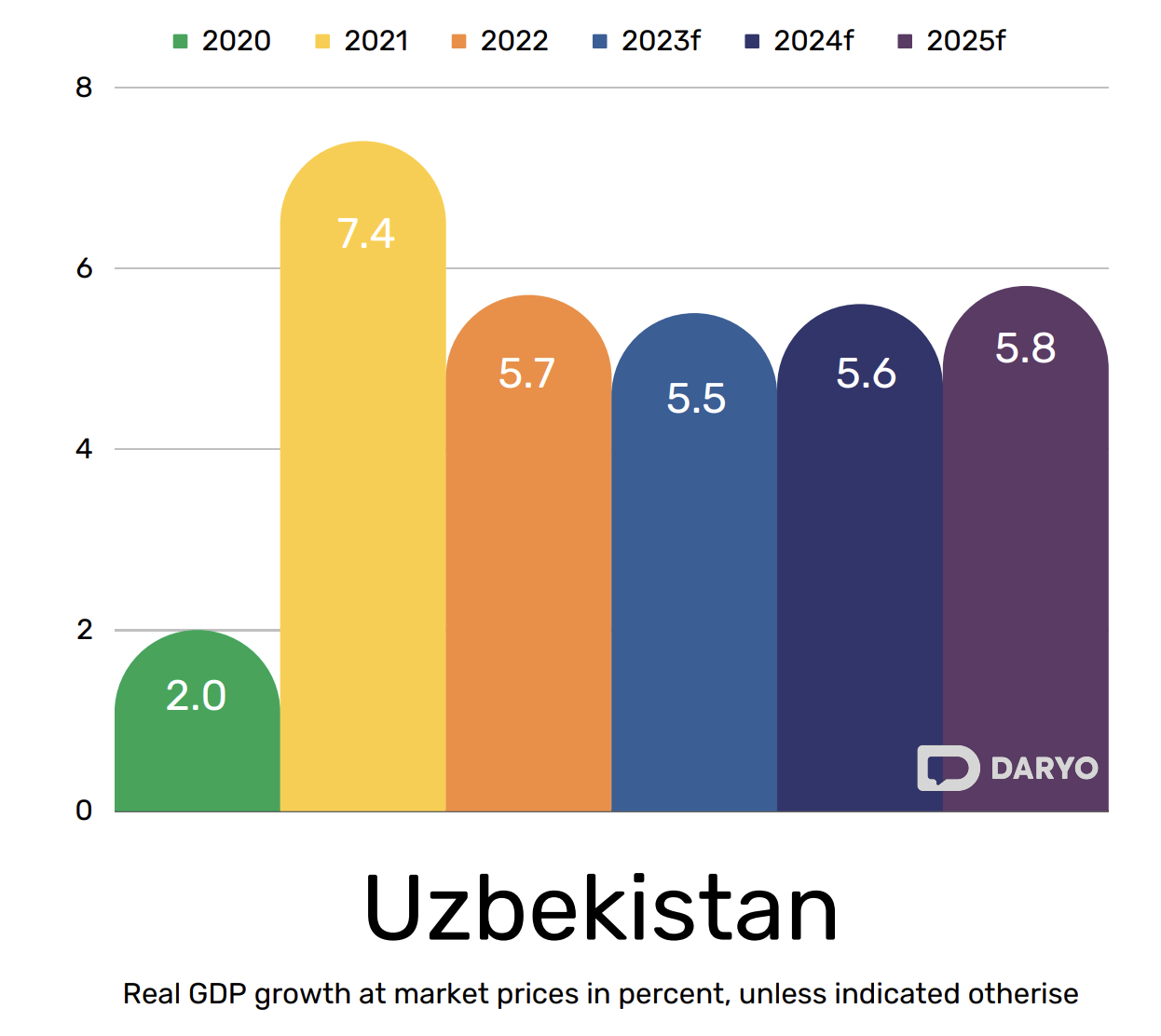

The World Bank's latest growth projections for Uzbekistan indicate a promising economic trajectory, with the GDP growth forecasted at 5.5%, 5.6%, and 5.8% for the years 2023 to 2025, respectively. These figures represent a slight increase from previous estimates. The report also contextualizes Uzbekistan's economic growth within the wider landscape of Central Asia's development, highlighting the country's role and significance in the regional economic progress.

Standard & Poor's (S&P) Assessment

S&P Global Ratings has affirmed Uzbekistan's foreign currency long-term credit rating at 'BB-', accompanied by a stable outlook. In addition, S&P predicts that Uzbekistan will experience an annual growth rate of 5.4% from 2023 to 2026. This optimistic projection is underpinned by several key factors: the nation's ongoing economic integration, the diversification of its export earnings, and effective fiscal management. These elements are identified below as crucial drivers for further improvement in the country's economic standing and creditworthiness.

Moody's Outlook

The current credit rating for Uzbekistan's economy stands at Ba3, paired with a stable outlook. Moody's indicates that structural reforms and the development of capital markets could pave the way for an upgraded rating in the future. However, this optimistic scenario is tempered by several risks. Challenges such as a potential weakening in GDP growth and fiscal metrics, coupled with concerns about political stability, are highlighted as key factors that could adversely impact the economic and credit outlook. These elements collectively play a significant role in determining the future trajectory of the rating.

Table of Ratings and Forecasts

Agency | Forecast/Rating | Key Points |

ADB | 5.5% GDP Growth (2023, 2024) | Industrial growth, green economy transition |

Fitch Solutions | 5.3% GDP Growth (2023) | State investments, external demand |

IMF | 5.7% Real GDP Growth (2022) | Fiscal consolidation, structural reforms |

World Bank | 5.5-5.8% GDP Growth (2023-2025) | Regional economic significance |

S&P | BB-' Rating (Stable Outlook) | Economic integration, fiscal management |

Fitch Ratings | BB- (STABLE) | Structural reforms that boost GDP growth prospects |

Moody's | Ba3 (Stable) | Structural reforms, capital market development |

Comparative Analysis of International Economic Ratings for Uzbekistan

Commonalities Across Ratings

- Stable Growth Outlook: All agencies forecast a stable and positive growth outlook for Uzbekistan. Projections like the ADB's 5.5% for 2023-2024, Fitch Solutions' revised forecast of 5.3% for 2023, and the World Bank's gradual increase from 5.5% to 5.8% for 2023-2025 converge on a narrative of steady economic advancement.

- Focus on Structural Reforms: IMF, Moody's, and other agencies stress the importance of structural reforms in various sectors, indicating a consensus on the need for continuous economic modernization and diversification.

- Recognition of Risks: There's a uniform recognition of challenges, such as inflation (ADB), remittance fluctuations (Fitch Solutions), and political stability concerns (Moody's), which could impact the economic landscape.

Differences in Perspectives and Emphases

- Growth Drivers and Sectors: While ADB highlights manufacturing and mining sectors as growth drivers, Fitch Solutions points to state investments and external demand, particularly in exports. This diversity in identified growth drivers indicates a multifaceted and dynamic economic structure in Uzbekistan.

- Fiscal and Monetary Policy Recommendations: IMF's specific recommendation for fiscal consolidation and tight monetary policies contrasts with the broader structural reform focus of other agencies. This shows a more nuanced approach to maintaining macro-financial stability.

- Credit Ratings and Economic Projections: S&P's rating at 'BB-' with a stable outlook and Moody's rating at Ba3 also show a stable but cautious view of Uzbekistan's creditworthiness. These credit ratings, while stable, are not at the top tier, reflecting room for improvement and the perceived risks.

- Regional vs. National Context: The World Bank places Uzbekistan's growth within the context of Central Asia's development, offering a regional perspective, whereas other agencies focus more on national specifics.

While there is a general consensus on Uzbekistan's stable and positive economic growth, different agencies offer unique insights based on their focus areas. Uzbekistan's economic forecast for 2024 presents a narrative of stability and growth. The assessments by international financial institutions and credit rating agencies collectively affirm the country's positive trajectory. Continuous reforms, fiscal consolidation, and diversification remain crucial for sustaining this growth and improving global financial standings. The investment landscape, enriched with various opportunities, further underscores Uzbekistan's potential as a thriving economy in Central Asia.

Written by: Tawney Kruger

Comments (0)